- France

- /

- Diversified Financial

- /

- ENXTPA:ABCA

Exploring Three Undiscovered European Gems for Savvy Investors

Reviewed by Simply Wall St

The European market is currently experiencing a wave of optimism, buoyed by potential EU-U.S. trade agreements and stable interest rates from the European Central Bank, which have contributed to modest gains in key indices like the STOXX Europe 600. With such economic conditions fostering resilience in the eurozone's private sector, investors are increasingly on the lookout for stocks that demonstrate strong fundamentals and growth potential within this dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Miquel y Costas & Miquel (BME:MCM)

Simply Wall St Value Rating: ★★★★★★

Overview: Miquel y Costas & Miquel, S.A. is a company that manufactures and sells thin and special lightweight paper primarily for the tobacco industry across Spain, the European Union, OECD countries, and internationally, with a market capitalization of €537.28 million.

Operations: The company generates revenue primarily from the tobacco industry, contributing €248.86 million, and industrial products, adding €96.96 million.

Miquel y Costas & Miquel, a notable player in the European market, showcases a strong financial footing with its debt to equity ratio dropping from 25.1% to 14.4% over five years and maintaining a satisfactory net debt to equity ratio of 0.7%. Despite earnings declining by 1% annually over the past five years, recent performance paints a brighter picture with earnings up by 14%, outpacing the forestry industry’s -22.9%. The company’s price-to-earnings ratio stands at an attractive 11x compared to Spain's market average of 18.4x, suggesting potential undervaluation for investors seeking opportunities in this sector.

- Click here and access our complete health analysis report to understand the dynamics of Miquel y Costas & Miquel.

Evaluate Miquel y Costas & Miquel's historical performance by accessing our past performance report.

ABC arbitrage (ENXTPA:ABCA)

Simply Wall St Value Rating: ★★★★★★

Overview: ABC arbitrage SA, with a market cap of €370.06 million, develops arbitrage strategies for liquid assets across Europe, North America, Asia, and internationally through its subsidiaries.

Operations: With a revenue of €51.49 million from arbitrage trading, ABC arbitrage SA focuses on developing strategies for liquid assets globally.

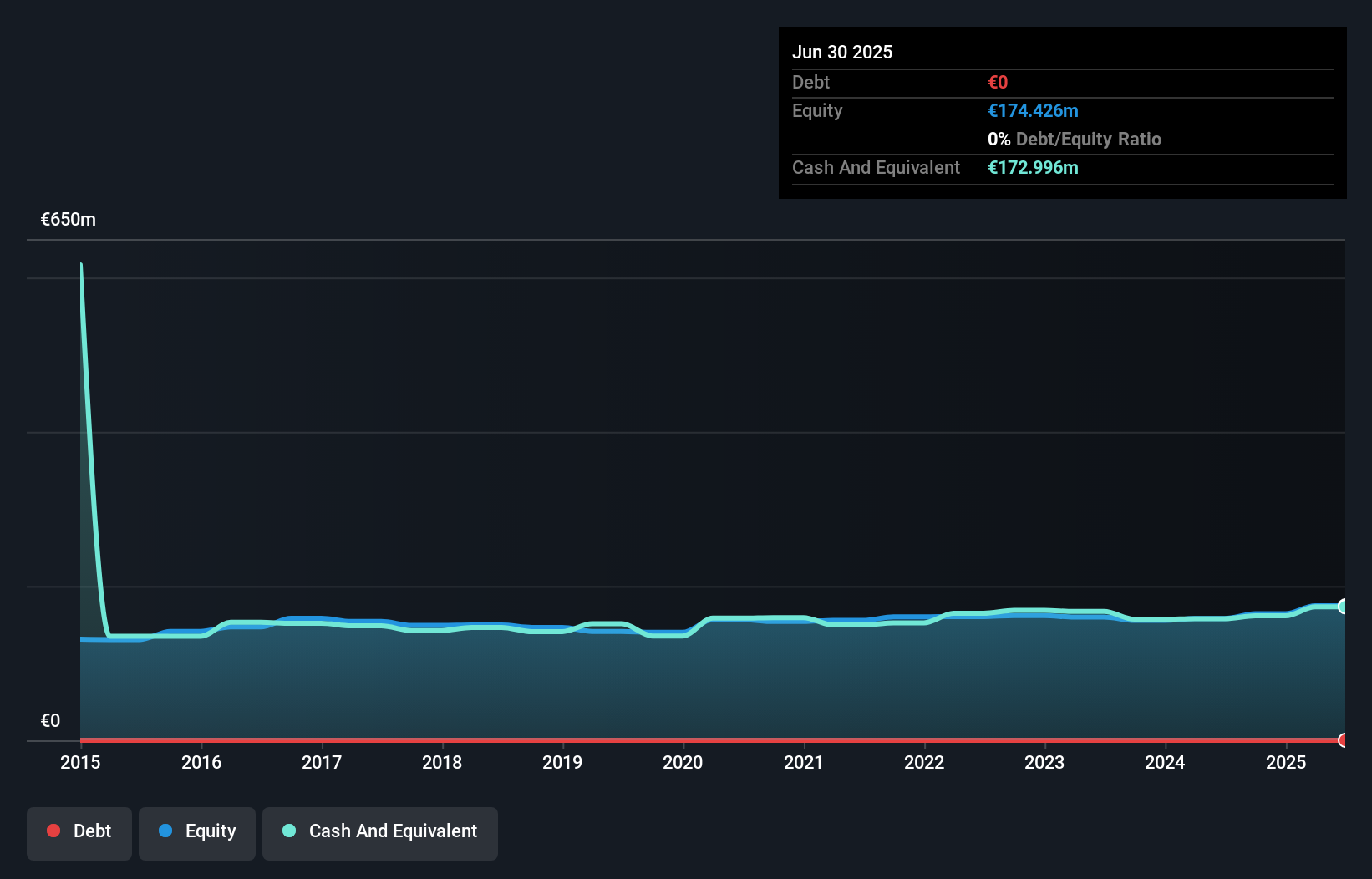

ABC arbitrage, a nimble player in the financial sector, stands out with its debt-free status and high-quality earnings. Trading at 20.1% below estimated fair value, it seems undervalued. Over the past year, earnings grew by 62.9%, although this lagged behind the industry average of 157.1%. Despite being profitable and having positive free cash flow, its future earnings are expected to decline by an average of 10.3% annually over the next three years. Recent shareholder meetings affirmed a €0.04 dividend per share for July 2025, with plans for further interim dividends pending board approval later this year.

- Navigate through the intricacies of ABC arbitrage with our comprehensive health report here.

Examine ABC arbitrage's past performance report to understand how it has performed in the past.

eQ Oyj (HLSE:EQV1V)

Simply Wall St Value Rating: ★★★★★☆

Overview: eQ Oyj is a publicly owned investment manager with a market capitalization of €536.22 million.

Operations: The primary revenue streams for eQ Oyj are Asset Management, contributing €58.53 million, and Corporate Finance, adding €4.58 million. The company's net profit margin is a crucial indicator to consider in evaluating its financial performance over time.

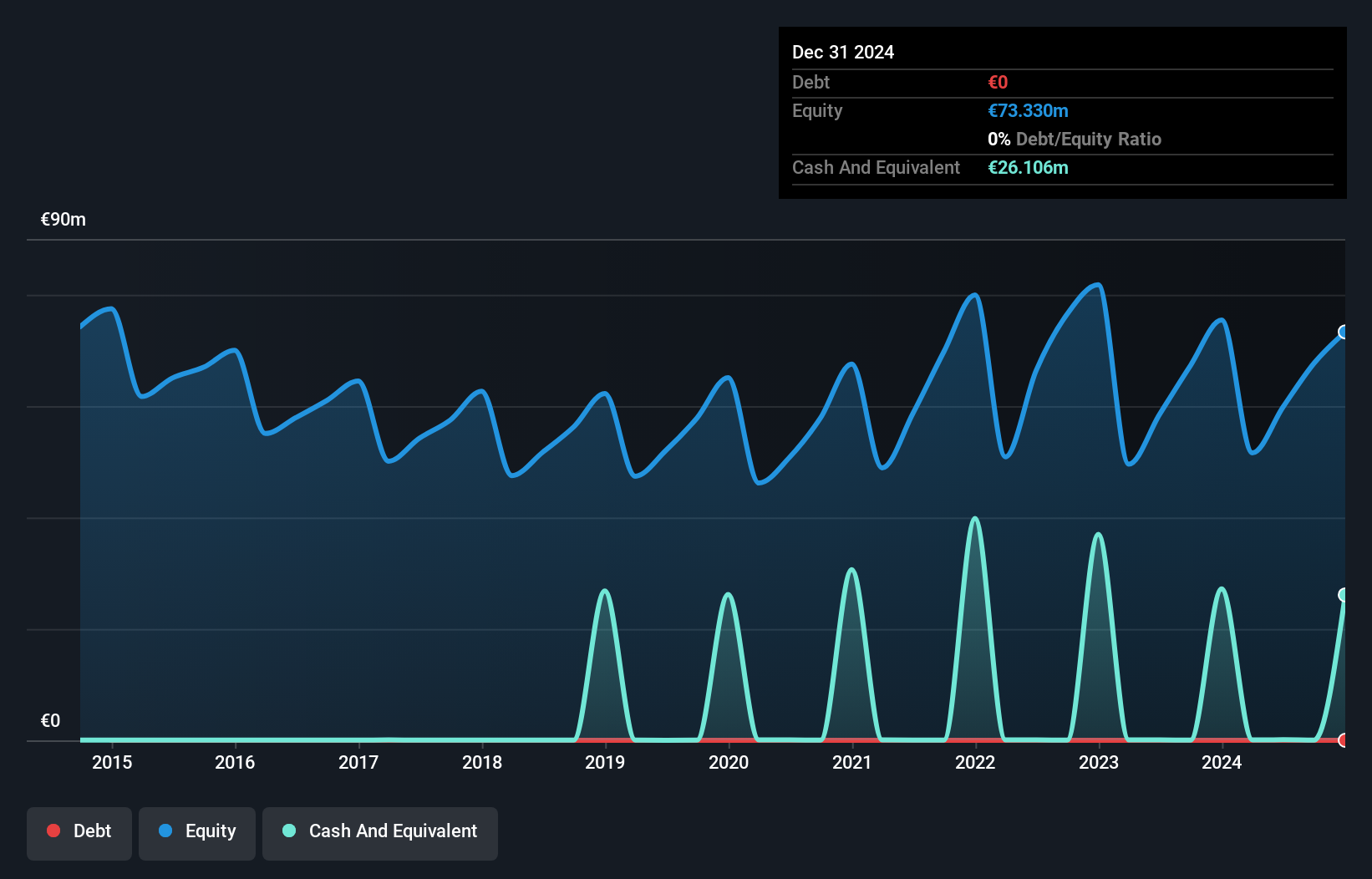

eQ Oyj, a financial services entity in Europe, stands out with its debt-free status over the past five years and high-quality earnings. Despite a recent 18.4% negative earnings growth, it remains profitable with positive free cash flow of €20.93 million as of March 2024. Trading at 7.1% below fair value suggests potential for investors seeking undervalued opportunities. Recent executive changes are noteworthy; Jouko Pölönen is set to take over as CEO on September 1, 2025, following his acquisition of a 2.4% stake for approximately €12 million, indicating confidence in the company’s prospects and leadership direction.

- Dive into the specifics of eQ Oyj here with our thorough health report.

Review our historical performance report to gain insights into eQ Oyj's's past performance.

Next Steps

- Explore the 317 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ABCA

ABC arbitrage

Develops arbitrage strategies for liquid assets in Europe, North America, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives