- Spain

- /

- Oil and Gas

- /

- BME:REP

Repsol (BME:REP) Valuation Check After Strong Year-To-Date Rally and Recent Pullback

Reviewed by Simply Wall St

Repsol (BME:REP) has quietly pulled ahead of many European energy peers this year, with the stock up about 30% year to date even after a weaker past month and past week.

See our latest analysis for Repsol.

The recent pullback, including a 1 month share price return of minus 8.77%, looks more like a breather within a strong run. Year to date share price gains and a robust 1 year total shareholder return suggest momentum is still broadly positive.

If Repsol’s move has you rethinking your energy exposure, it can be worth seeing what else the market is rewarding right now via fast growing stocks with high insider ownership.

With Repsol trading modestly below analyst targets but at a hefty intrinsic discount, investors face a familiar dilemma: is this a mispriced value opportunity, or is the market already baking in much of its future growth?

Most Popular Narrative: 4.6% Undervalued

With Repsol’s fair value in the narrative set modestly above the last close, the story hinges on how its future cash engines evolve.

Optimization of the upstream portfolio through targeted divestments of high cost, high emission assets and investment in scalable, low cost growth projects in Alaska, the U.K., and North America should improve production quality, boost cash flow from operations, and raise return on capital employed (ROCE) and net margins over time.

Curious what earnings path, margin reset, and share count assumptions sit behind that seemingly modest discount, and why the future multiple still compresses? The full narrative unpacks the numbers driving that view, piece by piece, in a way the share price alone does not.

Result: Fair Value of €16.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavier capex needs and slower than hoped progress in renewables could squeeze free cash flow and challenge the idea that Repsol’s upside is mispriced.

Find out about the key risks to this Repsol narrative.

Another Angle on Valuation

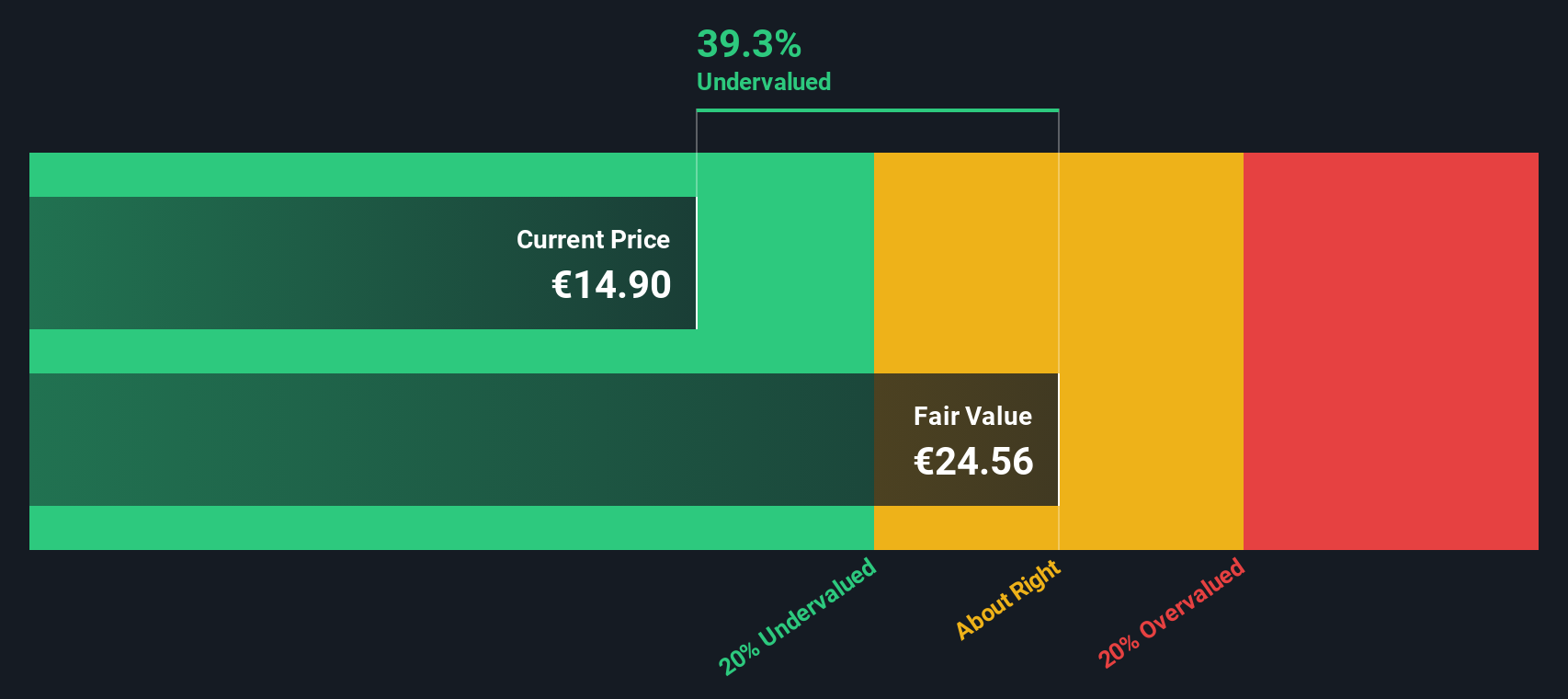

While the narrative pegs Repsol at a modest 4.6% discount to fair value, the SWS DCF model is far more generous, suggesting the shares trade about 45% below intrinsic value. If that cash flow outlook is even half right, is the current price too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Repsol Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Repsol research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investing move?

Do not stop with one opportunity; use the Simply Wall Street Screener now to uncover fresh ideas that match your strategy before the market prices them in.

- Explore early-stage opportunities by reviewing these 3640 penny stocks with strong financials that already demonstrate real financial strength.

- Research the next wave of innovation by examining these 26 AI penny stocks that use artificial intelligence in their business models.

- Assess potential risk and return profiles by scanning these 908 undervalued stocks based on cash flows where current prices are compared with estimated cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:REP

Repsol

Operates as a multi-e energy company in Spain, Peru, the United States, Portugal, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion