Almirall (BME:ALM): Reworked Debt Structure Prompts Fresh Look at Valuation After New 2031 Bond Issue

Reviewed by Simply Wall St

Almirall (BME:ALM) just reshaped its balance sheet, planning to redeem its €300 million 2.125% notes due 2026 while issuing €250 million in 3.75% senior unsecured notes maturing 2031, representing a meaningful capital structure refresh.

See our latest analysis for Almirall.

The new bond issue and planned redemption come as Almirall’s €12.84 share price rides strong momentum, with a 90 day share price return of 14.03% and a robust 1 year total shareholder return of 56.95% signaling that investors are rewarding both growth and cleaner financing.

If this kind of balance sheet reshaping interests you, it might be worth scanning other pharma stocks with solid dividends that combine income potential with solid healthcare fundamentals.

With earnings and cash flows improving and the new bond issue extending maturities, Almirall trades only modestly below analyst targets. This raises the real question: is this momentum stock still attractive, or is future growth already priced in?

Most Popular Narrative: 7.4% Undervalued

With Almirall closing at €12.84 against an implied fair value of about €13.86, the most followed narrative points to modest upside still on the table.

Analysts are assuming Almirall's revenue will grow by 10.5% annually over the next 3 years.

Analysts assume that profit margins will increase from 2.0% today to 10.2% in 3 years time.

Curious how a still early stage profit story can support that richer future earnings multiple, while keeping growth and margins marching higher for years to come?

Result: Fair Value of $13.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain, particularly around Ebglyss launch momentum and sustained U.S. weakness, which could quickly challenge today’s optimistic rerating narrative.

Find out about the key risks to this Almirall narrative.

Another View: Market Ratios Flash a Caution Sign

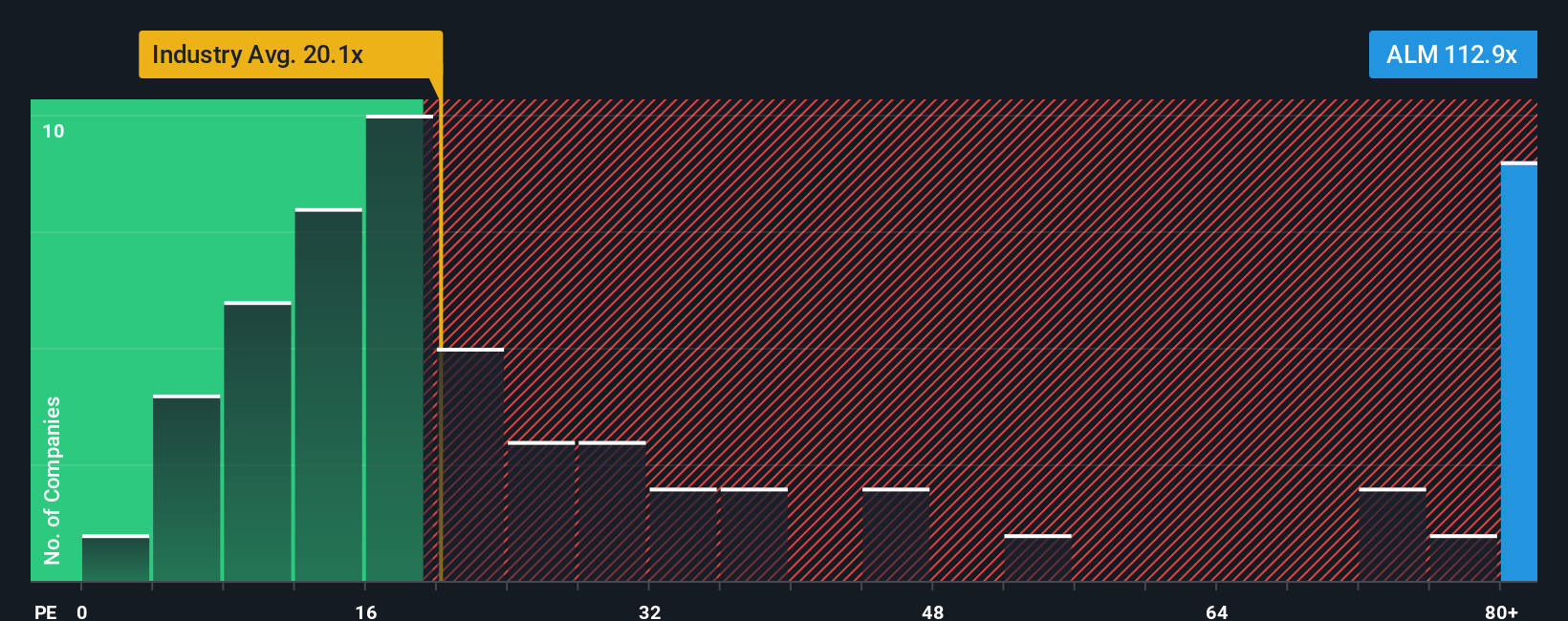

While the narrative and fair value work suggest upside, the market’s own yardstick tells a different story. Almirall trades on a 65.6x price to earnings ratio, roughly double both peers at 31.5x and its 32.2x fair ratio, implying little margin for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Almirall Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Almirall.

Looking for your next investing move?

Do not stop at one compelling story. Sharpen your edge by scanning hand picked stock ideas across different themes and uncovering where the next opportunity could be hiding.

- Capture growth potential early by scanning these 3636 penny stocks with strong financials that already back strong business quality with real financial traction.

- Position for the next productivity revolution by assessing these 26 AI penny stocks shaping everything from automation to intelligent decision making.

- Lock in attractive entry points with these 910 undervalued stocks based on cash flows that trade below what their cash flows suggest they are truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ALM

Almirall

Operates as a skin health-focused biopharmaceutical company in Spain, Europe, the Middle East, the United States, Asia, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)