Compañía de Distribución Integral Logista Holdings, S.A. (BME:LOG) On An Uptrend: Could Fundamentals Be Driving The Stock?

Compañía de Distribución Integral Logista Holdings' (BME:LOG) stock up by 4.9% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. In this article, we decided to focus on Compañía de Distribución Integral Logista Holdings' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Compañía de Distribución Integral Logista Holdings

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Compañía de Distribución Integral Logista Holdings is:

31% = €158m ÷ €516m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.31 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Compañía de Distribución Integral Logista Holdings' Earnings Growth And 31% ROE

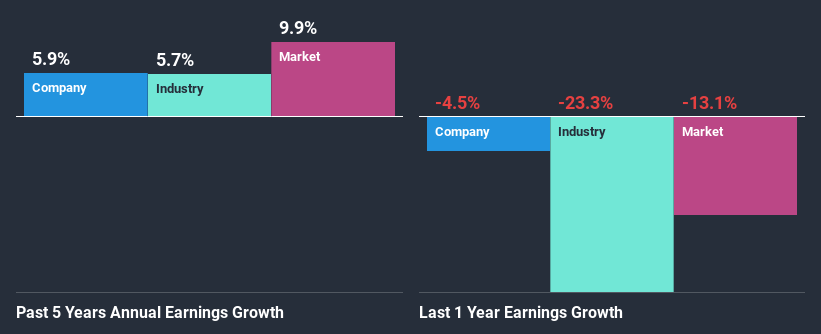

To begin with, Compañía de Distribución Integral Logista Holdings has a pretty high ROE which is interesting. Additionally, the company's ROE is higher compared to the industry average of 8.0% which is quite remarkable. This likely paved the way for the modest 5.9% net income growth seen by Compañía de Distribución Integral Logista Holdings over the past five years. growth

Next, on comparing with the industry net income growth, we found that Compañía de Distribución Integral Logista Holdings' reported growth was lower than the industry growth of 8.7% in the same period, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Compañía de Distribución Integral Logista Holdings''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Compañía de Distribución Integral Logista Holdings Making Efficient Use Of Its Profits?

Compañía de Distribución Integral Logista Holdings has a significant three-year median payout ratio of 95%, meaning that it is left with only 4.6% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Besides, Compañía de Distribución Integral Logista Holdings has been paying dividends over a period of six years. This shows that the company is committed to sharing profits with its shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 83%. Still, forecasts suggest that Compañía de Distribución Integral Logista Holdings' future ROE will rise to 37% even though the the company's payout ratio is not expected to change by much.

Summary

In total, it does look like Compañía de Distribución Integral Logista Holdings has some positive aspects to its business. Its earnings have grown respectably as we saw earlier, probably due to its high returns. However, it does reinvest little to almost none of its profits, so we wonder what effect this could have on its future growth prospects. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade Compañía de Distribución Integral Logista Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:LOG

Logista Integral

Through its subsidiaries, operates as a distributor and logistics operator in Spain, France, Italy, Portugal, and Poland.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026