- Spain

- /

- Specialty Stores

- /

- BME:ITX

Inditex (BME:ITX): Exploring Valuation as Long-Term Growth and Recent Returns Diverge

Reviewed by Simply Wall St

Industria de Diseño Textil (BME:ITX) shares have seen mild movement lately, catching the interest of investors who are weighing its long-term performance against recent returns. The stock’s pattern suggests underlying shifts in sentiment.

See our latest analysis for Industria de Diseño Textil.

Industria de Diseño Textil’s latest moves come on the back of subtle shifts in risk perception and growth optimism. While its share price returned nearly 8% this month, a one-year total shareholder return of -8.5% reminds investors that long-term momentum has faded. However, three- and five-year performance remains strong. Overall, the stock’s short-term momentum has picked up, but the longer-term trend reflects a more mixed outlook on value and risk.

If recent activity in ITX has you scanning for your next opportunity, broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading just below analyst targets and long-term growth appearing solid, the real question is whether ITX is trading below its intrinsic value or if the market has already factored in its future prospects. Is there a buying opportunity, or has growth already been priced in?

Most Popular Narrative: 3.7% Undervalued

Industria de Diseño Textil’s latest widely-followed narrative estimates fair value just above the recent close, setting a slightly optimistic tone. The difference points toward greater upside than current market levels suggest, and invites a look under the hood at what drives this calculation.

Inditex plans to expand its logistics capabilities with a significant investment program to increase global growth opportunities. This is expected to enhance operational efficiency and scalability, potentially leading to higher revenue growth in the medium to long term. The integration of technology in store operations, such as the rollout of soft tags and self-checkout terminals, aims to improve customer experience and operational efficiency. These changes can help drive up net margins by reducing operating expenses relative to sales growth.

Want to know the growth blueprint behind this high valuation? The secret sauce: bold expansion bets and a future profit multiple not typically seen in retail. Curious what bullish projections the narrative is banking on? Dive deeper to uncover the surprising numbers and big ambitions fueling this fair value call.

Result: Fair Value of €50.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, currency headwinds or rising inventory levels could disrupt the optimistic forecast. This makes ongoing execution and market conditions key to watch.

Find out about the key risks to this Industria de Diseño Textil narrative.

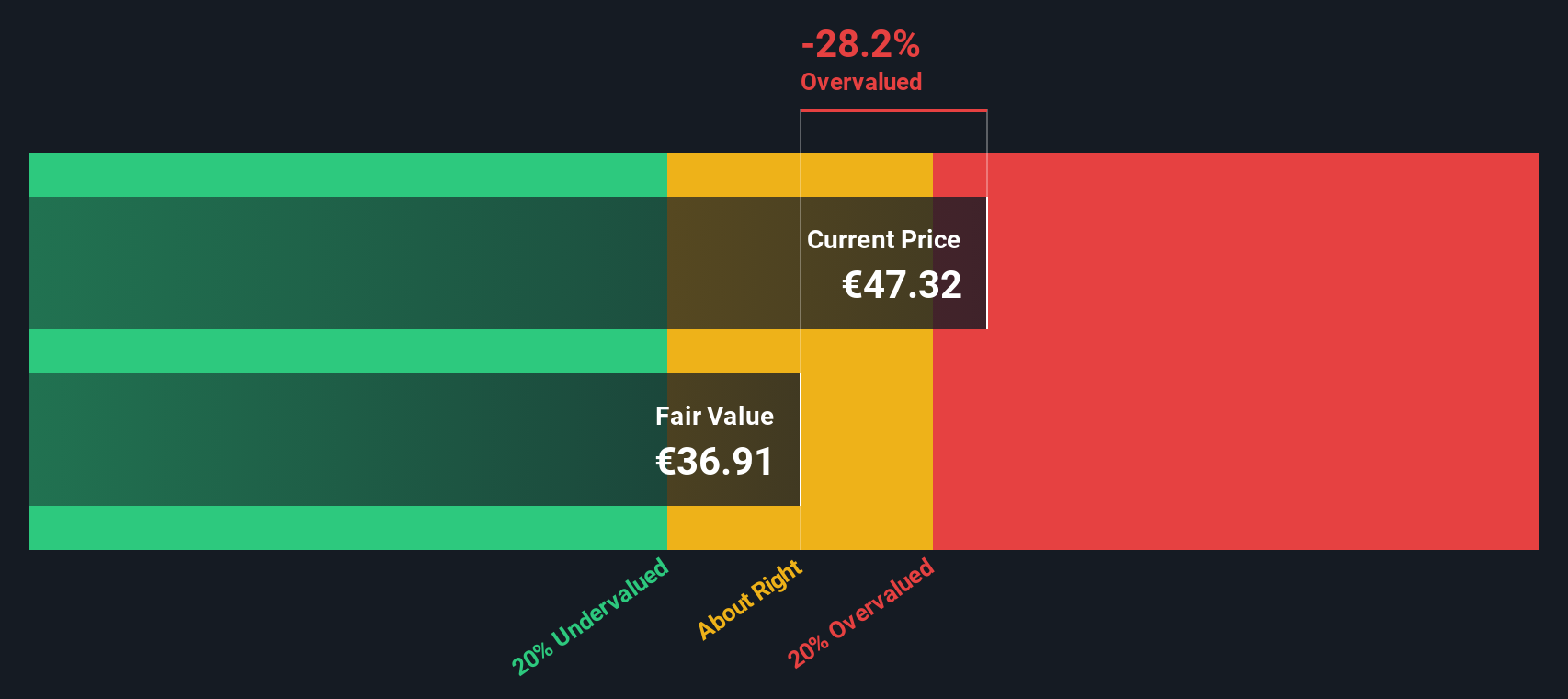

Another View: DCF Tells a Different Story

The SWS DCF model, which uses future cash flow estimates, offers a more reserved outlook compared to the analyst consensus. According to this approach, Industria de Diseño Textil’s fair value stands at €37.20, making the current price appear expensive. Are analysts overestimating the company’s long-term earning power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Industria de Diseño Textil for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Industria de Diseño Textil Narrative

If you see things differently or prefer digging into the numbers your way, you can piece together your own view in just a few minutes, and Do it your way

A great starting point for your Industria de Diseño Textil research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to uncover stocks with standout potential. Make your next smart move and scan these select opportunities before the window closes.

- Power up your watchlist by targeting unstoppable trends and tap into these 33 healthcare AI stocks as artificial intelligence shapes the next era of medicine.

- Snag attractive yields with companies known for steady payouts, starting with these 17 dividend stocks with yields > 3% which offers strong income potential above 3%.

- Catch early movers transforming digital finance and ride the wave with these 80 cryptocurrency and blockchain stocks leading blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ITX

Industria de Diseño Textil

Engages in the retail and online distribution of clothing, footwear, accessories, and household products in Spain, rest of Europe, the Americas, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion