- Spain

- /

- Infrastructure

- /

- BME:AENA

Aena (BME:AENA) Earnings Outpace Spain’s Average, Challenging Concerns Over Slower Revenue Growth

Reviewed by Simply Wall St

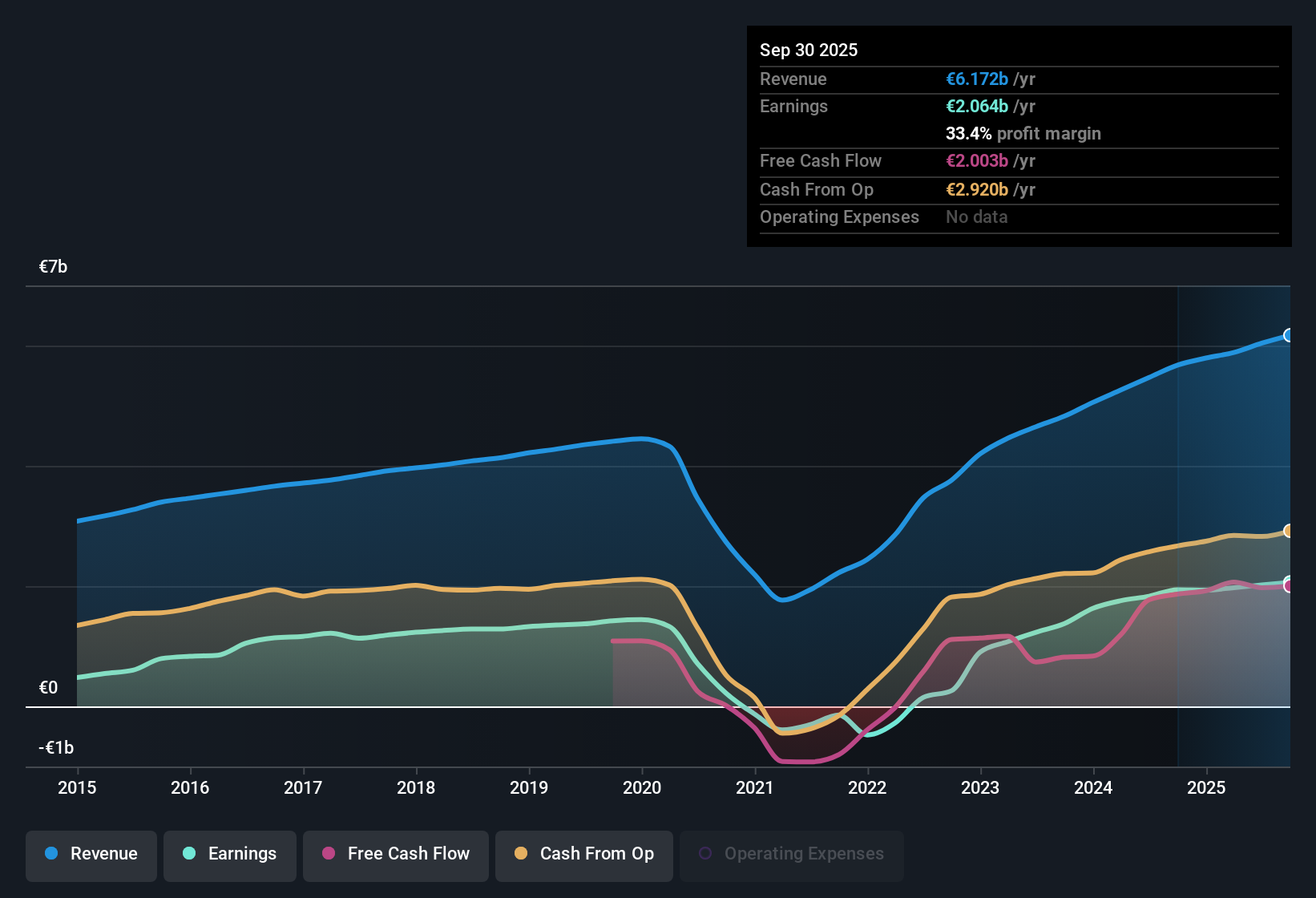

Aena S.M.E (BME:AENA) posted 3.8% forecast annual revenue growth, which trails the broader Spanish market’s 4.7% outlook, but earnings are projected to rise 5.1%, handily beating the national average. The company’s net profit margin sits at 33.4%, a touch lower than last year’s 34.2%, with EPS supported by high-quality, growing profits. Over the past five years, Aena delivered a remarkable 55.1% average annual profit growth, though the most recent year’s 6.3% bump signals a move toward a steadier, more moderate pace. Investors are weighing a valuation that trades at 17.3x earnings, representing a discount versus peers but a slight premium to the European infrastructure sector.

See our full analysis for Aena S.M.E.Next, we’ll put these numbers in context by comparing them to the market’s prevailing narratives and the views held by investors. Let’s see which stories align with the latest results, and which might need a second look.

See what the community is saying about Aena S.M.E

Margin Expansion in Analysts' Sights

- Forecasts show Aena’s profit margins are expected to rise from 33.4% to 34.7% within three years, even as revenue growth lags the wider Spanish market (3.8% vs. 4.7%).

- According to the analysts' consensus view, operational leverage from modernization and international expansion should support this margin improvement.

- Consensus narrative notes robust international passenger gains and commercial revenue growth are positioned to lift net margins over the longer term.

- Expanded commercial offerings, particularly duty-free, VIP, and mobility services, add high-margin, ancillary income streams on top of core aeronautical revenues.

Get the full breakdown and see how analysts debate the next move in margins. Are upgraded retail and new international flights enough of a catalyst? 📊 Read the full Aena S.M.E Consensus Narrative.

Debt Discipline Offsets Domestic Risks

- With net debt to EBITDA at just 1.64x, Aena maintains stronger balance sheet discipline than many airport peers during this phase of international expansion.

- Analysts' consensus view highlights a balancing act:

- Low leverage and financial discipline are viewed as positives for free cash flow and dividend potential, improving resilience against shocks.

- But exposure to the Spanish market, along with ongoing heavy CapEx for terminal modernization, means returns could face pressure if domestic travel softens or regulatory developments limit fee growth.

Valuation: Discount to Peers, Premium to Sector

- Aena’s current price-to-earnings ratio is 17.3x, which sits well below the peer average (51.9x) but slightly above the broader European infrastructure sector (16.9x). Shares trade at €23.81, essentially in line with the latest analyst price target of €24.27.

- Analysts' consensus view frames the shares as fairly valued for now.

- The modest 1.7% gap between price and analyst target suggests most see little short-term upside, reflecting current growth, margin, and risk trends.

- However, the share price is well above the DCF fair value estimate of €5.13, signaling that traditional cash flow models may not capture the market’s confidence in Aena’s growth, international strategy, and high-quality profits.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aena S.M.E on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures above? In just a few minutes, you can share your perspective and shape the ongoing discussion by Do it your way.

A great starting point for your Aena S.M.E research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Aena’s muted revenue growth, heavy capital expenditure, and risks tied to domestic travel and regulation could limit returns compared to other market opportunities.

If you want to focus on businesses that shine for consistent expansion and reliable profits, check out stable growth stocks screener (2115 results) for a shortlist of quality names delivering steady growth through change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AENA

Aena S.M.E

Engages in the management of airports in Spain, Brazil, the United Kingdom, Mexico, and Colombia.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion