Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros (BME:LDA) Will Pay A €0.0111691 Dividend In Three Days

Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros (BME:LDA) is about to trade ex-dividend in the next three days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. In other words, investors can purchase Línea Directa Aseguradora Compañía de Seguros y Reaseguros' shares before the 3rd of December in order to be eligible for the dividend, which will be paid on the 5th of December.

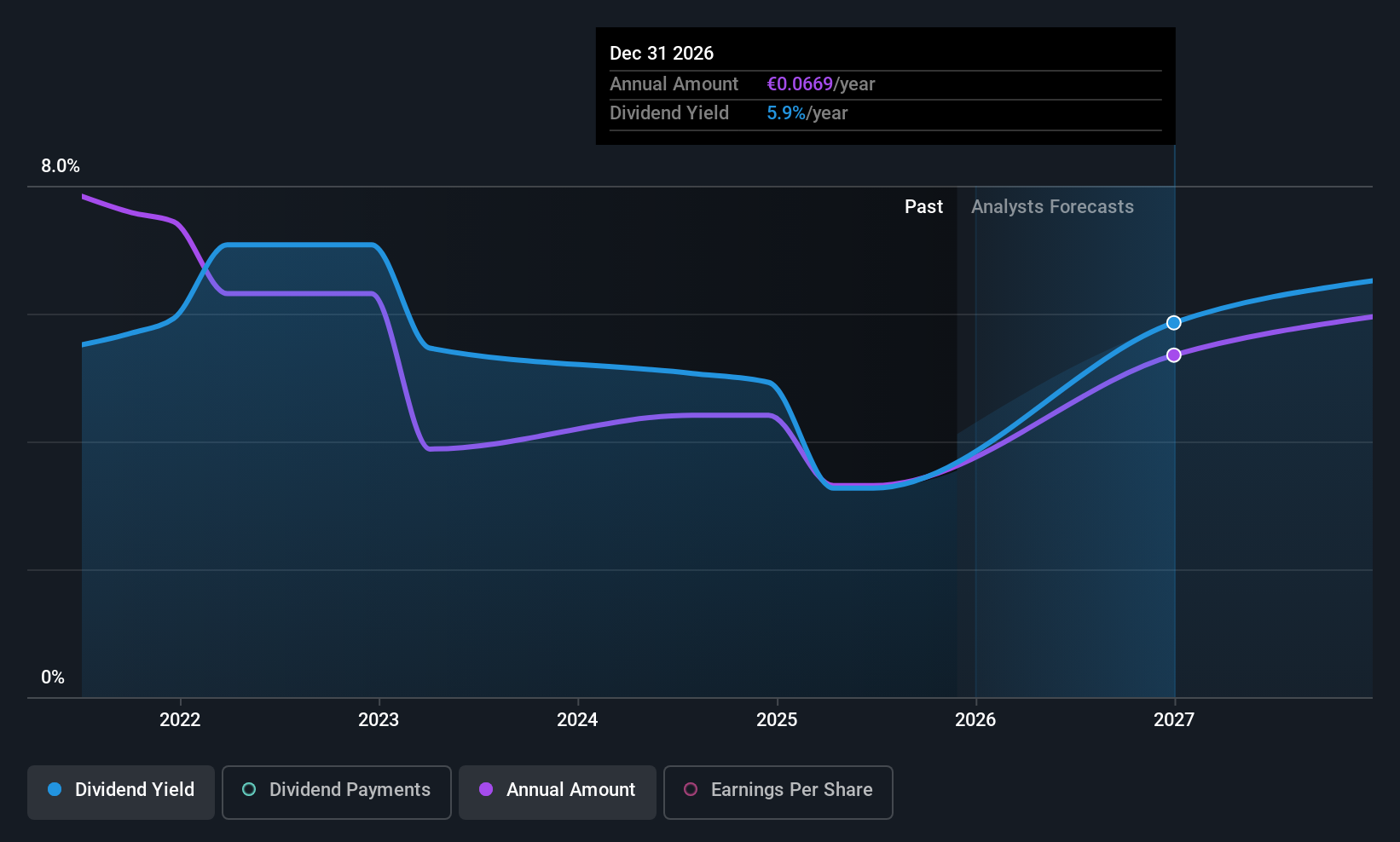

The company's upcoming dividend is €0.0111691 a share, following on from the last 12 months, when the company distributed a total of €0.041 per share to shareholders. Last year's total dividend payments show that Línea Directa Aseguradora Compañía de Seguros y Reaseguros has a trailing yield of 3.6% on the current share price of €1.142. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Línea Directa Aseguradora Compañía de Seguros y Reaseguros has a low and conservative payout ratio of just 18% of its income after tax.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

See our latest analysis for Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's not ideal to see Línea Directa Aseguradora Compañía de Seguros y Reaseguros's earnings per share have been shrinking at 5.0% a year over the previous five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Línea Directa Aseguradora Compañía de Seguros y Reaseguros's dividend payments per share have declined at 19% per year on average over the past four years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Should investors buy Línea Directa Aseguradora Compañía de Seguros y Reaseguros for the upcoming dividend? Earnings per share have shrunk noticeably in recent years, although we like that the company has a low payout ratio. This could suggest a cut to the dividend may not be a major risk in the near future. We're unconvinced on the company's merits, and think there might be better opportunities out there.

With that being said, if dividends aren't your biggest concern with Línea Directa Aseguradora Compañía de Seguros y Reaseguros, you should know about the other risks facing this business. In terms of investment risks, we've identified 1 warning sign with Línea Directa Aseguradora Compañía de Seguros y Reaseguros and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:LDA

Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Engages in insurance and reinsurance business in Spain and Portugal.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

ISRG Riding the Lightning

Duolingo (DUOL): The AI Learning Architect – Trading Profits for a 100M User Vision

Dycom Industries (DY): The Broadband Backbone – Scaling the Nation’s Fiber and AI Expansion

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks