- Belgium

- /

- Medical Equipment

- /

- ENXTBR:ONWD

Inmocemento Leads The Charge In Our European Penny Stock Spotlight

Reviewed by Simply Wall St

As European markets show signs of steady economic growth and benefit from looser monetary policy, the pan-European STOXX Europe 600 Index has risen by 1.60%, with major stock indexes also seeing gains. In this context, penny stocks—often representing smaller or newer companies—remain a relevant area for investors seeking unique opportunities beyond the more established names. While traditionally associated with higher risk, certain penny stocks stand out due to their financial resilience and potential for significant returns, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.548 | €1.57B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.68 | €83.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.02 | €64.06M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.29 | €379.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.074 | €7.96M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 296 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Inmocemento (BME:IMC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Inmocemento, S.A. operates in the cement and real estate sectors both in Spain and internationally, with a market cap of €1.64 billion.

Operations: The company generates revenue from its cement segment, which accounts for €651 million, and its real estate segment, contributing €291.10 million.

Market Cap: €1.64B

Inmocemento, S.A. demonstrates solid financial health with its net debt to equity ratio at 16.5% and operating cash flow effectively covering its debt obligations. The company has shown impressive earnings growth of 62.6% over the past year, surpassing both its five-year average growth rate of 33.8% and the industry average decline of -2%. Trading at a significant discount to estimated fair value, Inmocemento's short-term assets comfortably exceed both short-term and long-term liabilities. However, the board's lack of experience could be a potential concern for investors seeking seasoned governance in their investments.

- Jump into the full analysis health report here for a deeper understanding of Inmocemento.

- Evaluate Inmocemento's historical performance by accessing our past performance report.

Onward Medical (ENXTBR:ONWD)

Simply Wall St Financial Health Rating: ★★★★★★

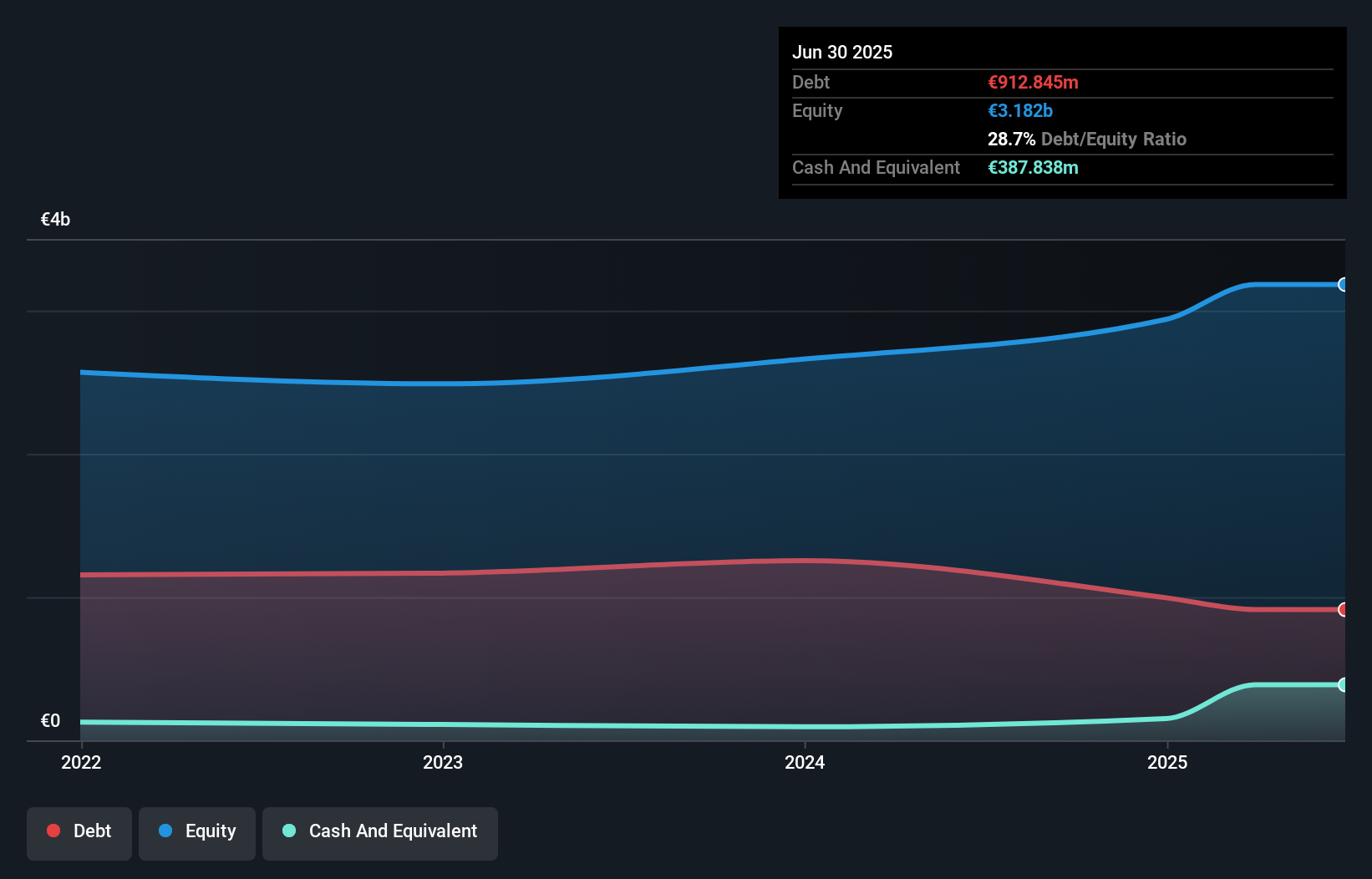

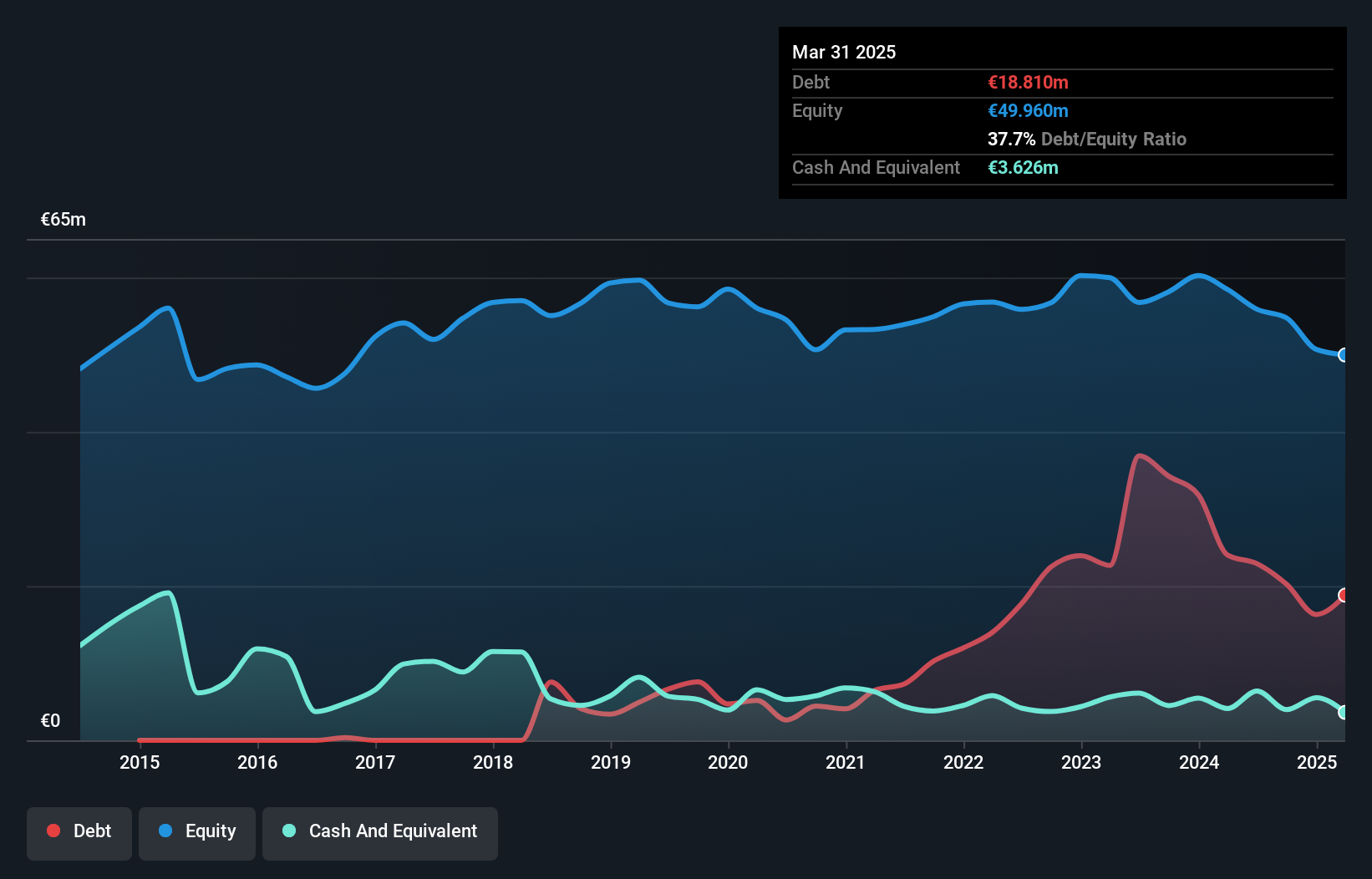

Overview: Onward Medical N.V. is a medical technology company focused on developing and commercializing therapies for functional recovery in individuals with Spinal Cord Injury, with a market cap of €182.76 million.

Operations: The company generates revenue from its Biotechnology (Startups) segment, amounting to €2.72 million.

Market Cap: €182.76M

Onward Medical N.V. is experiencing significant developments in its medical technology offerings, notably with the ARC-EX System receiving FDA clearance for expanded home use, enhancing its market presence across over 60 U.S. clinics. Despite being pre-revenue with €3 million in revenue, the company has a robust financial position, as short-term assets of €45.4 million exceed both short and long-term liabilities. Recent capital raised through a €50.85 million equity offering strengthens its cash runway beyond nine months despite current unprofitability and forecasted earnings decline over the next three years. The management team’s average tenure suggests recent restructuring efforts.

- Dive into the specifics of Onward Medical here with our thorough balance sheet health report.

- Examine Onward Medical's earnings growth report to understand how analysts expect it to perform.

Viscom (XTRA:V6C)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscom SE develops, manufactures, and sells inspection systems for industrial production applications across Europe, the Americas, and Asia with a market cap of €38.56 million.

Operations: The company's revenue is generated from various regions, with €36.95 million from Europe (excluding Germany), €29.91 million from Asia, €23.62 million originating in Germany, and €10.86 million from the Americas.

Market Cap: €38.56M

Viscom SE, despite being unprofitable with a negative return on equity of -14.77%, shows potential in the penny stock space due to its strategic focus on industrial inspection systems across diverse markets. The company's seasoned management team has maintained guidance for 2025, targeting revenue between €80 million and €90 million with an EBIT margin of 2% to 5%. While recent earnings reveal a net loss increase to €1.59 million for Q3, Viscom's short-term assets (€59.4M) comfortably cover both short and long-term liabilities, suggesting financial stability amidst volatility and competitive valuation against industry peers.

- Navigate through the intricacies of Viscom with our comprehensive balance sheet health report here.

- Understand Viscom's earnings outlook by examining our growth report.

Make It Happen

- Gain an insight into the universe of 296 European Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ONWD

Onward Medical

A medical technology company, develops and commercializes therapies to enable functional recovery for people with Spinal Cord Injury (SCI).

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion