A Fresh Look at Mapfre (BME:MAP) Valuation Following Strong Nine-Month 2025 Results

Reviewed by Simply Wall St

Mapfre (BME:MAP) just released financial results for the nine months ended September 2025, posting net income of €829 million, up from €653.5 million a year earlier. This has drawn attention from investors.

See our latest analysis for Mapfre.

Mapfre shares have shown impressive momentum, with a 63.4% year-to-date share price return as investors react positively to stronger earnings and a revived growth narrative. The longer-term picture is just as compelling, as evidenced by a five-year total shareholder return of 238.6% that easily outpaces the sector average.

If financial outperformance in insurance piques your interest, you might want to broaden your search and discover fast growing stocks with high insider ownership

But with shares surging this year and the current price now slightly above analyst targets, the real question is whether Mapfre still offers room for upside or if future growth is already fully factored in.

Most Popular Narrative: 18.4% Overvalued

Mapfre’s last close of €4.05 sits well above the analyst consensus fair value estimate of €3.42. This gap has investors questioning whether the recent rally has launched the stock beyond what long-term fundamentals can support.

The shift toward a more profitable mix in Life and Health insurance, where Mapfre is already demonstrating significant growth in Iberia and LatAm, positions the company to capitalize on demographic tailwinds. This supports long-term earnings and profit stability. Mapfre's established reputation, financial strength, and strong capital position (205% solvency ratio) make it well placed to capture market share in a regulatory environment that increasingly favors scale and transparency. This can result in sustainable revenue and earnings advantages.

Curious how much future growth is priced into today’s share price? The narrative’s calculation hinges on distinct expectations for revenue, margins, and the profit multiple Mapfre can command. Want to know the surprising financial assumptions backing this call? Click through to uncover the exact numbers shaping Mapfre’s fair value.

Result: Fair Value of €3.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility and increased climate-related losses could both undermine Mapfre’s growth expectations and cloud the outlook for sustained earnings momentum.

Find out about the key risks to this Mapfre narrative.

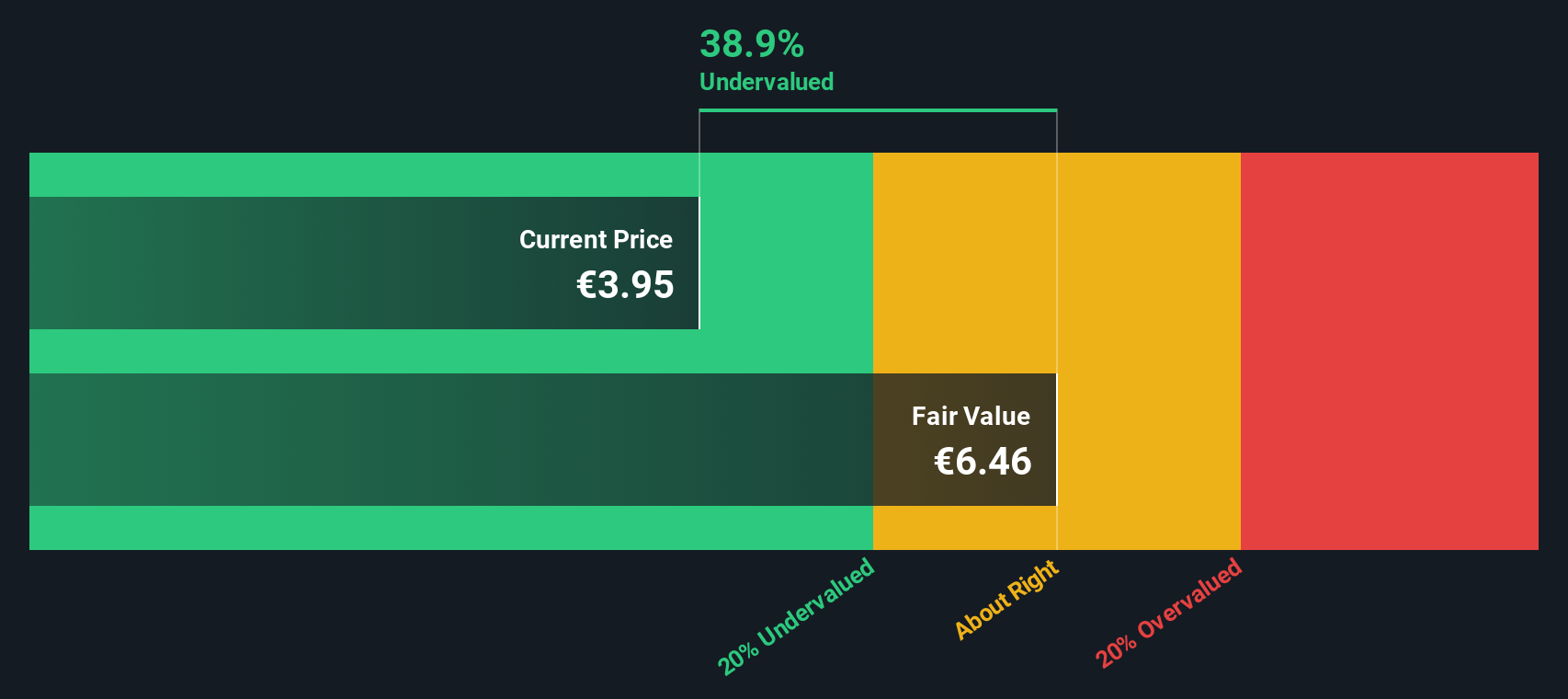

Another View: Our DCF Model Flips the Script

While analyst price targets see Mapfre as overvalued, the SWS DCF model produces a dramatically different outlook. It estimates fair value at €6.36 per share, which suggests the market may be underpricing Mapfre's future cash flows. Could the consensus be too cautious, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mapfre Narrative

If you see things differently or want to take a hands-on approach, you can dig into the numbers and shape your own Mapfre story in just a few minutes. Do it your way

A great starting point for your Mapfre research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t limit yourself to a single stock when the market is bursting with emerging trends and high-potential sectors. Let Simply Wall Street’s screeners guide you to your next best investment move. These actionable ideas could be exactly what your portfolio needs next.

- Jump into the crypto revolution by reviewing these 82 cryptocurrency and blockchain stocks offering exposure to blockchain innovation and digital finance transformation.

- Unlock stable returns with these 15 dividend stocks with yields > 3% featuring companies boasting attractive yields above 3% for consistent income seekers.

- Embrace rapid growth in artificial intelligence with these 26 AI penny stocks that are propelling the future of automation and smart technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:MAP

Mapfre

Engages in the investment, insurance, property, financial, and services businesses in Spain.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives