- Spain

- /

- Infrastructure

- /

- BME:AENA

What Do Recent Airport Traffic Gains Mean for Aena S.M.E’s Stock in 2025?

Reviewed by Simply Wall St

Wondering what’s next for Aena S.M.E after those remarkable gains? If you’re considering whether to hold tight or take profits, you’re definitely not alone. Over the past few years, Aena S.M.E’s stock performance has drawn plenty of attention, from the impressive 117.2% return over five years to a three-year climb of 135.2%. Even its year-to-date return stands strong at 15.5%. But, like any stock, it’s not all sunshine. The past month, for example, saw an 8.6% dip, and the last week alone slipped by 5.1% as investor sentiment adjusted to broader market jitters.

Some market watchers suggest recent volatility is not just about the company itself, but also reflects shifting risk appetites globally and uncertainty around infrastructure spending. Despite these near-term bumps, it is impossible to ignore how resilient Aena S.M.E has been historically. For long-term investors, such track records often signal growth potential, even with fresh risks emerging on the horizon.

So, does Aena S.M.E deserve a spot in your portfolio at today’s price? Looking at our valuation scoreboard, the company is undervalued in 2 out of 6 standard checks, giving it a value score of 2. That suggests there is some opportunity, but not without caveats. In the next section, we will break down the main valuation methods and see how Aena S.M.E stacks up by the numbers. Plus, stick around, because I will share a smarter approach to valuation that can help you truly cut through the noise.

Aena S.M.E scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Aena S.M.E Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to present value. This process helps investors understand what the business could be worth today based on expected performance in the years ahead.

For Aena S.M.E, the latest twelve months' free cash flow stands at roughly €1.69 billion. Analysts forecast free cash flow growth over the next several years, with projections reaching approximately €2.06 billion by 2028. Looking out to 2035, Simply Wall St's extrapolation suggests free cash flow could climb to around €2.24 billion. This confirms continued growth, though at a moderating pace. All of these figures reflect the company's strong ability to generate cash from its core airport infrastructure operations.

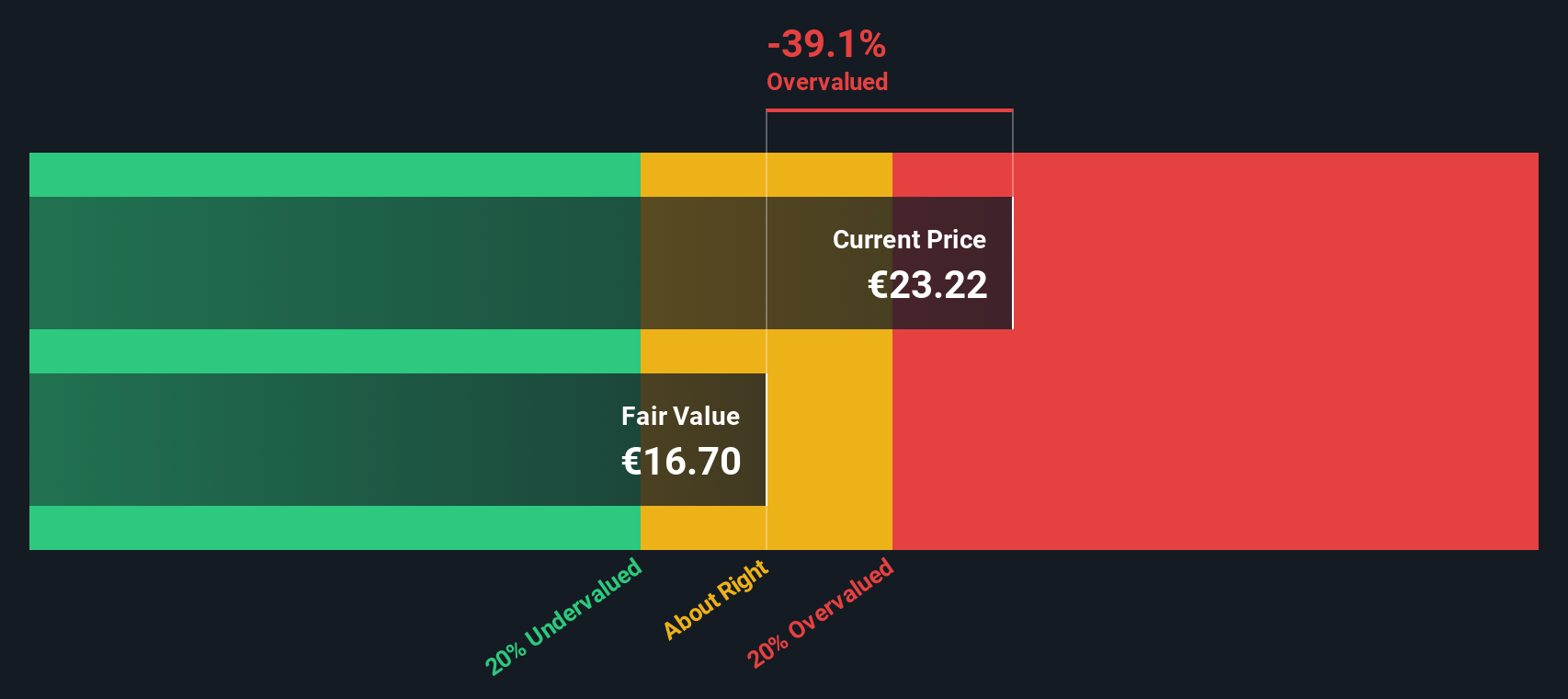

Based on the two-stage Free Cash Flow to Equity model, the estimated intrinsic value is €16.81 per share. Compared to the current share price, this implies the stock is about 38.7% overvalued. This signals that investors are paying a premium well above what the cash flows justify today.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Aena S.M.E.

Approach 2: Aena S.M.E Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a classic valuation metric, especially suitable for consistently profitable companies like Aena S.M.E. This ratio tells investors how much they are paying for each euro of the company's earnings, offering a straightforward glimpse into whether the current market price reflects the business’s true potential.

It's important to remember that what counts as a “normal” or “fair” P/E can shift depending on growth expectations and risk factors. Fast-growing firms or those with more stable earnings often justify higher P/E ratios, since investors expect future returns to be greater. Conversely, if risks are high or growth is muted, lower P/E multiples are the norm.

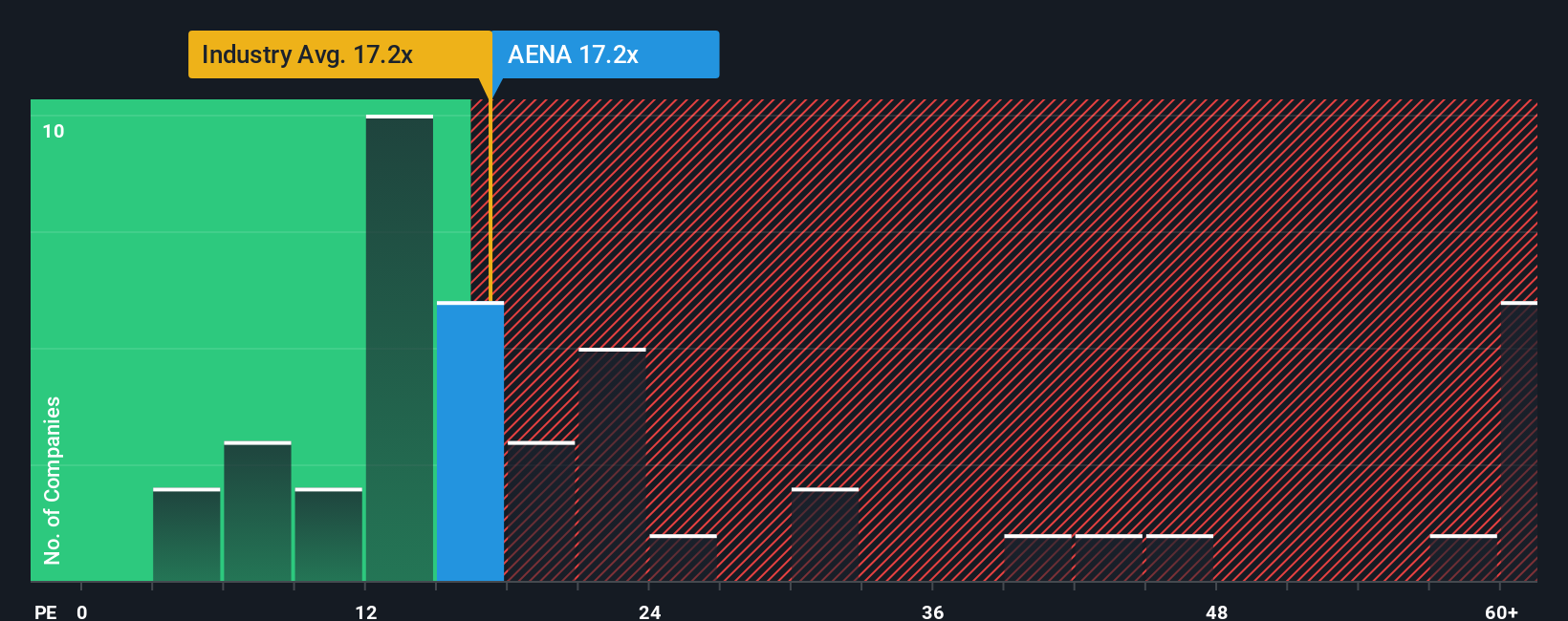

Currently, Aena S.M.E trades on a P/E ratio of 17.3x. This is slightly higher than the Infrastructure industry average of 14.7x, but well below the peer group average of 48.0x. To add more context, Simply Wall St uses a proprietary “Fair Ratio,” which is 16.7x for Aena S.M.E. This benchmark takes into account not only growth and industry, but also profit margins, market capitalization, and known company-specific risks. The Fair Ratio is particularly powerful because it is tailored to Aena S.M.E’s unique fundamentals, rather than relying on potentially misleading simple averages.

With the company’s actual P/E almost matching its Fair Ratio, Aena S.M.E currently looks about right on this metric. The market seems to have found a reasonable middle ground between the company's prospects and its risks.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Aena S.M.E Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is your personal investment story for a company like Aena S.M.E. It combines your perspective on future revenue, earnings, and profit margins with your view of what the company should be worth. This approach connects a story to a clear, data-driven forecast and fair value.

Narratives make investment decisions easier and more dynamic by helping you track how new information, such as earnings results or market news, changes both the company's outlook and its estimated fair value in real time. On Simply Wall St’s Community page, millions of investors are already using Narratives to make transparent, grounded decisions. Each Narrative maps the latest forecast to an up-to-date fair value, allowing you to instantly see if Aena S.M.E is a buy, hold, or sell at current prices.

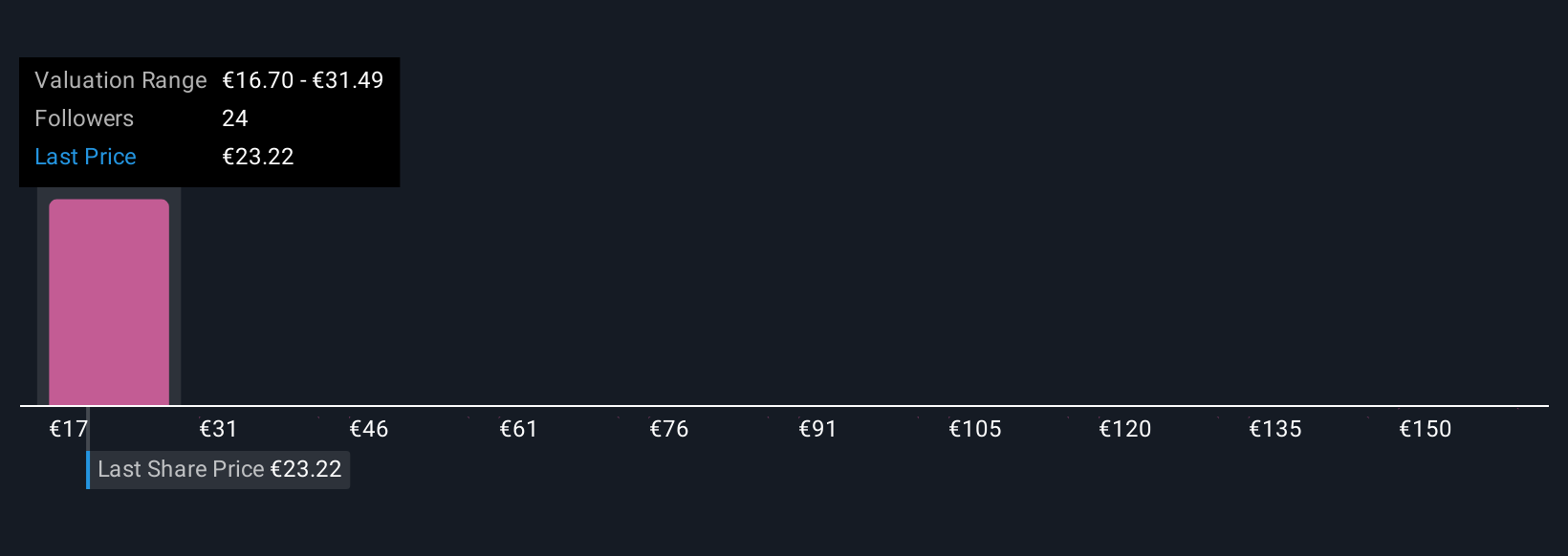

The power of Narratives is that they recognize everyone’s story and outlook can be different. For example, one Aena S.M.E investor might be bullish and set a high target price of €28.9 based on expectations of ongoing global expansion and rising profits, while another, more cautious, sees risks and sets a conservative value near €17.5. Narratives let you compare these viewpoints, test your own, and respond quickly as the facts change so you can invest smarter and with confidence.

Do you think there's more to the story for Aena S.M.E? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AENA

Aena S.M.E

Engages in the management of airports in Spain, Brazil, the United Kingdom, Mexico, and Colombia.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives