- Spain

- /

- Telecom Services and Carriers

- /

- BME:LLN

LleidaNetworks Serveis Telemàtics, S.A. (BME:LLN) Stocks Shoot Up 30% But Its P/S Still Looks Reasonable

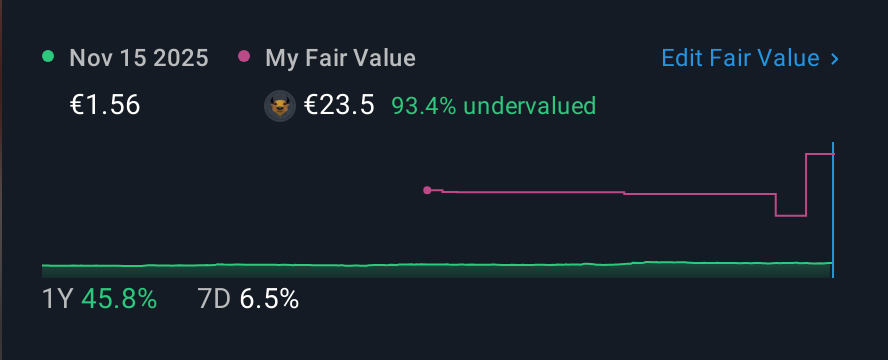

LleidaNetworks Serveis Telemàtics, S.A. (BME:LLN) shareholders have had their patience rewarded with a 30% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

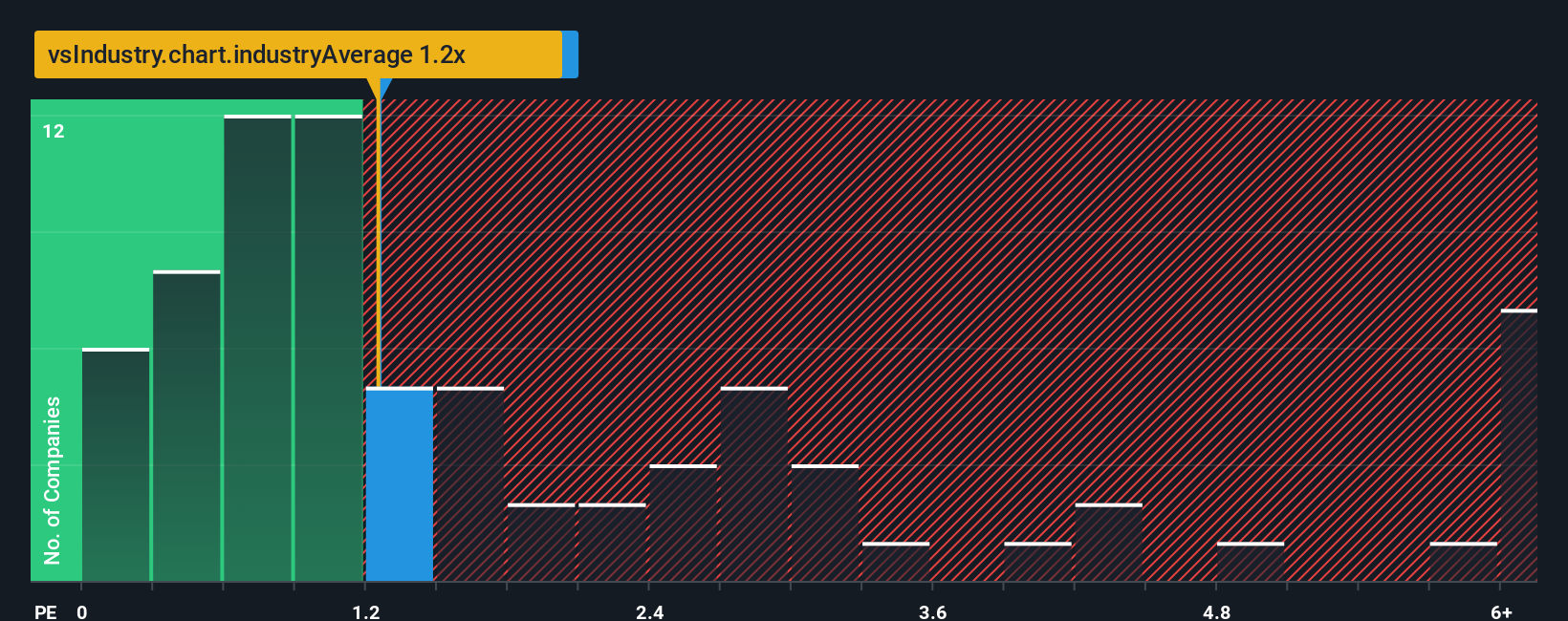

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about LleidaNetworks Serveis Telemàtics' P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Telecom industry in Spain is also close to 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for LleidaNetworks Serveis Telemàtics

How Has LleidaNetworks Serveis Telemàtics Performed Recently?

Revenue has risen firmly for LleidaNetworks Serveis Telemàtics recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on LleidaNetworks Serveis Telemàtics will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LleidaNetworks Serveis Telemàtics will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like LleidaNetworks Serveis Telemàtics' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The latest three year period has also seen a 7.1% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 2.0% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, it's clear to see why LleidaNetworks Serveis Telemàtics' P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On LleidaNetworks Serveis Telemàtics' P/S

LleidaNetworks Serveis Telemàtics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we've seen, LleidaNetworks Serveis Telemàtics' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 4 warning signs for LleidaNetworks Serveis Telemàtics (2 are potentially serious!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:LLN

LleidaNetworks Serveis Telemàtics

Operates as a teleoperator for short message management services through the internet in Spain and internationally.

Slight risk and fair value.

Market Insights

Community Narratives