- Spain

- /

- Basic Materials

- /

- BDM:CMO

Undiscovered Gems In Europe These 3 Small Caps With Promising Potential

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index rises by 3.44% amid easing tariff concerns, the eurozone's economic growth has doubled its pace, signaling a potential shift in market sentiment and opportunities for investors. In this environment of cautious optimism and mixed economic indicators, identifying small-cap stocks with promising potential requires a keen eye for companies that can navigate uncertainty while capitalizing on emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Cementos Molins (BDM:CMO)

Simply Wall St Value Rating: ★★★★★★

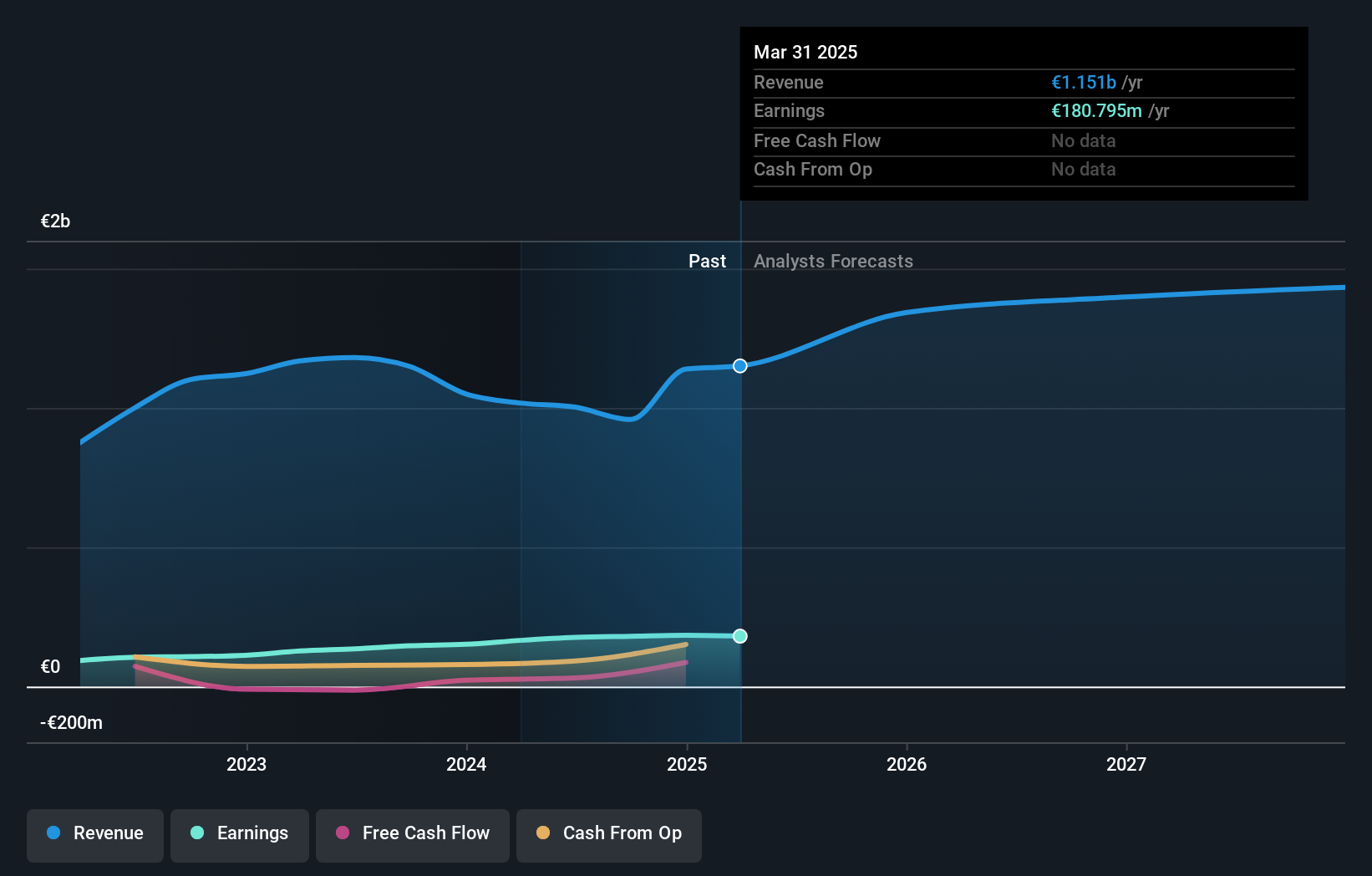

Overview: Cementos Molins, S.A. is a multinational company engaged in the manufacturing and sale of cement, lime, precast concrete, and other construction materials across various countries including Spain, Argentina, Mexico, and several others; it has a market capitalization of approximately €1.75 billion.

Operations: Revenue primarily comes from cement sales at €593.68 million, followed by precast concrete at €220.90 million and concrete & aggregates at €160.88 million. Construction solutions contribute an additional €86.97 million to the revenue stream.

Cementos Molins, a nimble player in the European market, has shown impressive financial health with its debt to equity ratio dropping from 24.2% to 13.2% over five years, indicating prudent financial management. This company boasts high-quality earnings and an EBIT that covers interest payments 4.6 times over, showcasing robust profitability. Recent results highlight a net income of €184 million for 2024, up from €151 million the previous year, with basic earnings per share rising to €2.78 from €2.29. Trading at a significant discount of 80% below estimated fair value suggests potential for future appreciation.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★★★

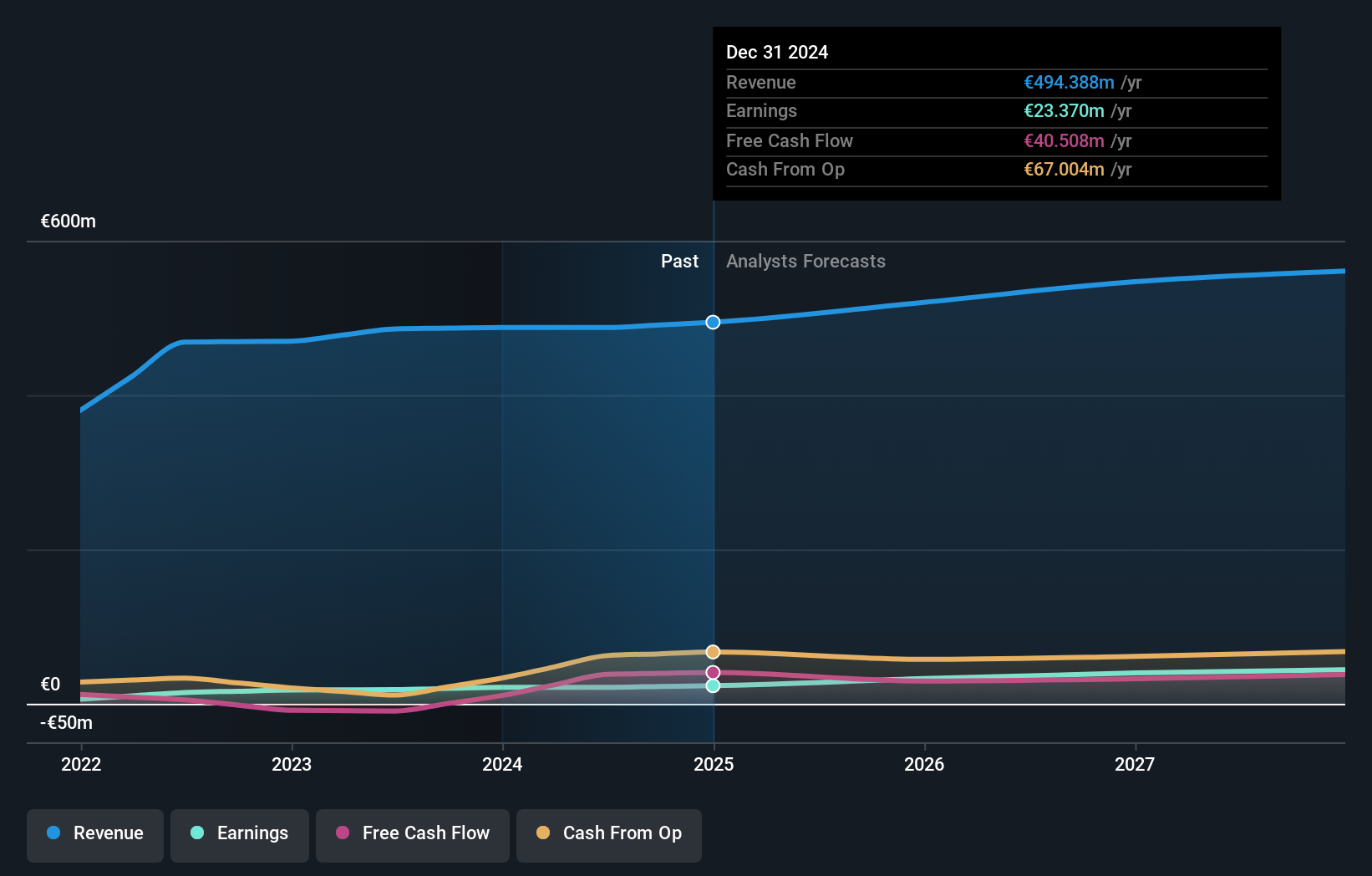

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €452.12 million.

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, totaling €494.39 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

EPC Groupe, a relatively small player in the European market, has shown promising financial health with its debt to equity ratio dropping from 73.9% to 45.5% over five years, indicating improved leverage management. The company reported EUR 490.16 million in sales for 2024, up from EUR 482.27 million the previous year, while net income rose to EUR 23.37 million from EUR 21.35 million, reflecting solid profitability growth of about 9%. Its earnings per share increased to EUR 11.22 from EUR 10.16, suggesting efficient operations and value creation for shareholders amidst a satisfactory net debt position at just under the industry threshold of concern.

- Get an in-depth perspective on EPC Groupe's performance by reading our health report here.

Assess EPC Groupe's past performance with our detailed historical performance reports.

Nyab (OM:NYAB)

Simply Wall St Value Rating: ★★★★★☆

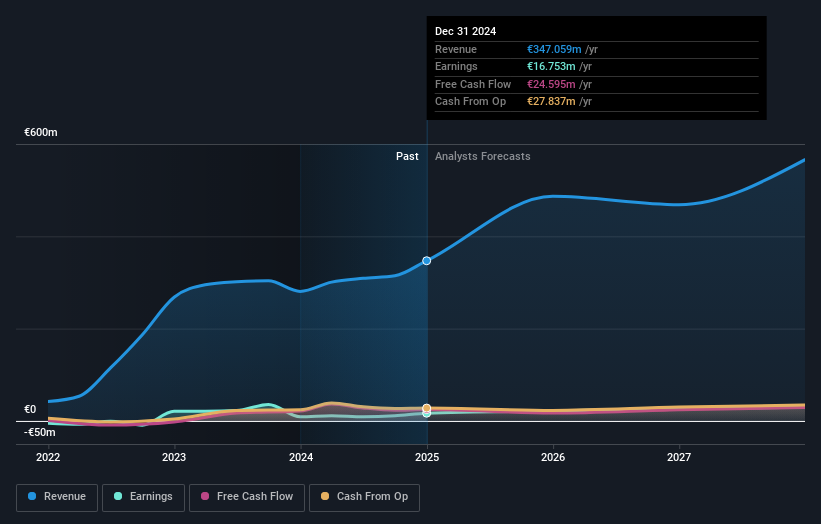

Overview: Nyab AB (publ) offers engineering, construction, and maintenance services for energy, infrastructure, and industrial projects in Finland and Sweden with a market cap of SEK4.14 billion.

Operations: Nyab generates revenue primarily from its Heavy Construction segment, which contributed €345.94 million.

Nyab is making waves in the construction industry with a robust earnings growth of 85.1% over the past year, far outpacing the sector's -12%. The company’s financial health appears solid, as it holds more cash than total debt and boasts an impressive EBIT interest coverage ratio of 32.1x. Recent strategic moves include securing a SEK 409 million contract for reconstructing a key Swedish highway section and another SEK 144 million project for railway development. These projects not only bolster Nyab's order book but also highlight its role in critical infrastructure development across Sweden.

- Click here and access our complete health analysis report to understand the dynamics of Nyab.

Evaluate Nyab's historical performance by accessing our past performance report.

Next Steps

- Delve into our full catalog of 332 European Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BDM:CMO

Cementos Molins

Manufactures and markets materials and solutions for construction.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives