As global markets navigate mixed performances and economic uncertainties, investors are increasingly turning their attention to reliable income sources such as dividend stocks. In this climate, a good dividend stock is characterized by its ability to provide consistent payouts and stability, making it an attractive option for those seeking steady returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market capitalization of AED4.44 billion.

Operations: National Bank of Umm Al-Qaiwain (PSC) generates its revenue from Treasury and Investments amounting to AED418.58 million and Retail and Corporate Banking contributing AED192.74 million.

Dividend Yield: 6.8%

National Bank of Umm Al-Qaiwain (PSC) offers a competitive dividend yield of 6.76%, placing it in the top 25% of dividend payers in the AE market. However, its dividends have been unreliable and volatile over the past decade, with notable annual drops exceeding 20%. Despite a reasonable payout ratio of 58%, concerns arise from a high level of bad loans at 4.2% and low allowance for these loans at 57%. Earnings growth has averaged 12.5% annually over five years, supporting current dividend coverage but not guaranteeing future stability or growth.

- Click to explore a detailed breakdown of our findings in National Bank of Umm Al-Qaiwain (PSC)'s dividend report.

- Insights from our recent valuation report point to the potential overvaluation of National Bank of Umm Al-Qaiwain (PSC) shares in the market.

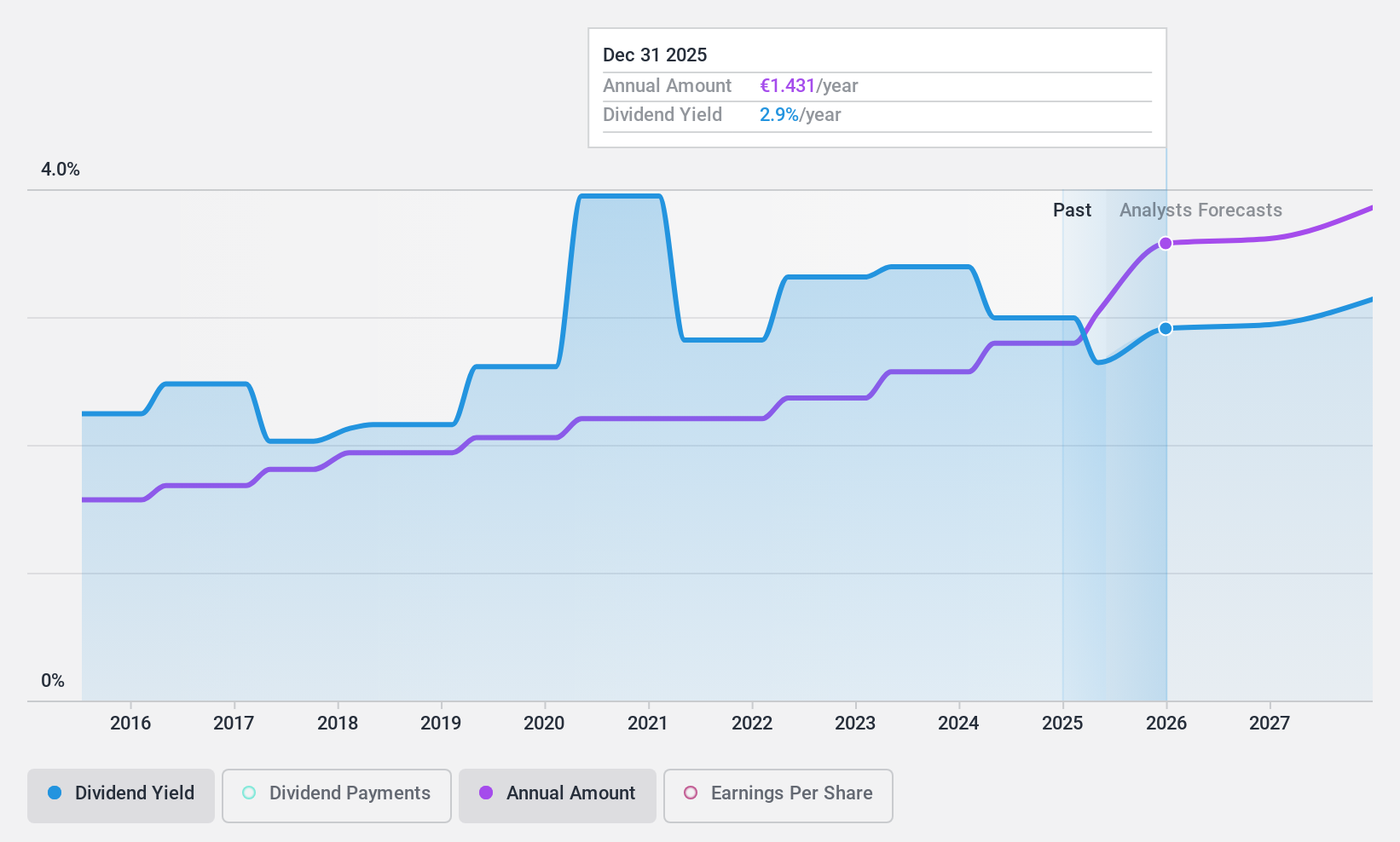

Grupo Catalana Occidente (BME:GCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Grupo Catalana Occidente, S.A. and its subsidiaries offer insurance products and services globally, with a market cap of €4.30 billion.

Operations: Grupo Catalana Occidente, S.A., along with its subsidiaries, generates revenue through its global provision of insurance products and services.

Dividend Yield: 3.1%

Grupo Catalana Occidente offers a stable dividend yield of 3.07%, backed by reliable and growing payments over the past decade. The company's dividends are well-covered, with a low payout ratio of 10.2% and a cash payout ratio of 27.4%. Despite trading at good value, its dividend yield is lower than the Spanish market's top tier payers. Recent earnings growth and revenue increases suggest continued financial stability, although future earnings are expected to decline slightly.

- Get an in-depth perspective on Grupo Catalana Occidente's performance by reading our dividend report here.

- According our valuation report, there's an indication that Grupo Catalana Occidente's share price might be on the cheaper side.

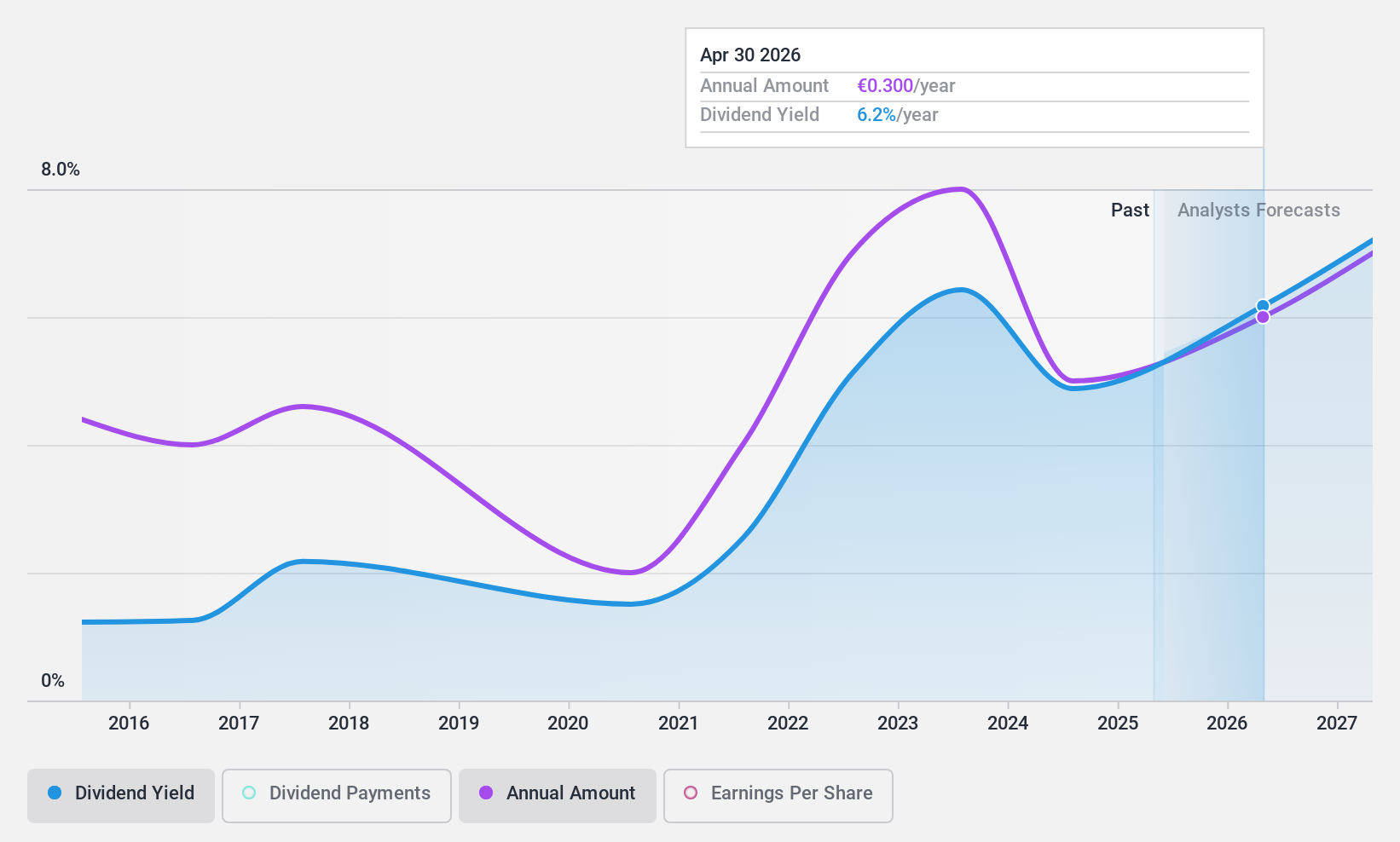

Zumtobel Group (WBAG:ZAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zumtobel Group AG operates in the global lighting industry with a market cap of €212.90 million.

Operations: Zumtobel Group AG generates its revenue from the Lighting segment with €891.00 million and the Components segment with €304.65 million.

Dividend Yield: 5%

Zumtobel Group's dividend payments have been volatile and unreliable over the past decade, despite a recent increase. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 49.2% and 26.7%, respectively. However, its dividend yield of 5% lags behind Austria's top tier payers. Recent earnings results show stable sales but decreased net income, highlighting potential challenges in maintaining financial performance amidst a lower profit margin than last year.

- Navigate through the intricacies of Zumtobel Group with our comprehensive dividend report here.

- Our valuation report here indicates Zumtobel Group may be undervalued.

Make It Happen

- Navigate through the entire inventory of 1971 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GCO

Grupo Catalana Occidente

Provides insurance products and services in Spain, the European Union, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives