- Spain

- /

- Specialty Stores

- /

- BME:NTH

Naturhouse Health (BME:NTH) Margin Gain Challenges Bearish Narrative Despite Forecasted Earnings Decline

Reviewed by Simply Wall St

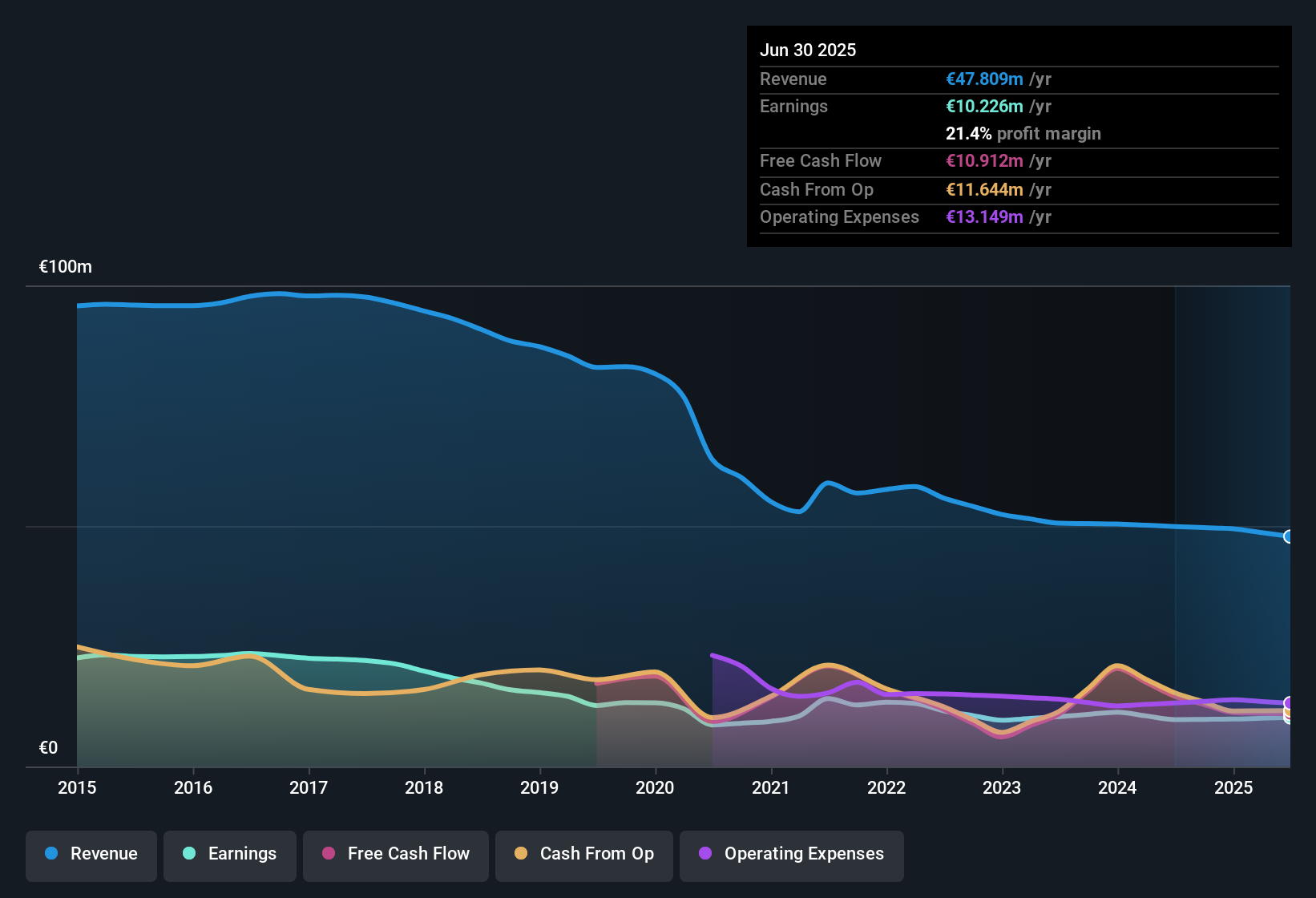

Naturhouse Health (BME:NTH) reported that while earnings are forecast to decline by 4.6% annually and revenue by 0.4% per year over the next three years, recent results show signs of improvement. Earnings grew 5% over the past year, a strong reversal from the average 1.5% annual decline of the past five years, and net profit margins have risen to 21.4% from 19.5% last year. With shares trading at €2.18, above the latest discounted cash flow estimate of €1.88, investors are weighing these positive margin improvements and the attractive 12.8x price-to-earnings ratio, which is significantly below sector averages, against the clear risk of future revenue and earnings declines.

See our full analysis for Naturhouse Health.Next up, we will see how these headline numbers stack up against the stories and expectations driving the Naturhouse Health narrative. Some widely held assumptions may be confirmed, while others could be called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Push Higher

- Net profit margin reached 21.4%, up from 19.5% in the previous year. This signals the company is extracting more earnings from every euro of revenue amid low revenue growth forecasts.

- While the improvement in margins heavily supports the bullish case that Naturhouse can sustain profitability despite projected revenue headwinds,

- The margin expansion comes as earnings are expected to decrease by 4.6% annually over the next three years. This highlights a tension between recent cost discipline and longer-term growth risks.

- Bulls may point to these robust margins as a sign of operational resilience, but with ongoing revenue pressures, maintaining this efficiency may become increasingly difficult.

Price-to-Earnings Still a Standout Value

- The current price-to-earnings ratio of 12.8x is well below both peer (34.6x) and industry (20x) averages, suggesting the share price may not fully reflect the company's recent margin improvements.

- What’s surprising is that, even though Naturhouse’s shares are trading above the DCF fair value of €1.88 at €2.18,

- This relative discount to industry multiples could attract value-oriented investors, especially if Naturhouse continues to defend its net margin advances despite stagnating sales.

- The lower multiple creates a buffer for downside risk, but the premium to fair value implies that any stalling in margin momentum could bring a valuation correction.

Forecasts Signal Declines Despite Momentum

- Earnings are forecast to shrink by an average of 4.6% annually even after a notable 5% uptick this past year. Revenue is also set to decline by 0.4% per year through the next three years.

- The prevailing analysis underscores that, although recent results show Naturhouse can grow its bottom line in challenging conditions,

- The projected multi-year decline in both top- and bottom-line figures keeps longer-term optimism in check.

- This ongoing contraction, against a backdrop of sector competition and cost pressures, means bulls face an uphill battle if trends do not reverse.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Naturhouse Health's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strengthening margins, Naturhouse Health faces persistent pressure from declining revenue and earnings forecasts. These challenges could undermine future performance.

For investors who want more stable and consistent growth potential, use our stable growth stocks screener to focus on companies delivering reliable expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Naturhouse Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:NTH

Naturhouse Health

Operates in the nutrition and dietetics industry in Spain, Italy, France, Poland, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives