Earnings Update: Global Dominion Access, S.A. (BME:DOM) Just Reported Its Interim Results And Analysts Are Updating Their Forecasts

Last week, you might have seen that Global Dominion Access, S.A. (BME:DOM) released its half-yearly result to the market. The early response was not positive, with shares down 3.7% to €3.10 in the past week. Results look mixed - while revenue fell marginally short of analyst estimates at €571m, statutory earnings were in line with expectations, at €0.30 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Global Dominion Access

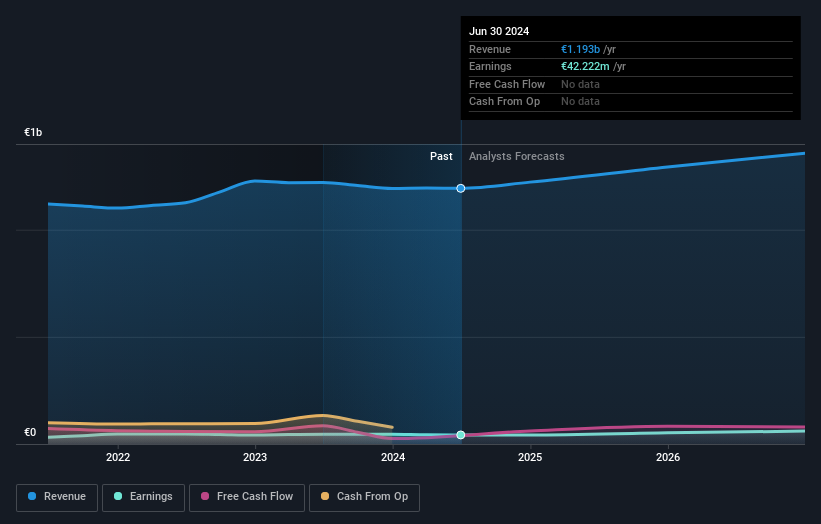

Following the latest results, Global Dominion Access' four analysts are now forecasting revenues of €1.22b in 2024. This would be an okay 2.4% improvement in revenue compared to the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of €1.24b and earnings per share (EPS) of €0.31 in 2024. Overall, while the analysts have reconfirmed their revenue estimates, the consensus now no longer provides an EPS estimate. This implies that the market believes revenue is more important after these latest results.

There's been no real change to the consensus price target of €6.54, with Global Dominion Access seemingly executing in line with expectations. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Global Dominion Access analyst has a price target of €7.80 per share, while the most pessimistic values it at €6.00. This is a very narrow spread of estimates, implying either that Global Dominion Access is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Global Dominion Access' growth to accelerate, with the forecast 4.9% annualised growth to the end of 2024 ranking favourably alongside historical growth of 2.3% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 6.1% per year. So it's clear that despite the acceleration in growth, Global Dominion Access is expected to grow meaningfully slower than the industry average.

The Bottom Line

The clear take away from these updates is that the analysts made no change to their revenue estimates for next year, with the business apparently performing in line with their models. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Global Dominion Access' revenue is expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

We have estimates for Global Dominion Access from its four analysts out to 2026, and you can see them free on our platform here.

You still need to take note of risks, for example - Global Dominion Access has 1 warning sign we think you should be aware of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:DOM

Global Dominion Access

Provides integral services for business process efficiency and sustainability worldwide.

Very undervalued with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion