- Spain

- /

- Telecom Services and Carriers

- /

- BME:CLNX

Did Cellnex Telecom's (BME:CLNX) Latest Earnings Shift Its Profitability Story for Investors?

Reviewed by Sasha Jovanovic

- Cellnex Telecom reported its third quarter and nine-month 2025 earnings, with sales rising to €995 million and €2.94 billion respectively, but shifting to a net loss of €148 million for the quarter and €263 million for the period.

- While revenues showed modest year-over-year growth, the transition from positive net income to losses may raise questions regarding cost management and profitability amid expansion efforts.

- We will explore how Cellnex's move from profit to net loss could impact its investment narrative as outlined by analysts.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cellnex Telecom Investment Narrative Recap

To be a shareholder in Cellnex Telecom, you need to believe in the long-term value of steady infrastructure expansion, growing tenancies, and efficiency gains across key European markets. The recent report of higher revenues but reversal to a net loss does not appear to materially affect the near-term catalyst of operational improvements, but it does heighten attention to cost controls and the risk of asset sales impacting future earnings capacity.

Among Cellnex’s recent announcements, the €800 million share buyback stands out as most relevant. While buybacks can support shareholder value and signal management's commitment to optimizing capital structure, their benefit may be counterbalanced in the short run by ongoing losses, particularly if further asset disposals limit the company’s ability to generate organic growth.

But despite growing revenue, investors should be alert to the contrasting risk that asset disposals could reduce long-term earnings potential if core operations...

Read the full narrative on Cellnex Telecom (it's free!)

Cellnex Telecom's narrative projects €4.7 billion revenue and €155.4 million earnings by 2028. This requires 5.8% yearly revenue growth and a €394.6 million increase in earnings from the current €-239.2 million.

Uncover how Cellnex Telecom's forecasts yield a €44.15 fair value, a 67% upside to its current price.

Exploring Other Perspectives

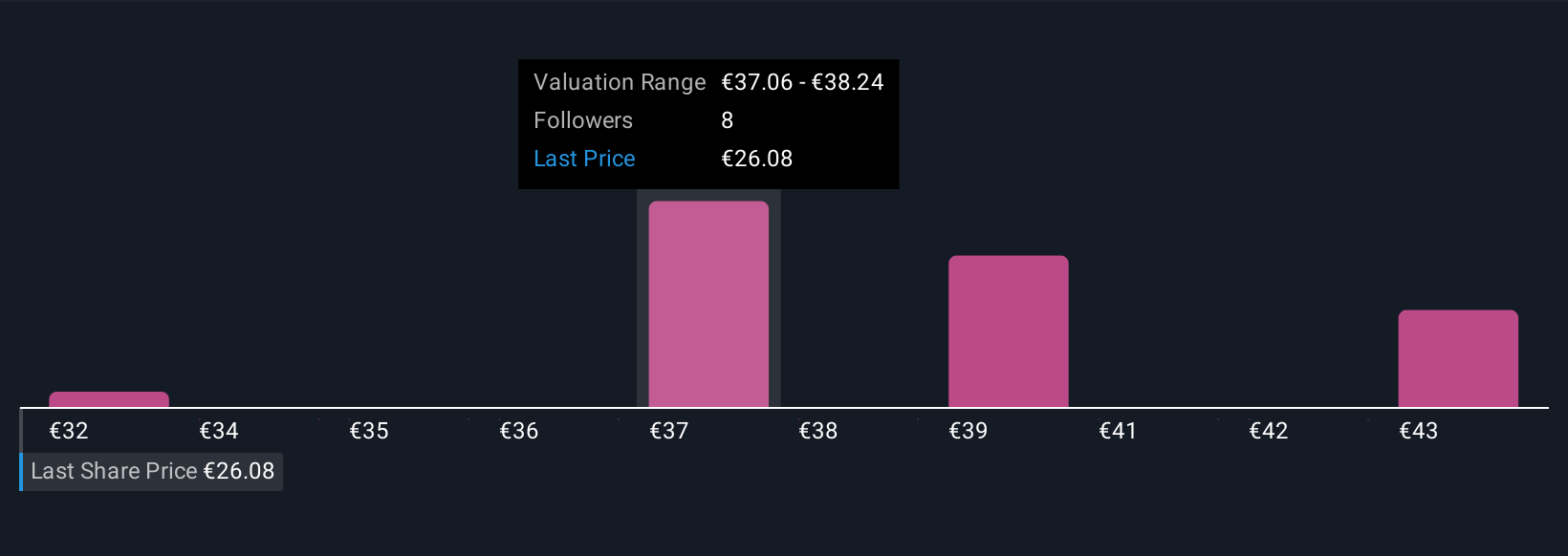

Four Simply Wall St Community members estimate Cellnex's fair value between €32.33 and €44.15, a wide span that underscores differing outlooks. With cost management now in focus, consider how your own assessment weighs near-term improvement against possible effects from future asset disposals.

Explore 4 other fair value estimates on Cellnex Telecom - why the stock might be worth just €32.33!

Build Your Own Cellnex Telecom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cellnex Telecom research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Cellnex Telecom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cellnex Telecom's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CLNX

Cellnex Telecom

Engages in the management of terrestrial telecommunications infrastructures in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives