Línea Directa (BME:LDA): Assessing Valuation Following Strong Q3 and 9-Month Profit Growth

Reviewed by Simply Wall St

Línea Directa Aseguradora Compañía de Seguros y Reaseguros (BME:LDA) has released its third quarter and nine-month 2025 financials, revealing a jump in net income compared to last year. This uptick in profitability draws investor focus to the company’s recent performance.

See our latest analysis for Línea Directa Aseguradora Compañía de Seguros y Reaseguros.

After these strong earnings, Línea Directa Aseguradora’s share price has pulled back around 10% in the past month. However, the stock’s 3-year total shareholder return of over 30% shows that long-term investors have still been well rewarded. Momentum may be cooling in the short term as the market absorbs the recent profit news. This could suggest a shift in risk appetite or expectations for growth ahead.

If the current turbulence has you looking beyond the insurance sector, now’s a smart moment to widen your search and discover fast growing stocks with high insider ownership

With the recent decline in share price despite solid earnings and a strong long-term return, investors are left to wonder if the current valuation offers an attractive entry point or if the market is already factoring in future growth.

Most Popular Narrative: 13.5% Undervalued

According to the most widely followed valuation narrative, Línea Directa Aseguradora’s fair value is above the last close price. This leaves room for market optimism if the story behind the numbers stays intact.

Ongoing investment in digitalization, process automation, and expense control (highlighted as core strengths, with expense ratios cited as a key competitive advantage) points to continued improvement in combined ratio and net margin expansion.

Curious what’s driving this bullish outlook? The narrative is built on bold assumptions for earnings and profitability, plus a margin story that breaks from tradition. Want to know which high-impact levers could unlock more upside? Only the full narrative has the answers.

Result: Fair Value of €1.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Spain's motor insurance market and slow growth in other segments could limit diversification and put the positive outlook at risk.

Another View: The Multiples Perspective

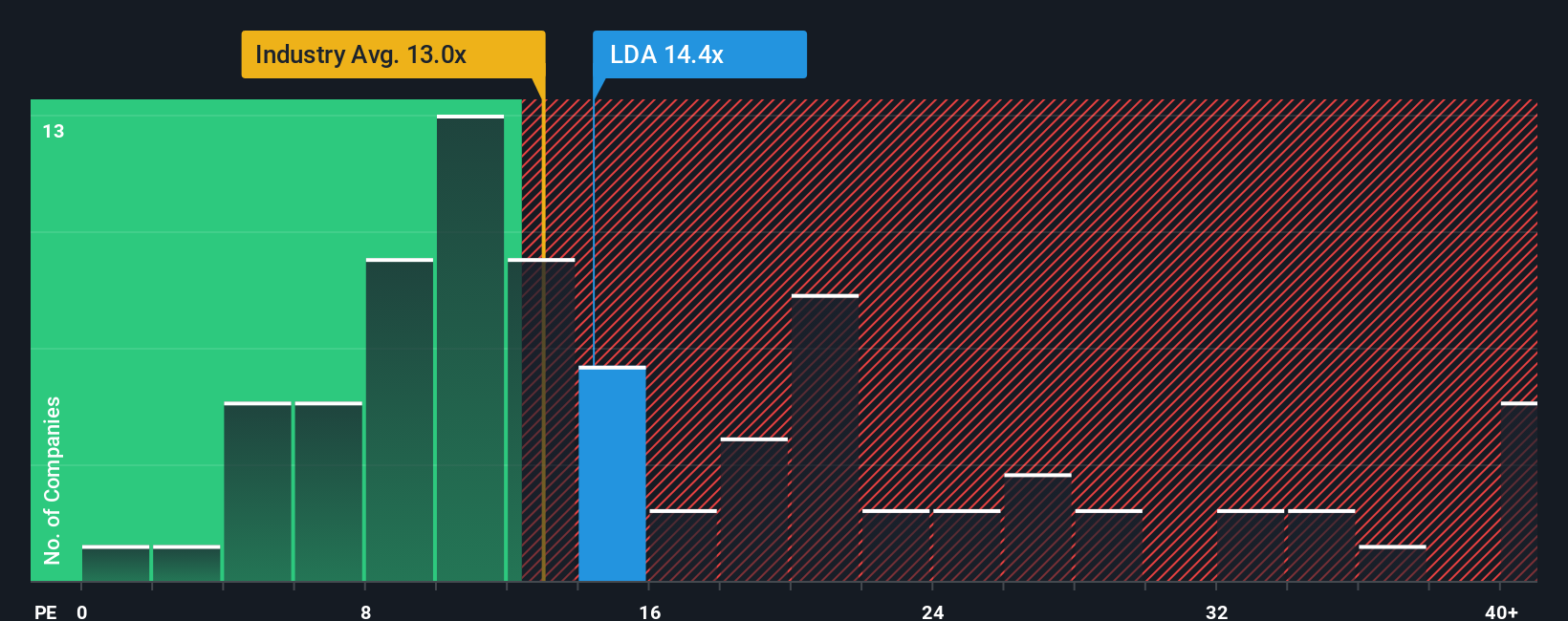

Looking at market price-to-earnings ratios presents a slightly different picture. Línea Directa is trading at 15x earnings, which is pricier than its industry peers at 12.5x and the fair ratio of 12.7x. This premium suggests a potential valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Línea Directa Aseguradora Compañía de Seguros y Reaseguros Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own narrative quickly and uncover your own insights, Do it your way.

A great starting point for your Línea Directa Aseguradora Compañía de Seguros y Reaseguros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Sharpen your edge with stocks handpicked for their unique opportunities. Don’t let others get ahead while you miss out on these powerful themes.

- Tap into long-term income with consistently high yields by checking out these 21 dividend stocks with yields > 3% on established payout leaders who are shaping tomorrow’s dividend landscape.

- Ride the artificial intelligence wave and pursue rapid innovation through these 26 AI penny stocks, which highlights companies at the forefront of automation and smart technologies.

- Catalyze your returns by targeting strong value opportunities among these 852 undervalued stocks based on cash flows, designed to flag stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:LDA

Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Engages in insurance and reinsurance business in Spain and Portugal.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Dentsply Sirona Stock: Dental Technology Built for Cycles, Not Headlines

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion