- Spain

- /

- Basic Materials

- /

- BDM:CMO

Will Lower Earnings and Sales in 2025 Change Cementos Molins' (BDM:CMO) Investment Narrative?

Reviewed by Sasha Jovanovic

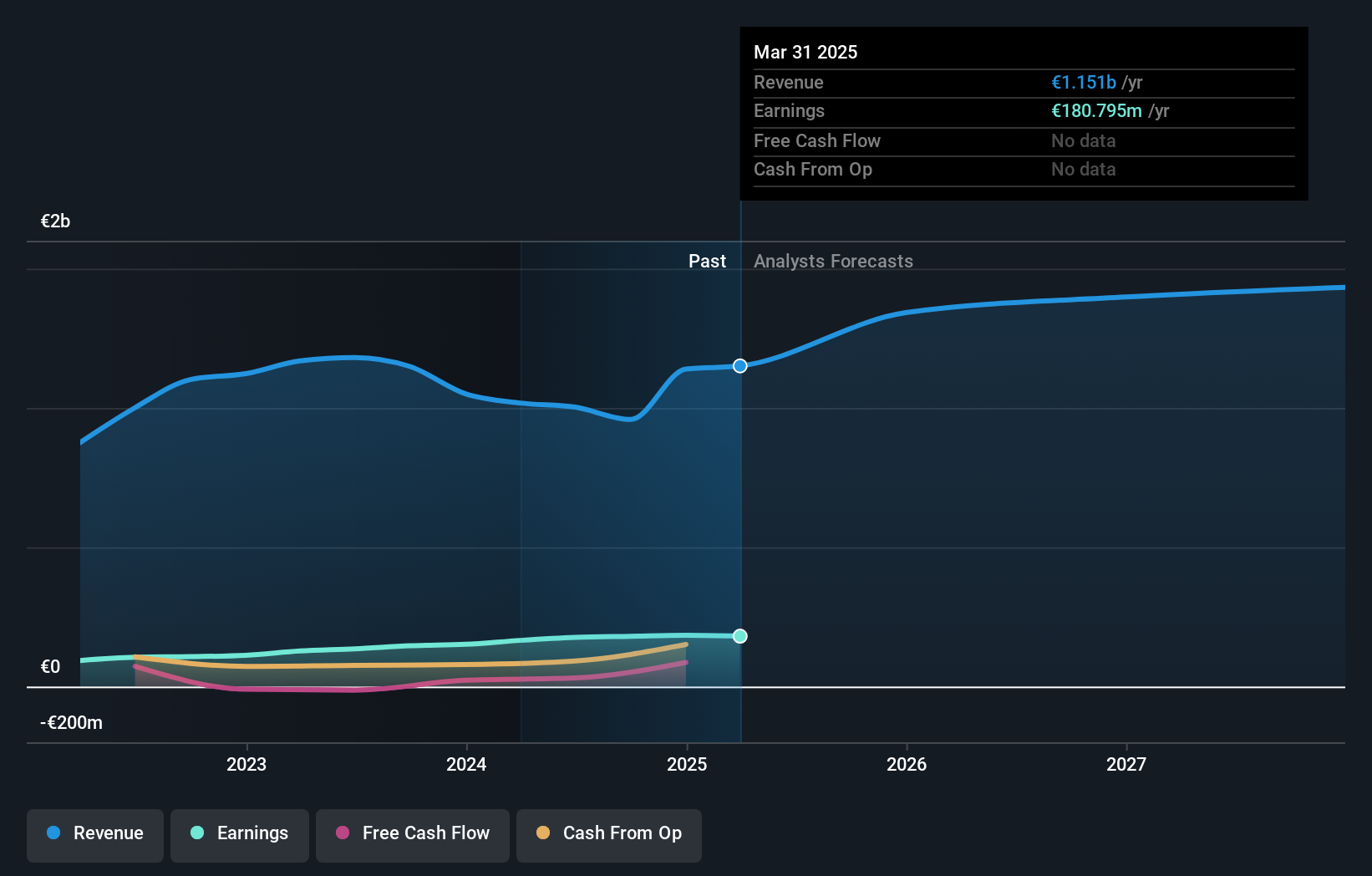

- Cementos Molins reported earnings results on October 30, 2025, announcing that sales for the nine months ended September 30 reached €751.4 million, with net income at €140.6 million, both down from the previous year.

- This decline in sales and net income stands out as a signal of changing business conditions impacting the company's financial performance this year.

- With both top- and bottom-line results decreasing, we’ll examine how these latest earnings figures shape Cementos Molins’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Cementos Molins' Investment Narrative?

Any shareholder in Cementos Molins has to believe in the company’s ability to remain resilient and adapt, even as this latest earnings update shows a decline in both sales and net income for the nine months to September 2025. The slide in revenue and profits is a deviation from the previously steady and mostly positive momentum, and could shift the tone around short term catalysts, particularly if construction demand weakens further or if operational efficiency initiatives do not offset cost pressures. So far, the recent results do not appear to have resulted in a sharp change to the share price or to average analyst fair value estimates, suggesting the news is not seen as materially impairing the long-term opportunity, but it does call even more attention to the risk of continued profit pressure. At this stage, the market seems to be weighing near-term earnings softness against earlier strategic moves, like the joint venture with TITAN, as it reassesses the company’s competitive position and prospects.

But while earlier growth signs supported optimism, the risk of persistent margin pressure is still very real.

Exploring Other Perspectives

Explore 3 other fair value estimates on Cementos Molins - why the stock might be worth as much as 11% more than the current price!

Build Your Own Cementos Molins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cementos Molins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cementos Molins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cementos Molins' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BDM:CMO

Cementos Molins

Manufactures and markets materials and solutions for construction.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives