Grifols (BME:GRF): Exploring Valuation as Investor Sentiment Shifts on Recent Fundamentals

Reviewed by Kshitija Bhandaru

Grifols (BME:GRF) has drawn investor interest following recent movements in its stock price. Shares have climbed over the past month, prompting market watchers to reassess how the company’s latest financial performance compares with its valuation.

See our latest analysis for Grifols.

Grifols’ share price has gathered momentum in recent weeks, reflecting a shift in market sentiment as investors weigh up its steadily improving fundamentals. The stock’s performance over the past year has been modest, with a 1-year total shareholder return just above zero. However, recent positive price action suggests that confidence in its outlook could be on the rise.

If you’re weighing up what’s next, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

That brings us to the question on every investor’s mind: Is Grifols currently undervalued based on its fundamentals, or has the market already factored in future growth prospects, potentially limiting further upside?

Most Popular Narrative: 23.5% Undervalued

The narrative’s estimated fair value for Grifols is significantly above the last close price, creating a notable spread that has the attention of investors. The upcoming outlook relies on several key assumptions and bold operational bets, as detailed in this widely followed narrative.

“Robust global demand for plasma-derived therapies is driving above-market revenue growth for Grifols' core immunoglobulin, albumin, and alpha-1 franchises, a trend supported by increased disease prevalence from an aging population and rising diagnosis rates, which is expected to support sustained revenue expansion.”

Curious what is fueling this valuation? The reasons include a combination of aggressive margin expansion and ambitious growth targets, all based on evolving global healthcare dynamics. Want to see how much future profit growth is expected to support the higher fair value? Unlock the full story and find out which assumptions are driving this price.

Result: Fair Value of $16.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as persistent pricing pressure in key markets and high debt levels could challenge Grifols' growth outlook and future earnings momentum.

Find out about the key risks to this Grifols narrative.

Another View: Based on Earnings Ratios

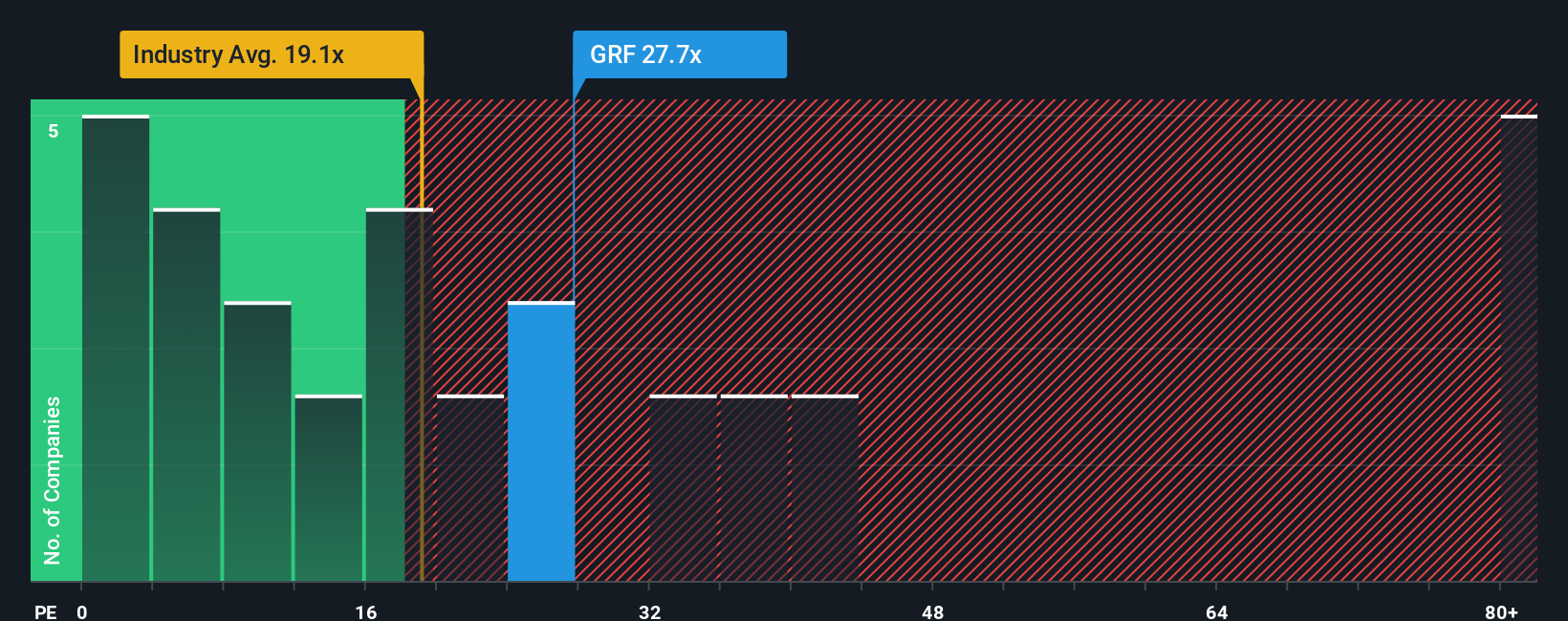

While the fair value estimate suggests Grifols is deeply undervalued, its current price-to-earnings ratio of 28.8x is higher than the European Biotechs industry average of 20.3x, but much lower than the peer average of 52.5x. The fair ratio for Grifols is estimated at 28.4x, not far off its current level. This means valuation risk and upside are finely balanced and the share price could be closer to fair value than some think.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grifols Narrative

If you have a different perspective or want to dive into the numbers on your own terms, it’s easy to craft a personalized view of Grifols in just minutes, so why not Do it your way?

A great starting point for your Grifols research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing to the next level by scanning markets for fresh opportunities most investors overlook. Don’t let the next big winner pass you by.

- Capture higher returns by targeting companies with sustainable yields in these 19 dividend stocks with yields > 3% and secure your income stream well above market averages.

- Capitalize on momentum in digital finance when you check out these 78 cryptocurrency and blockchain stocks, uncovering businesses behind crypto infrastructure and blockchain innovation.

- Seize early growth stories by finding overlooked gems among these 3569 penny stocks with strong financials, ideal for those eager to spot tomorrow’s potential leaders today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GRF

Grifols

Operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives