- Spain

- /

- Capital Markets

- /

- BME:R4

Renta 4 Banco (BME:R4) Margin Beats Industry as Valuation Premium Prompts Investor Caution

Reviewed by Simply Wall St

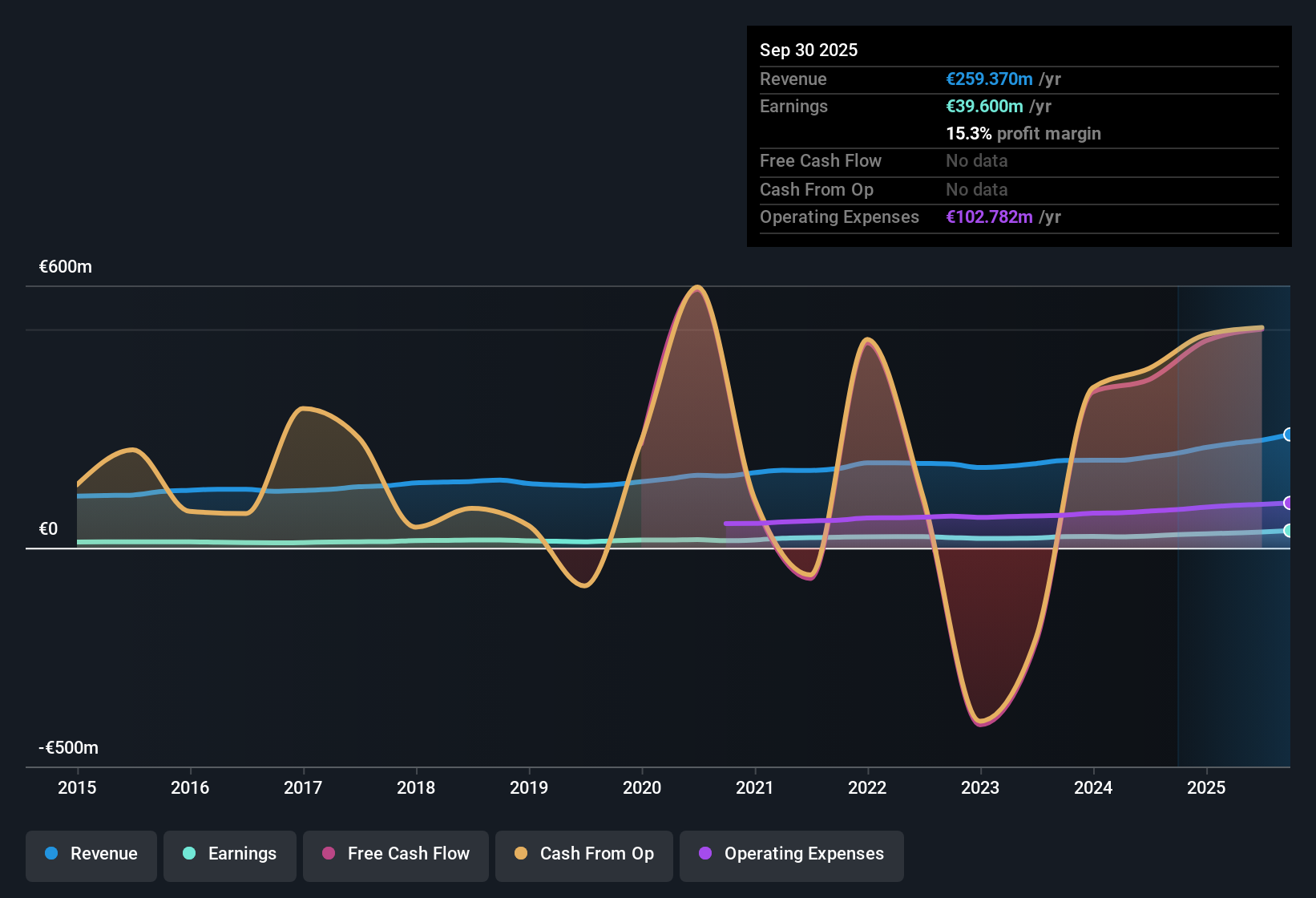

Renta 4 Banco (BME:R4) posted 31.6% earnings growth over the past year, outpacing its five-year average growth of 12% per year. The company’s net profit margin reached 15.3%, up from last year’s 13.9%. This reflects improved operational efficiency and high-quality earnings.

See our full analysis for Renta 4 Banco.Next, we will set these results against the current market narratives to see where the numbers reinforce expectations and where they put investor views to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Jumps Above Peers

- The net profit margin rose to 15.3%, outpacing last year’s 13.9% and indicating stronger cost efficiency than typical industry peers.

- Stronger margin expansion aligns closely with commentary about Renta 4 Banco’s digital push and operational focus. Bulls argue this gives the business a nimbleness that larger banks lack.

- Consistently growing margins suggest that efficiency initiatives are paying off and may set Renta 4 Banco apart from more sluggish competitors.

- The data also shows that much of this improvement occurred in a single year rather than over a steady multi-year trajectory, leaving the bullish case partially reliant on continued execution rather than proven persistence.

Valuation Premium Raises Eyebrows

- Shares currently trade at a Price-to-Earnings ratio of 20.3x, notably above the European Capital Markets industry average of 16.6x and the peer group’s 16x. This signals a premium valuation compared to direct competitors.

- The prevailing market view sees this rich multiple as a double-edged sword:

- On one hand, the premium may reflect the market’s recognition of high-quality earnings and consistent growth, with investors appearing willing to pay extra for operational reliability.

- However, with the current share price of €19.80 well above the DCF fair value estimate of €6.17, it highlights a significant gap that could invite skepticism regarding future upside.

Dividend Sustainability Becomes a Key Question

- The principal risk highlighted in recent analysis centers on dividend sustainability, which remains a top concern even as profit growth accelerates.

- Prevailing market commentary notes a tug-of-war: while reliable income steers many investors toward Renta 4 Banco, bears argue that despite growing profits, future payouts could face pressure if earnings growth moderates or sector headwinds strengthen.

- This concern is increased by the stock’s premium valuation, making investors sensitive to any hint of dividend reduction or slower growth.

- Ultimately, strong past performance may not fully shield the dividend if sector uncertainties persist.

If you want to see how the balanced take on growth versus valuation plays out, check the full consensus on Renta 4 Banco below. 📊 Read the full Renta 4 Banco Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Renta 4 Banco's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust earnings growth, Renta 4 Banco’s significant premium to fair value and sector peers suggests investors face heightened valuation risk if momentum loses strength.

If you’re seeking stocks with more compelling upside relative to their fundamentals, check out these 848 undervalued stocks based on cash flows and discover opportunities that may offer better value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:R4

Renta 4 Banco

Engages in the provision of wealth management, brokerage, and corporate advisory services in Spain and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives