- Spain

- /

- Telecom Services and Carriers

- /

- BME:CLNX

Investors Interested In Cellnex Telecom, S.A.'s (BME:CLNX) Revenues

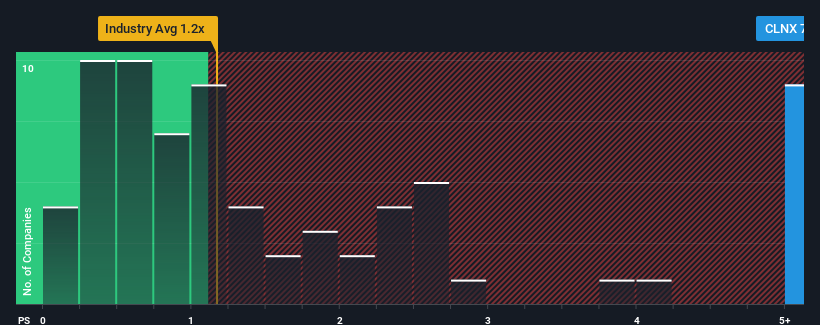

When close to half the companies in the Telecom industry in Spain have price-to-sales ratios (or "P/S") below 1.2x, you may consider Cellnex Telecom, S.A. (BME:CLNX) as a stock to avoid entirely with its 7.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Cellnex Telecom

How Has Cellnex Telecom Performed Recently?

Cellnex Telecom certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cellnex Telecom.Is There Enough Revenue Growth Forecasted For Cellnex Telecom?

Cellnex Telecom's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. Pleasingly, revenue has also lifted 205% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 10% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 2.5% each year growth forecast for the broader industry.

In light of this, it's understandable that Cellnex Telecom's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Cellnex Telecom's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Cellnex Telecom shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 1 warning sign for Cellnex Telecom you should be aware of.

If these risks are making you reconsider your opinion on Cellnex Telecom, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:CLNX

Cellnex Telecom

Operates infrastructure for wireless telecommunication in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland.

Reasonable growth potential with mediocre balance sheet.