Exploring Aplicaciones y Tratamiento de Sistemas And 2 Other European Small Caps with Solid Foundations

Reviewed by Simply Wall St

In the current European market landscape, major stock indexes have shown mixed performance, with Germany's DAX and Italy's FTSE MIB experiencing gains while France's CAC 40 and the UK's FTSE 100 faced declines. Amidst these fluctuations, small-cap stocks can offer unique opportunities for investors due to their potential for growth and resilience in diverse economic conditions. Identifying promising small-cap companies often involves looking at those with solid foundations and strong fundamentals that can navigate varying economic climates effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Aplicaciones y Tratamiento de Sistemas (BME:ATSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aplicaciones y Tratamiento de Sistemas, S.A. is a company with a market cap of €229.39 million that specializes in providing computer services.

Operations: ATSI generates revenue primarily from its computer services segment, totaling approximately €185.73 million.

Aplicaciones y Tratamiento de Sistemas, a smaller player in the IT sector, has shown promising growth with earnings increasing by 2.1% over the past year, surpassing the industry's 1.3%. The company reported sales of €47.19 million for the first half of 2025, nearly doubling from €24.85 million a year ago, while net income rose to €6.49 million from €4.48 million previously. Its financial health appears robust with a satisfactory net debt to equity ratio of 14.3%, and interest payments are well covered by EBIT at 17.8 times coverage, indicating efficient debt management strategies in place.

- Click here and access our complete health analysis report to understand the dynamics of Aplicaciones y Tratamiento de Sistemas.

Learn about Aplicaciones y Tratamiento de Sistemas' historical performance.

Novabase S.G.P.S (DB:NVQ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Novabase S.G.P.S., S.A. is an IT consulting and services provider operating through its subsidiaries in Portugal, Europe, Africa, the Middle East, and internationally with a market cap of €330.22 million.

Operations: The company's revenue primarily stems from its Next-Gen segment, generating €130.27 million, while the Value Portfolio contributes €1.29 million.

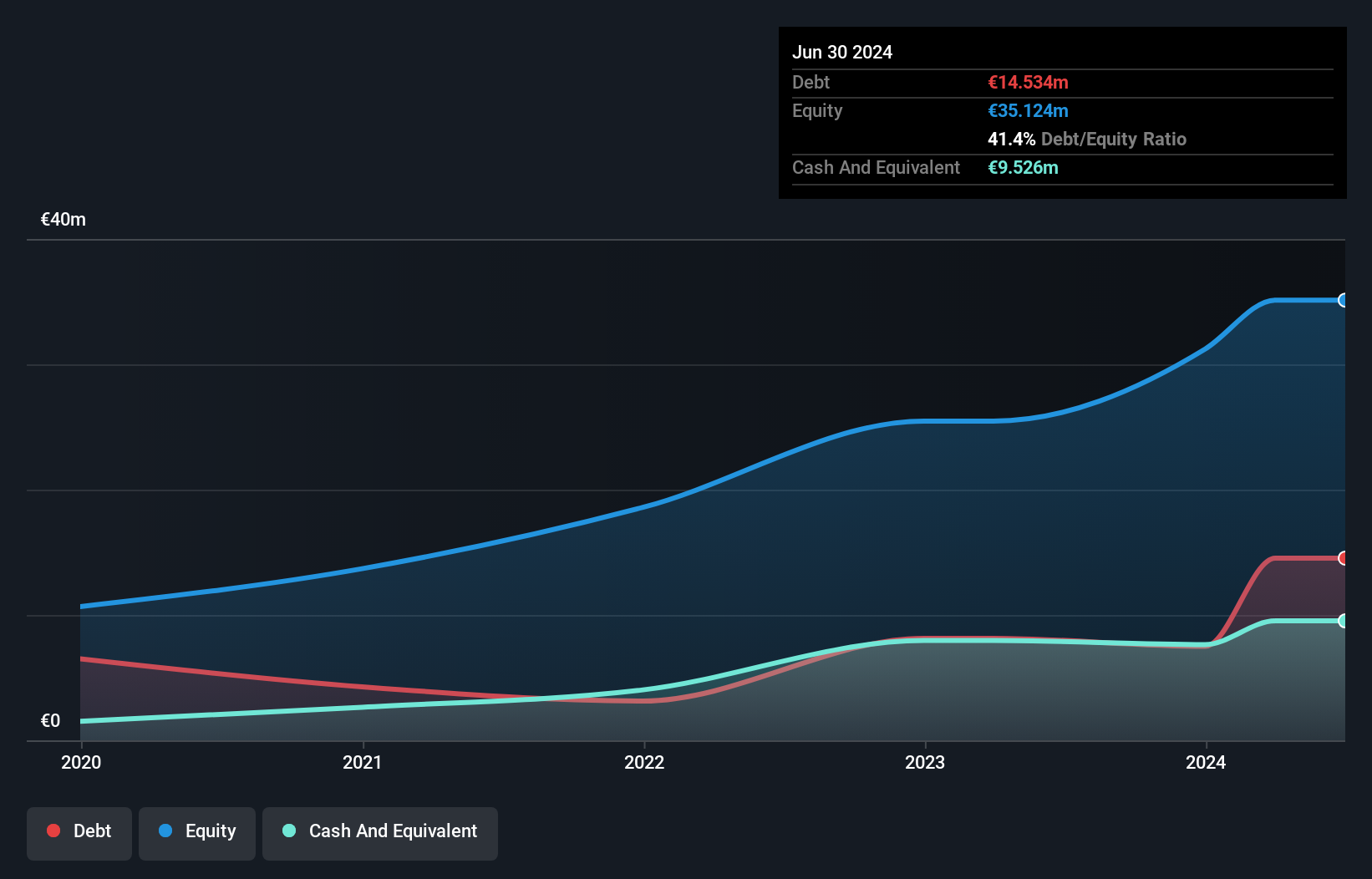

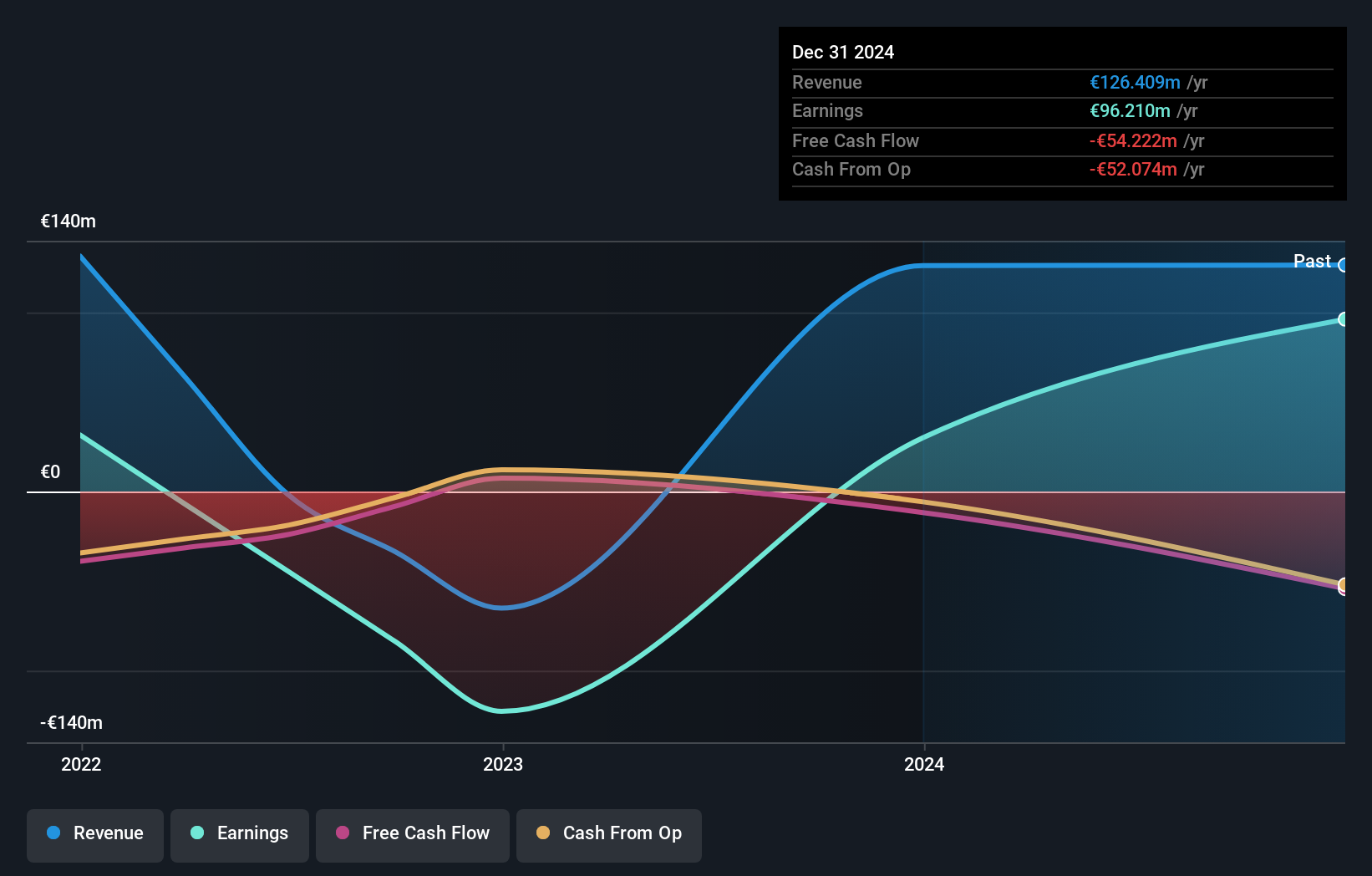

Novabase, a relatively modest player in the tech landscape, has demonstrated notable financial resilience. Over the past year, earnings surged by 117.8%, significantly outpacing the IT industry's -14% trend. Despite a 3% annual dip in earnings over five years, its debt-to-equity ratio impressively shrank from 40.5% to 13.4%. Trading at a discount of 27.2% below estimated fair value suggests potential undervaluation opportunities for investors seeking hidden gems in Europe’s tech sector. The company also boasts more cash than total debt and maintains high-quality non-cash earnings, indicating robust financial health amidst industry challenges.

- Dive into the specifics of Novabase S.G.P.S here with our thorough health report.

Evaluate Novabase S.G.P.S' historical performance by accessing our past performance report.

Deutsche Balaton (HMSE:BBHK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Deutsche Balaton AG is a private equity firm specializing in investments in both listed and unlisted companies, real estate, and other assets, with a market capitalization of €238.07 million.

Operations: The primary revenue streams for Deutsche Balaton AG include Beta Systems and Asset Management, generating €80.55 million and €45.86 million respectively.

BBHK, a compact player in the European market, showcases intriguing financial dynamics. Its earnings have surged by 221.2% over the past year, outpacing the Capital Markets industry growth of 27.5%. Despite a yearly earnings decline of 16.1% over five years, BBHK maintains a strong position with more cash than total debt and has reduced its debt-to-equity ratio from 38.1% to 4.6%. The price-to-earnings ratio stands at an attractive 2.5x compared to Germany's market average of 17.8x, suggesting potential undervaluation for investors looking beyond mainstream options.

- Click to explore a detailed breakdown of our findings in Deutsche Balaton's health report.

Explore historical data to track Deutsche Balaton's performance over time in our Past section.

Turning Ideas Into Actions

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 306 more companies for you to explore.Click here to unveil our expertly curated list of 309 European Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Novabase S.G.P.S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NVQ

Novabase S.G.P.S

Through its subsidiaries, provides IT consulting and services in Portugal, rest of Europe, Africa, the Middle East, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion