Pulling back 88% this week, Trajano Iberia Socimi's BME:YTRA) five-year decline in earnings may be coming into investors focus

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Trajano Iberia Socimi, S.A. (BME:YTRA) shareholders for doubting their decision to hold, with the stock down 96% over a half decade. The falls have accelerated recently, with the share price down 91% in the last three months. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 88% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

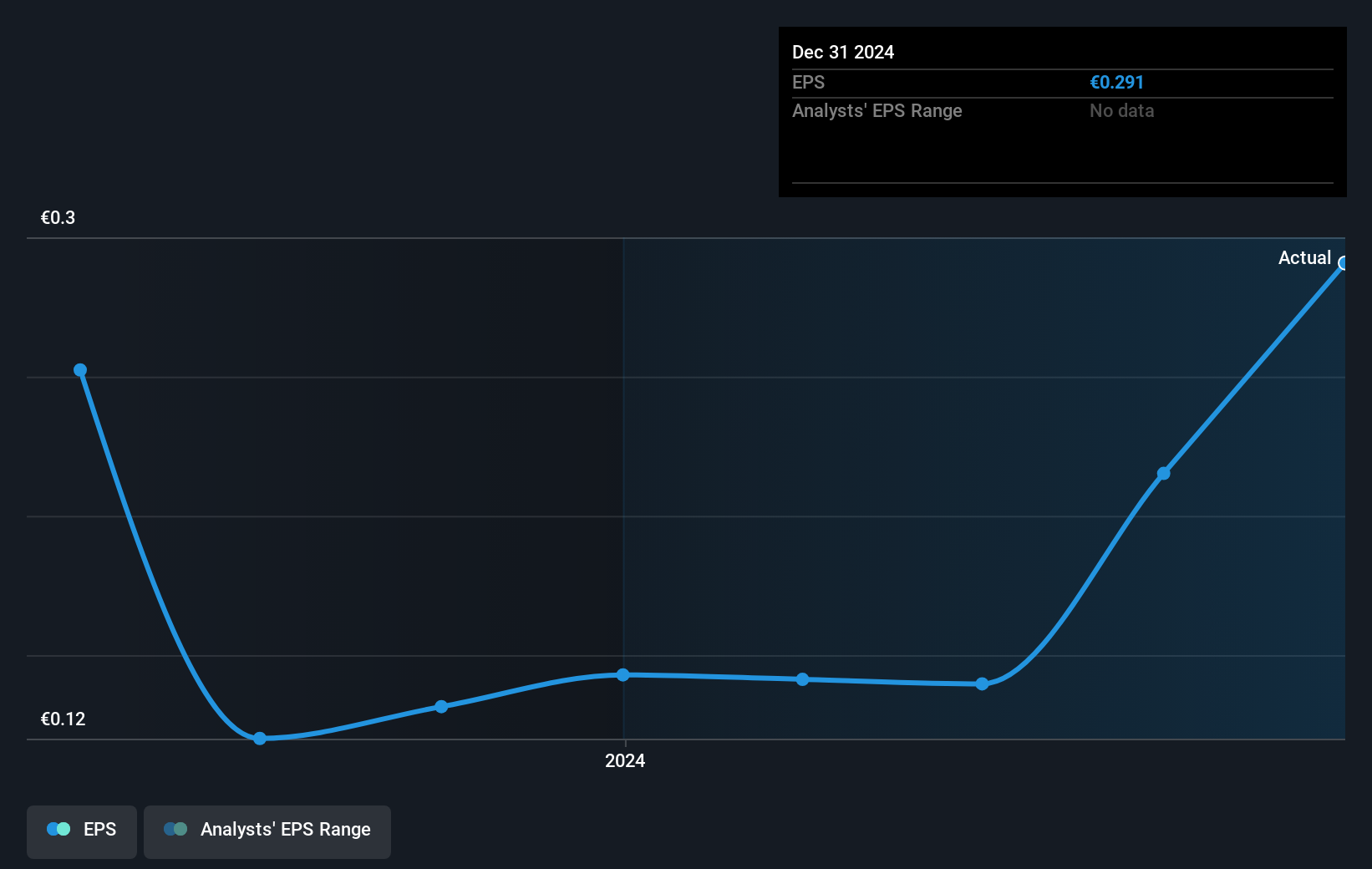

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Looking back five years, both Trajano Iberia Socimi's share price and EPS declined; the latter at a rate of 30% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 49% per year, over the period. This implies that the market was previously too optimistic about the stock. The low P/E ratio of 1.03 further reflects this reticence.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Trajano Iberia Socimi's key metrics by checking this interactive graph of Trajano Iberia Socimi's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Trajano Iberia Socimi, it has a TSR of 60% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Trajano Iberia Socimi shareholders have received a total shareholder return of 63% over one year. That's including the dividend. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for Trajano Iberia Socimi (4 don't sit too well with us!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Trajano Iberia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:TRA

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives