Izertis (BME:IZER) Margins Edge Up, Reinforcing Bullish Profitability Narrative Despite Valuation Concerns

Reviewed by Simply Wall St

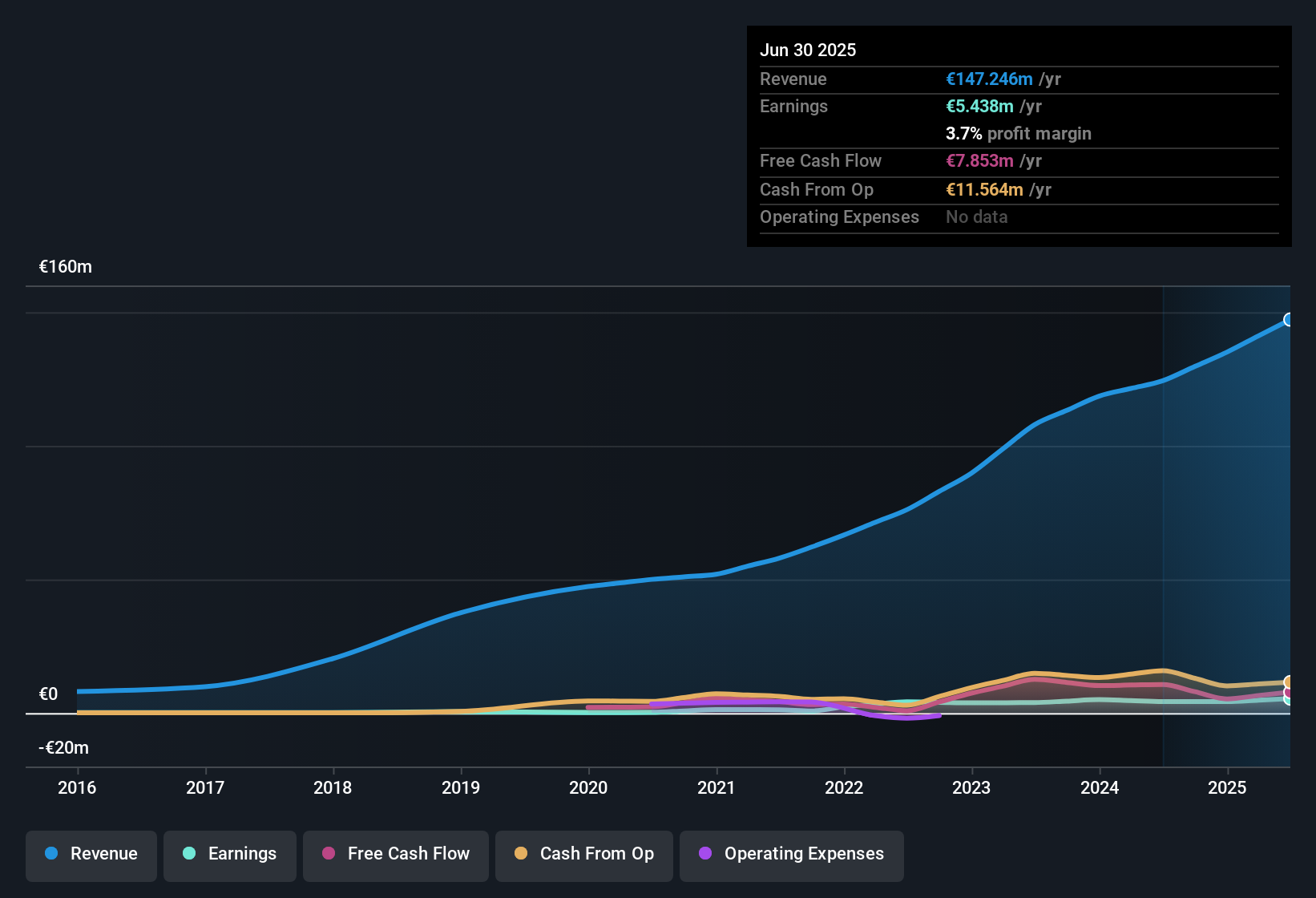

Izertis (BME:IZER) posted notable gains in its latest results, with earnings climbing 27.1% year-over-year and averaging 29.2% annual growth over the last five years. Net profit margins also ticked up to 3.7% from 3.4% last year, signaling continued improvement in profitability. With forecasts calling for earnings to grow at 30% per year and revenue set to expand at 21.6% annually, both well ahead of the Spanish market averages, investors are taking notice of Izertis’s accelerating momentum.

See our full analysis for izertis.Now, it’s time to see where the numbers confirm or challenge the most talked-about narratives in the market and the investment community.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Higher at 3.7%

- Net profit margin improved to 3.7% from last year’s 3.4%, highlighting gains in profitability as Izertis scales its business.

- What’s notable is that despite ongoing sector competition, Izertis managed to slightly expand margins. This is a key point in bullish arguments that digital transformation demand is supporting both growth and profitability.

- Bulls often worry that wage inflation or cost pressure could erode profits, but the reported margin trend suggests Izertis has so far maintained its earnings power.

- This performance stands out in an industry where competitive pricing can easily reduce net margins.

Financial Position Remains a Flagged Risk

- Izertis is identified as not being in a strong financial position despite solid revenue and earnings growth.

- Critics point out that high earnings quality and robust top-line expansion are tempered by a weaker balance sheet, raising questions about how much growth can be funded internally.

- Rapid 27.1% earnings growth and 21.6% revenue growth forecasts might be challenging to sustain if capital or liquidity becomes tight.

- This tension is a recurring bearish narrative. Headline numbers will only carry weight if the company can strengthen its financial base during expansion.

Valuation: Premium Price Versus Peers

- Izertis trades at a Price-To-Earnings Ratio of 49.4x, which is more than double the peer (24.3x) and industry (19.1x) averages, and the current share price of €9.42 is far above the DCF fair value estimate of €1.71.

- Analysts openly discuss whether current optimism is overextended, especially given that the share price already reflects aggressive growth assumptions.

- Bears argue that a high valuation leaves little room for missteps, so even minor earnings misses could cause the stock to move closer to industry or DCF levels.

- The ongoing gap between intrinsic value and market price suggests new buyers currently face greater risk-reward considerations.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on izertis's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid growth and margin improvement, Izertis’s high valuation and weaker financial position raise concerns for investors seeking stronger fundamentals and balance sheet strength.

If you’re looking for companies with healthier financial foundations, check out solid balance sheet and fundamentals stocks screener that show more robust balance sheets alongside solid performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if izertis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IZER

izertis

Provides technological consultancy services in Spain, Portugal, and Mexico.

High growth potential with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026