Almirall (BME:ALM) shareholders are up 3.5% this past week, but still in the red over the last five years

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Almirall, S.A. (BME:ALM) shareholders for doubting their decision to hold, with the stock down 40% over a half decade.

The recent uptick of 3.5% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Almirall

Almirall wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

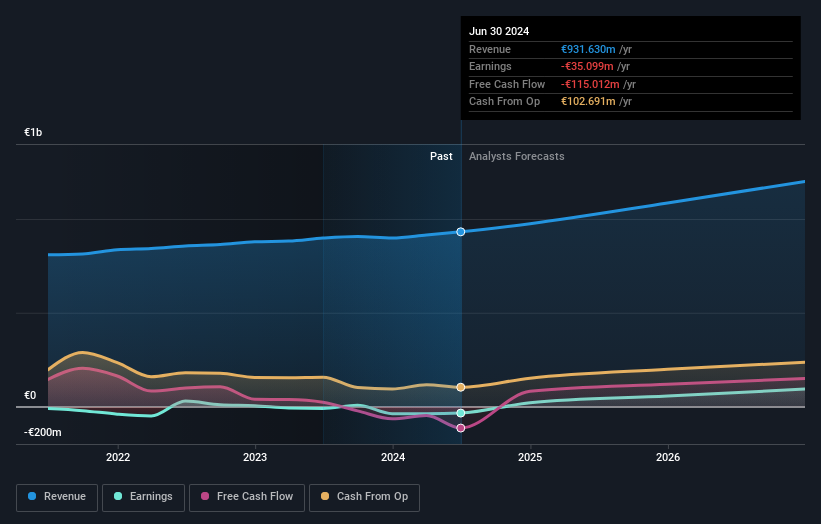

Over five years, Almirall grew its revenue at 1.0% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 7% (annualized) in the same time frame. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Almirall is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Almirall will earn in the future (free analyst consensus estimates)

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Almirall's TSR for the last 5 years was -36%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Almirall shareholders are down 0.9% for the year (even including dividends), but the market itself is up 30%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 6% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Almirall may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ALM

Almirall

Operates as a skin health-focused biopharmaceutical company in Spain, Europe, the Middle East, the United States, Asia, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives