- Spain

- /

- Energy Services

- /

- BME:TRE

Técnicas Reunidas (BME:TRE) shareholder returns have been splendid, earning 300% in 3 years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For example, the Técnicas Reunidas, S.A. (BME:TRE) share price has soared 266% in the last three years. Most would be happy with that. On top of that, the share price is up 23% in about a quarter.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

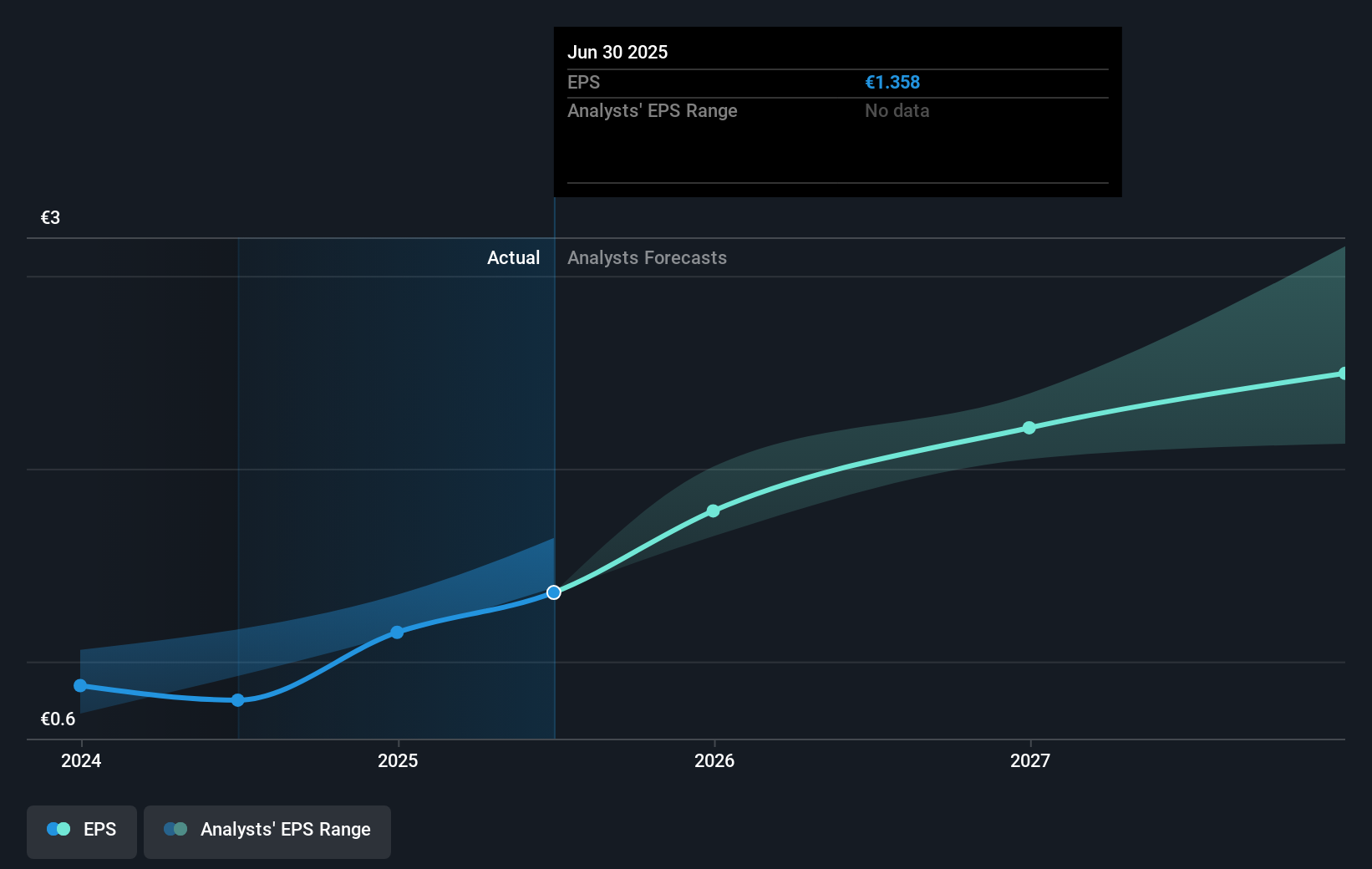

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Técnicas Reunidas moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Técnicas Reunidas has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Técnicas Reunidas' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Técnicas Reunidas' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Técnicas Reunidas shareholders, and that cash payout contributed to why its TSR of 300%, over the last 3 years, is better than the share price return.

A Different Perspective

We're pleased to report that Técnicas Reunidas shareholders have received a total shareholder return of 111% over one year. That's better than the annualised return of 20% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is Técnicas Reunidas cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Técnicas Reunidas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:TRE

Técnicas Reunidas

An engineering and construction company, designs and manages industrial plant projects worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives