- Spain

- /

- Telecom Services and Carriers

- /

- BME:CLNX

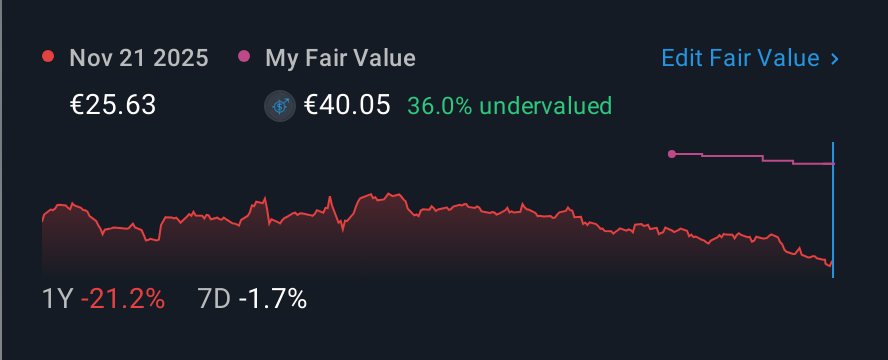

Cellnex Telecom's (BME:CLNX) Solid Profits Have Weak Fundamentals

Cellnex Telecom, S.A.'s (BME:CLNX) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that shareholders have noticed something concerning in the numbers.

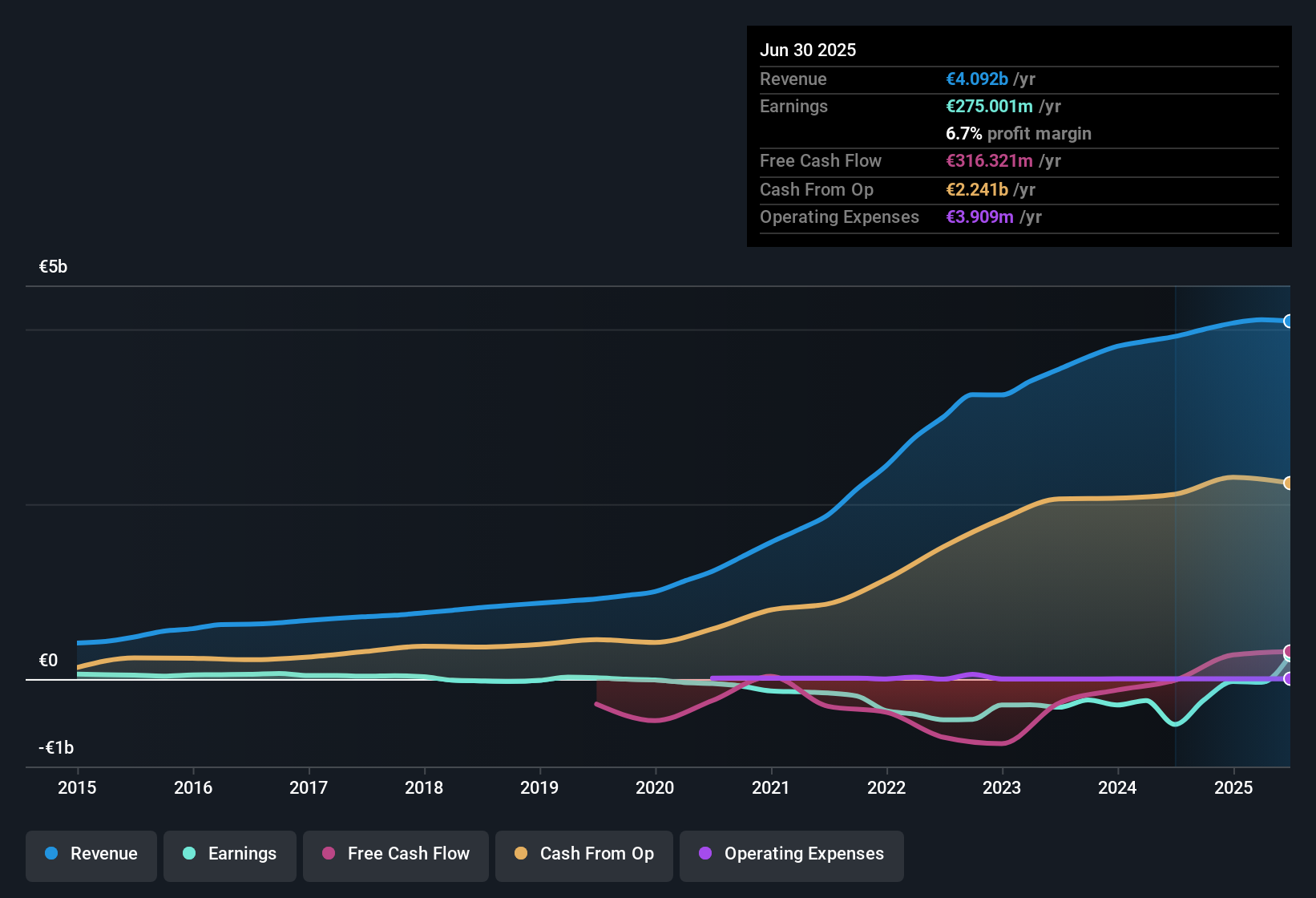

An Unusual Tax Situation

We can see that Cellnex Telecom received a tax benefit of €540m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Cellnex Telecom's Profit Performance

In its most recent report, Cellnex Telecom disclosed a tax benefit, as we discussed above. Given that sort of benefit is not recurring, it's safe to say the statutory profit overstates its underlying profitability quite significantly. For this reason, we think that Cellnex Telecom's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The good news is that it earned a profit in the last twelve months, despite its previous loss. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Cellnex Telecom, you'd also look into what risks it is currently facing. For example, we've discovered 1 warning sign that you should run your eye over to get a better picture of Cellnex Telecom.

Today we've zoomed in on a single data point to better understand the nature of Cellnex Telecom's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:CLNX

Cellnex Telecom

Engages in the management of terrestrial telecommunications infrastructures in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Is This Lens Maker Mispriced? A Blind Spot in Plain Sight

From Porcelain to Silicon: Why the World’s Most Famous Toilet Maker is Now an AI Powerhouse

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks