- Spain

- /

- Specialty Stores

- /

- BME:ITX

Assessing Inditex After 10% Jump and International Growth News in 2025

Reviewed by Bailey Pemberton

If you’ve recently checked your portfolio and wondered what to do next with Industria de Diseño Textil, you’re not alone. Whether you’re contemplating holding on, taking profits, or buying in, the stock’s recent movements have caught the attention of both long-time shareholders and new investors alike. After a strong bounce back over the past month, with a gain of nearly 10% in just 30 days, the stock is showing some renewed energy. This short-term upswing follows a slight 3% climb in the past week, hinting that sentiment may be shifting. Still, stepping back, there is a different story when you look year-to-date and at the trailing 12 months, with returns of -1.2% and -6.5%, respectively. Longer-term holders are likely in much better spirits, thanks to gains of over 130% in three years and 165% over five years.

Recent news has provided even more context for these moves, highlighting the company’s continued push for international expansion and investments in sustainable production methods. These developments have added new dimensions to market perceptions of Industria de Diseño Textil, possibly influencing how risk and growth are being weighed by analysts and investors.

So, how does all this recent action stack up when you break down the numbers? On classic valuation metrics, the company earns a value score of 2 out of 6, indicating it appears undervalued on two key checks out of six total. In the next section, we will unpack what these valuation methods reveal and explore an even more insightful way to think about value before you make your next move.

Industria de Diseño Textil scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

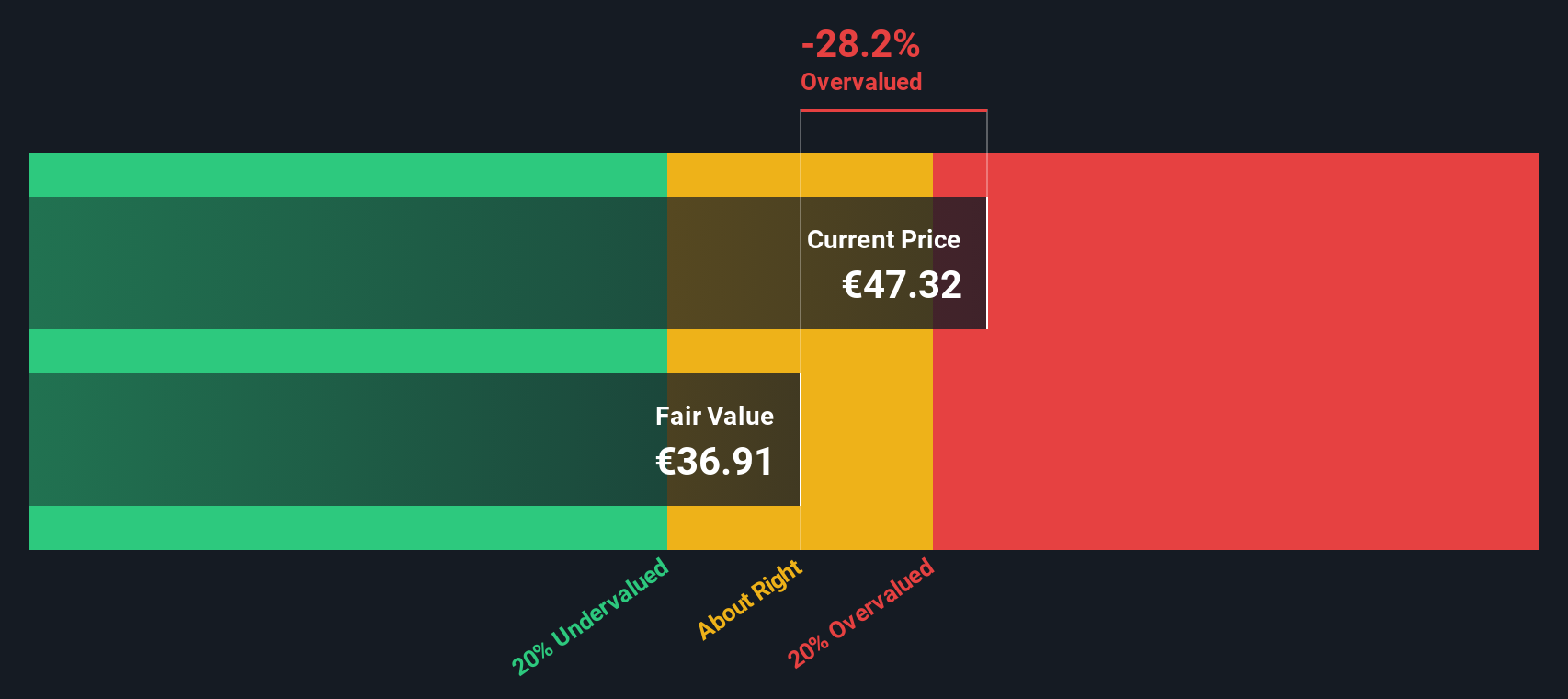

Approach 1: Industria de Diseño Textil Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth by projecting its future cash flows and then discounting those back to their value today. For Industria de Diseño Textil, the DCF approach looks at the company’s ability to generate free cash flow, both now and in the future, to determine its fair value.

Currently, the company’s trailing twelve-month free cash flow stands at approximately €6.3 billion. Analyst forecasts extend five years out, estimating annual free cash flow to reach roughly €8.3 billion by 2029. Beyond that, Simply Wall St extrapolates the growth further and projects free cash flow could rise to about €11.1 billion in a decade.

According to the DCF model, this stream of expected cash generation results in an intrinsic value per share of €37.39. This figure is around 33% below the current share price, implying that Industria de Diseño Textil is trading at a significant premium based on its future cash-generating potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Industria de Diseño Textil may be overvalued by 32.9%. Find undervalued stocks or create your own screener to find better value opportunities.

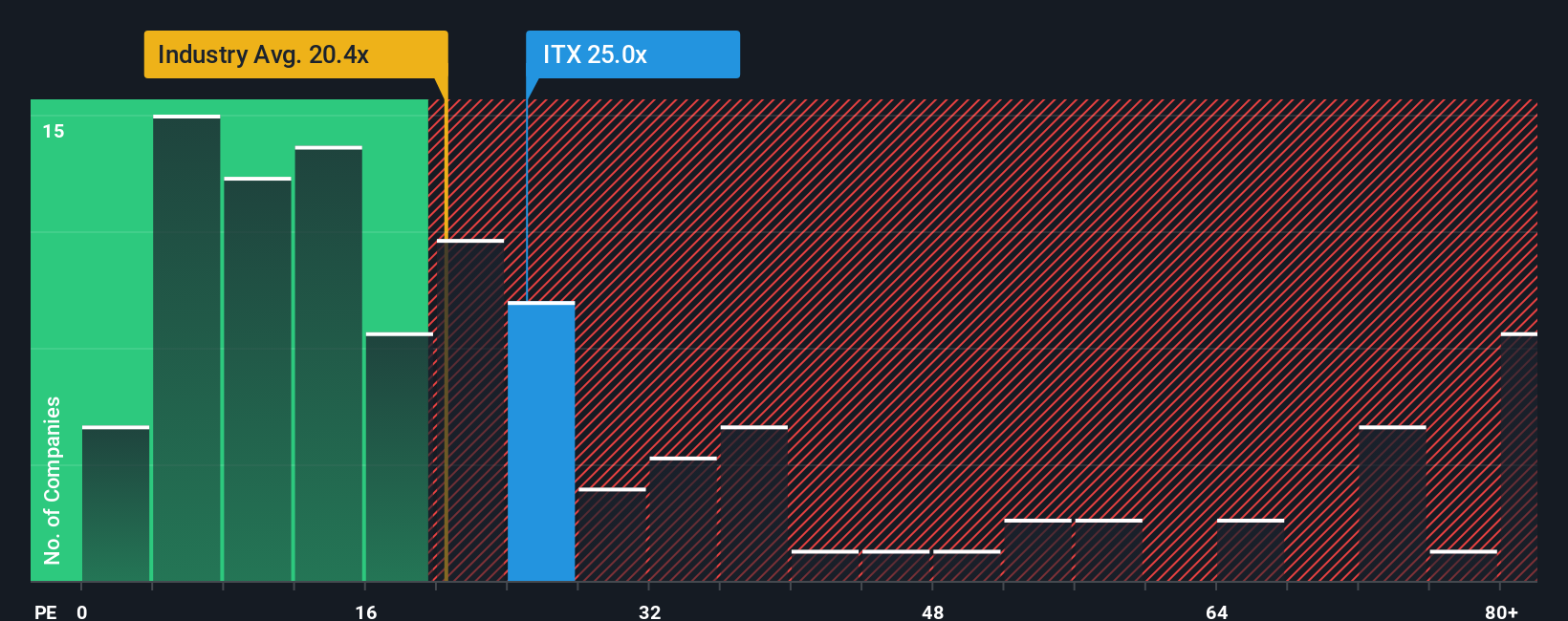

Approach 2: Industria de Diseño Textil Price vs Earnings

For consistently profitable companies like Industria de Diseño Textil, the Price-to-Earnings (PE) ratio is often the preferred valuation tool. It helps investors quickly gauge how much they are paying for each euro of current earnings. A higher PE ratio can reflect strong growth expectations or lower perceived risk. A lower PE might signal the opposite.

Currently, Industria de Diseño Textil trades at a PE ratio of 26.3x. When compared to the specialty retail industry average of 16.7x and the company’s peer group average of 30.6x, it sits somewhat in the middle. This indicates a valuation above the broader industry but a bit below close peers. This placement suggests the market recognizes its quality and growth, but is not pricing it at the most optimistic levels.

To go a step further, Simply Wall St’s proprietary “Fair Ratio” model takes additional factors into account, including the company’s earnings growth, margins, market cap, and risk profile. For Industria de Diseño Textil, the Fair Ratio is 32.4x. This benchmark customizes the valuation to the company’s specifics and offers a sharper perspective than broad industry or peer averages.

Comparing the Fair Ratio of 32.4x with the actual PE of 26.3x, the shares appear meaningfully undervalued by this measure. The wider gap suggests that, relative to its future prospects and risk, the stock may be trading at a discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

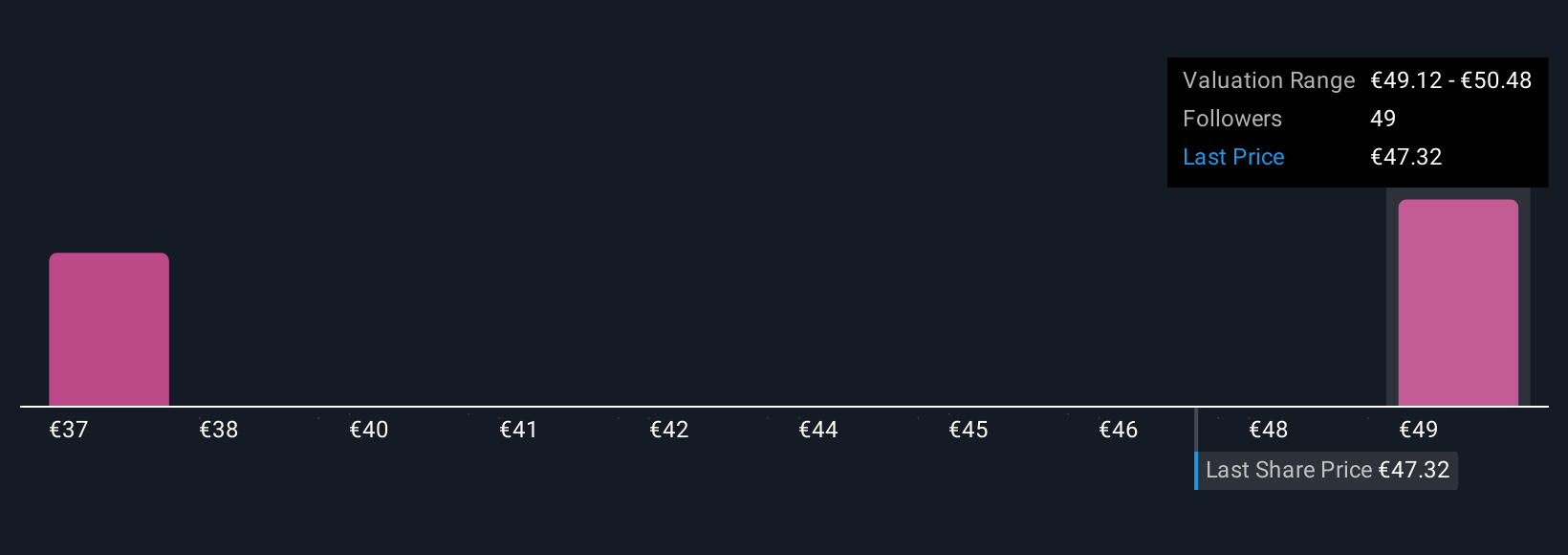

Upgrade Your Decision Making: Choose your Industria de Diseño Textil Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you craft your own investment story for a company, weaving together the numbers, such as your assumptions for future revenue, earnings, and margins, with your perspective on what really drives the business. Narratives help connect the dots from a company's evolving story to financial forecasts and all the way to an estimated fair value, making your decision-making much more dynamic and personal.

On Simply Wall St, millions of investors use Narratives on the Community page to express and update their own view, compare it with others, and see how new information, such as news or earnings, reshapes the outlook in real time. By comparing your Fair Value to the current Price, Narratives empower you to decide if, when, and why to buy or sell, based on your unique take.

For example, with Industria de Diseño Textil, one Narrative sees logistics expansion and tech upgrades driving long-term growth and sets a bullish fair value of €60.0. Meanwhile, another, more cautious perspective, points to risks from tariffs and inventory and sets a conservative target of just €38.4.

Do you think there's more to the story for Industria de Diseño Textil? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ITX

Industria de Diseño Textil

Engages in the retail and online distribution of clothing, footwear, accessories, and household products in Spain, rest of Europe, the Americas, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion