We Wouldn't Rely On Facephi Biometria's (BME:FACE) Statutory Earnings As A Guide

Broadly speaking, profitable businesses are less risky than unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Facephi Biometria (BME:FACE).

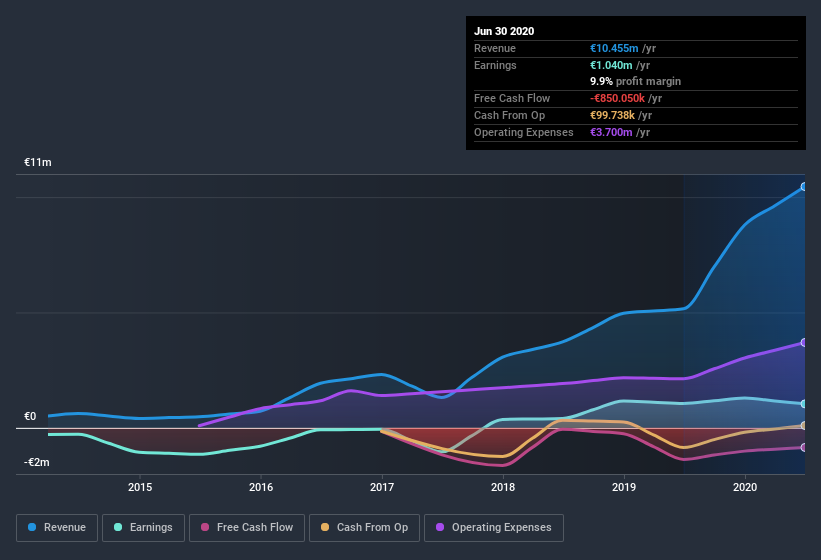

We like the fact that Facephi Biometria made a profit of €1.04m on its revenue of €10.5m, in the last year. We know some investors love those high revenue growth stocks, but we do like to look at profit, even if it is, perhaps, a bit old fashioned. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

Check out our latest analysis for Facephi Biometria

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. So today we'll look at what Facephi Biometria's cashflow tells us about its earnings, as well as examining how issuing shares is impacting shareholder value. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Facephi Biometria's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to June 2020, Facephi Biometria had an accrual ratio of 0.30. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Even though it reported a profit of €1.04m, a look at free cash flow indicates it actually burnt through €850k in the last year. We also note that Facephi Biometria's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of €850k. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Facephi Biometria issued 9.4% more new shares over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Facephi Biometria's EPS by clicking here.

How Is Dilution Impacting Facephi Biometria's Earnings Per Share? (EPS)

Facephi Biometria was losing money three years ago. But over the last year profit has held pretty steady. Meanwhile, earnings per share were actually down 7.1%, over the last twelve months. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Facephi Biometria's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Facephi Biometria's Profit Performance

As it turns out, Facephi Biometria couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). Considering all this we'd argue Facephi Biometria's profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. To that end, you should learn about the 6 warning signs we've spotted with Facephi Biometria (including 2 which make us uncomfortable).

Our examination of Facephi Biometria has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Facephi Biometria or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:FACE

Facephi Biometria

Engages in the biometric facial recognition technology solutions in Spain and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion