- Spain

- /

- Basic Materials

- /

- BME:IMC

Undiscovered Gems in Europe with Strong Fundamentals December 2025

Reviewed by Simply Wall St

In December 2025, the European market has shown resilience with the pan-European STOXX Europe 600 Index rising by 1.60%, buoyed by steady economic growth and favorable monetary policy conditions. As investors navigate this landscape, identifying stocks with strong fundamentals becomes crucial for capitalizing on these positive trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Inmocemento (BME:IMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Inmocemento, S.A. operates through its subsidiaries in the cement and real estate sectors both within Spain and internationally, with a market capitalization of approximately €1.64 billion.

Operations: Inmocemento generates revenue primarily from its cement segment, contributing approximately €651 million, and its real estate segment, adding around €291 million. The company's net profit margin is a key financial metric to consider when evaluating its overall profitability.

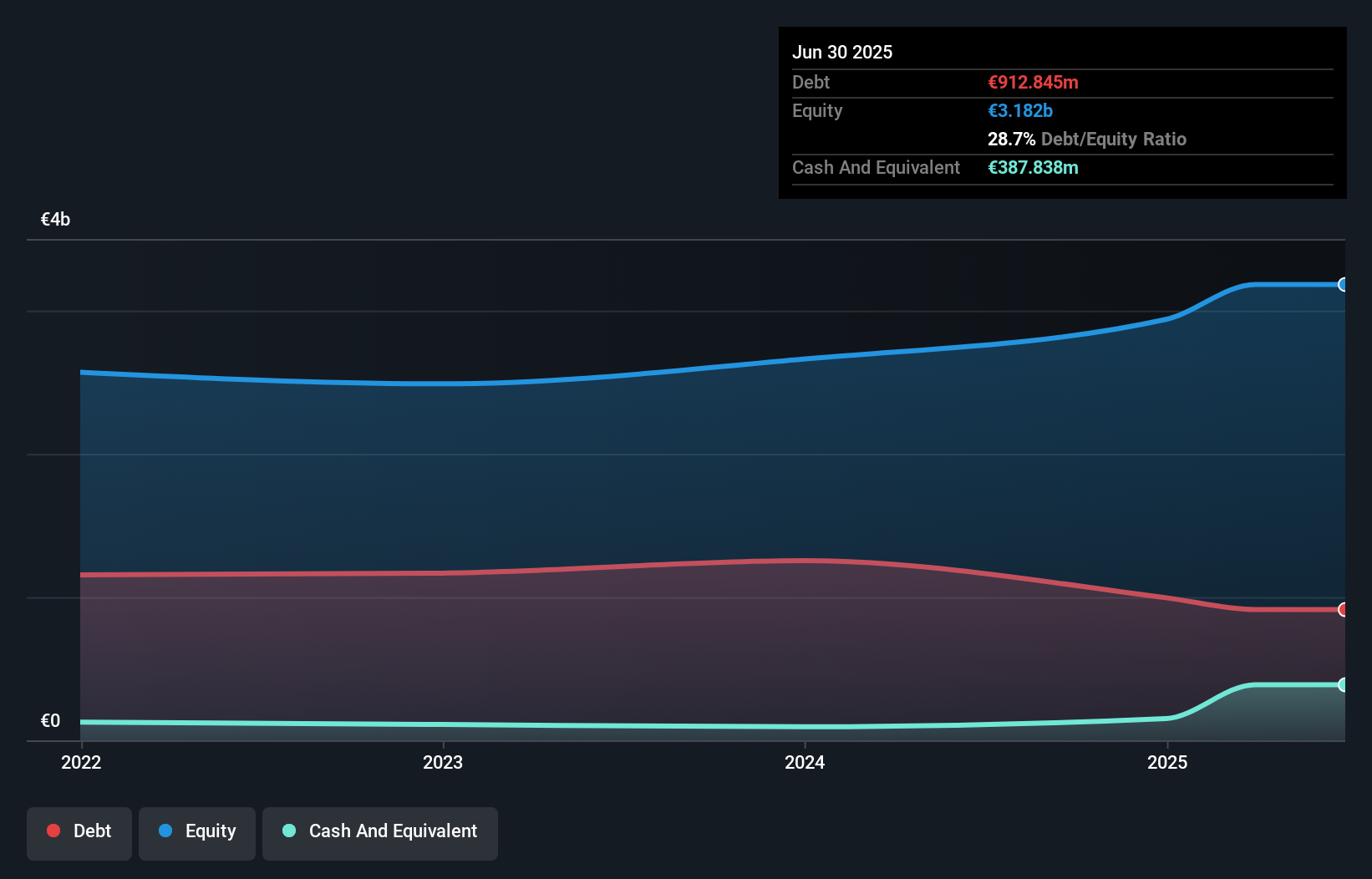

Inmocemento, a smaller player in the European market, showcases promising attributes with its earnings growth of 62.6% over the past year, outpacing the Basic Materials industry's -2% performance. Its interest payments are comfortably covered by EBIT at 7.6x, indicating robust financial health. Trading at 59.5% below estimated fair value suggests potential undervaluation, appealing to investors seeking value opportunities. The net debt to equity ratio stands at a satisfactory 16.5%, reinforcing its stable position despite insufficient data on debt reduction over five years. With high-quality earnings and positive free cash flow (US$289 million), Inmocemento seems poised for continued resilience in its sector.

- Take a closer look at Inmocemento's potential here in our health report.

Evaluate Inmocemento's historical performance by accessing our past performance report.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renta 4 Banco, S.A. operates in wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €760.96 million.

Operations: Renta 4 Banco generates revenue primarily through its wealth management, brokerage, and corporate advisory services. The company's financial performance is characterized by a net profit margin that reflects its operational efficiency in these sectors.

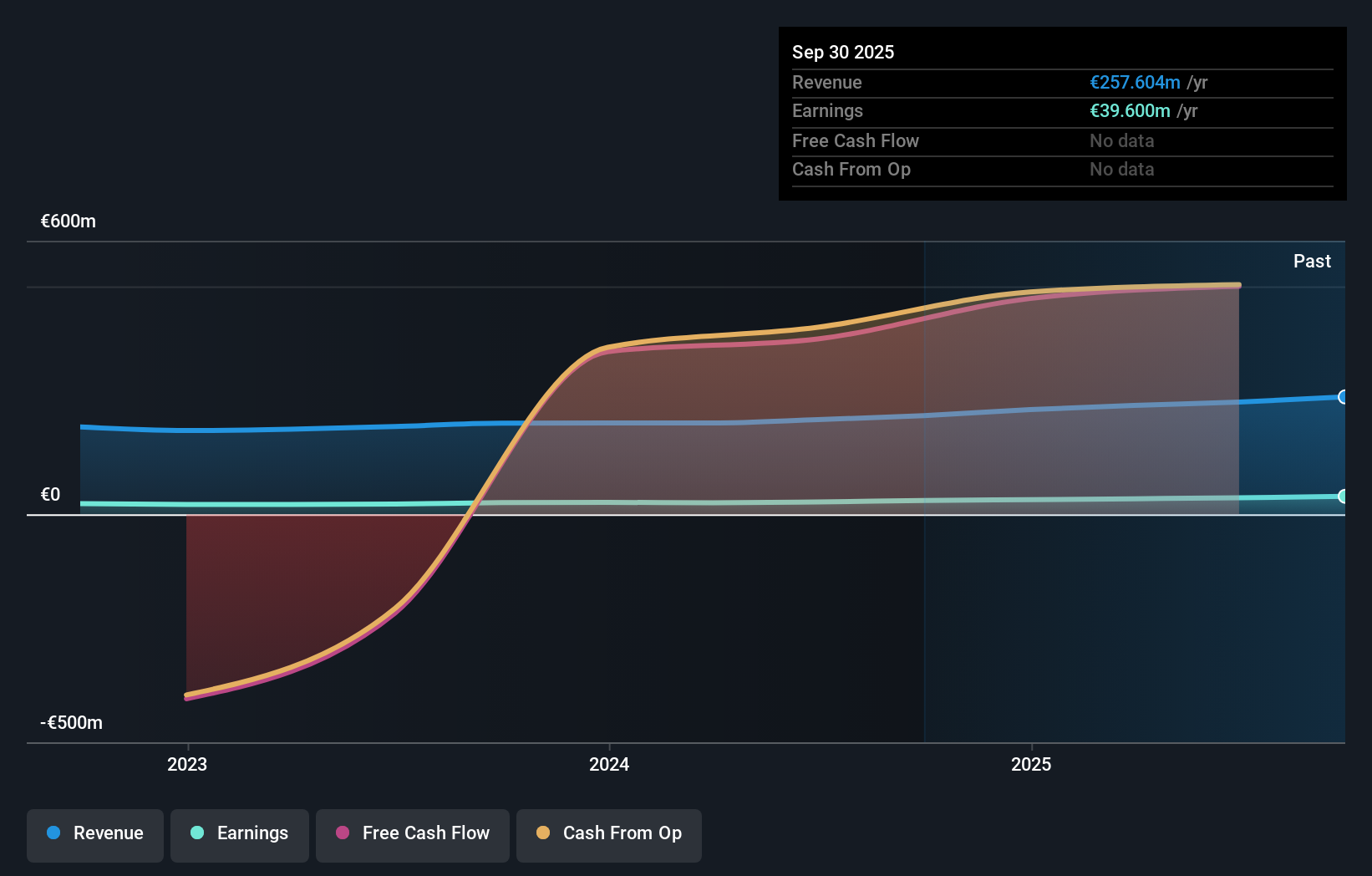

Renta 4 Banco, a nimble player in the financial sector, boasts impressive earnings growth of 31.6% over the past year, outpacing its industry peers' 10.5%. The firm has shed its debt burden completely from a debt to equity ratio of 2.6% five years ago and now stands debt-free. Recent results highlight a robust net income increase to €11.42 million for Q3 and €30.68 million for nine months ending September 2025, compared to previous figures of €8.04 million and €23.22 million respectively, showcasing high-quality earnings that bolster investor confidence in this dynamic enterprise's trajectory.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) is engaged in the development, manufacturing, and assembly of components and systems for industrial customers across various countries including Sweden, Finland, Germany, the USA, China, and others with a market cap of SEK17.47 billion.

Operations: AQ Group generates revenue primarily from its System and Component segments, with SEK1.42 billion and SEK8.12 billion respectively. The company's financial performance is influenced by these key segments, which contribute significantly to its overall revenue streams.

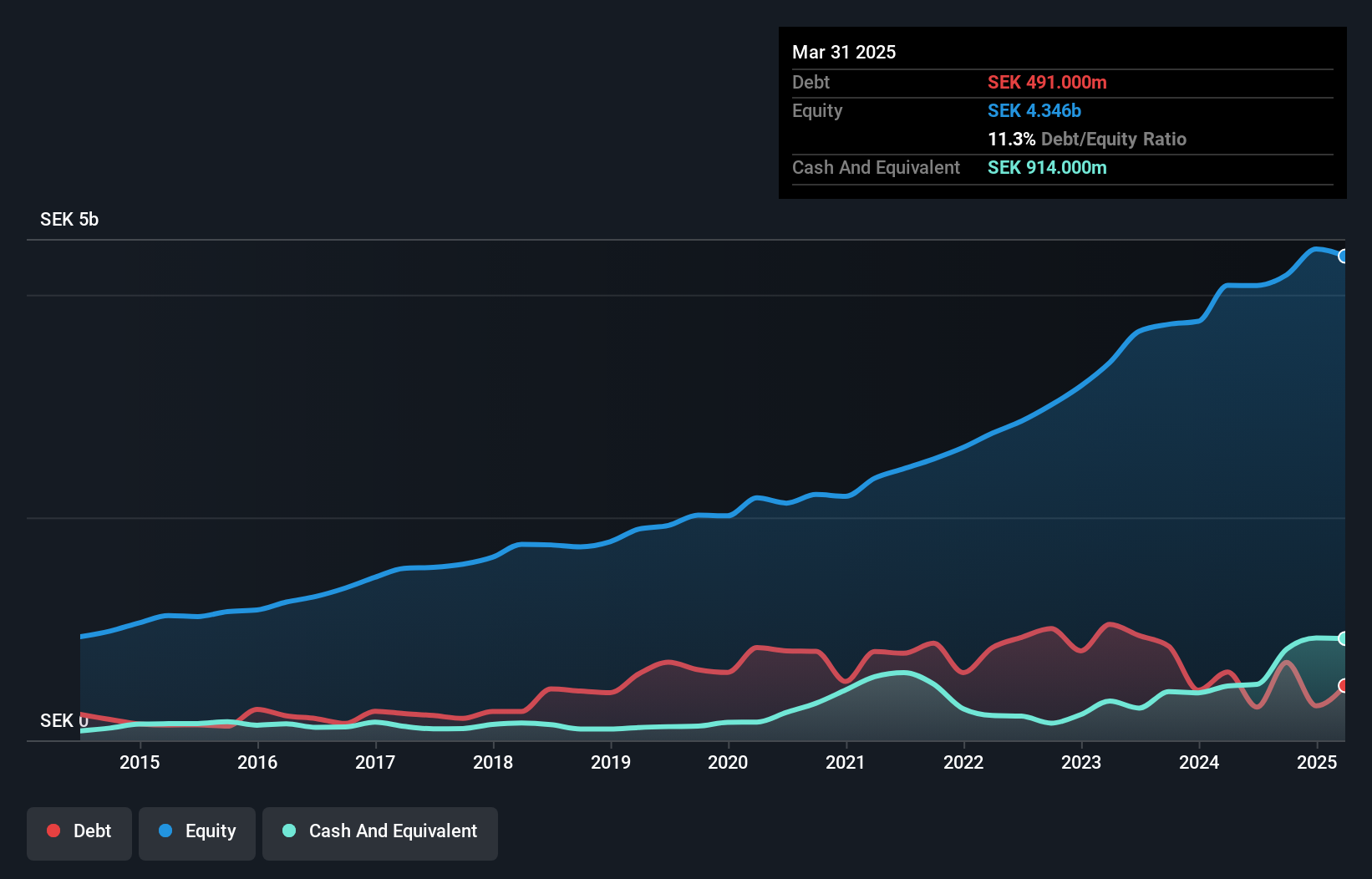

AQ Group, a promising player in the electrical industry, has shown consistent earnings growth of 18.2% annually over five years, though recent growth of 3.1% lagged behind the industry average. The company boasts high-quality earnings and maintains a strong financial position with cash exceeding total debt and interest payments well-covered by EBIT at 119.8 times coverage. Its debt to equity ratio improved significantly from 36.2% to 3.2%. Despite recent insider selling, AQ's price-to-earnings ratio of 26.3x remains attractive compared to the industry average of 27.4x, indicating potential value for investors seeking opportunities in this sector.

- Click here to discover the nuances of AQ Group with our detailed analytical health report.

Assess AQ Group's past performance with our detailed historical performance reports.

Key Takeaways

- Dive into all 308 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IMC

Inmocemento

Through its subsidiaries, engages in the cement and real estate businesses in Spain and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion