As global markets navigate a landscape marked by fluctuating corporate earnings, AI competition concerns, and steady interest rates from the Federal Reserve, small-cap stocks have experienced mixed performance amid broader economic shifts. With indices like the S&P MidCap 400 and Russell 2000 reflecting these dynamics, investors are increasingly on the lookout for undiscovered gems that exhibit strong fundamentals and resilience in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Proeduca Altus (BME:PRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Proeduca Altus, S.A. is a company that specializes in providing online education services and has a market capitalization of approximately €1.25 billion.

Operations: Proeduca Altus generates revenue primarily through the provision of services, amounting to €344.09 million, while sales contribute a minimal €0.03 million.

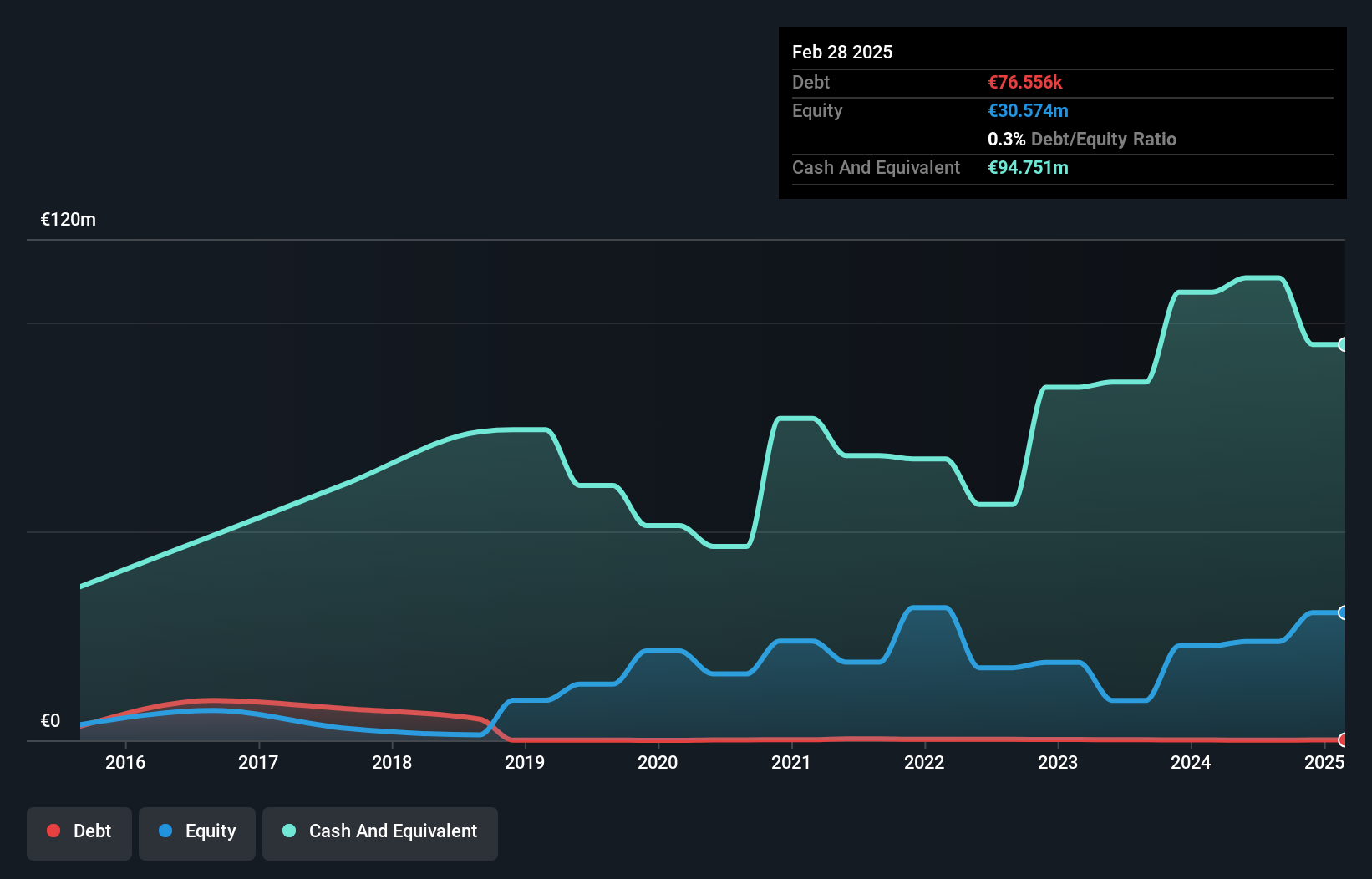

Proeduca Altus, a small cap in the education sector, showcases robust financial health with high quality earnings and an impressive 20.8% earnings growth over the past year, outpacing its industry peers at 16.6%. The company has more cash than total debt and reduced its debt to equity ratio from 0.2 to 0.1 over five years, reflecting prudent financial management. Additionally, Proeduca's profitability ensures that cash runway isn't a concern while maintaining positive free cash flow indicates strong operational efficiency. A recent €0.32 dividend payout further highlights its commitment to returning value to shareholders.

- Click here and access our complete health analysis report to understand the dynamics of Proeduca Altus.

Gain insights into Proeduca Altus' past trends and performance with our Past report.

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norion Bank AB (publ) offers financial solutions for corporate and private individuals, focusing on small and medium-sized companies in Sweden, Finland, Norway, and internationally, with a market cap of SEK8.05 billion.

Operations: Norion Bank generates revenue primarily through its Real Estate and Consumer segments, contributing SEK1.15 billion and SEK908 million, respectively. The Payments segment also plays a significant role with SEK505 million in revenue.

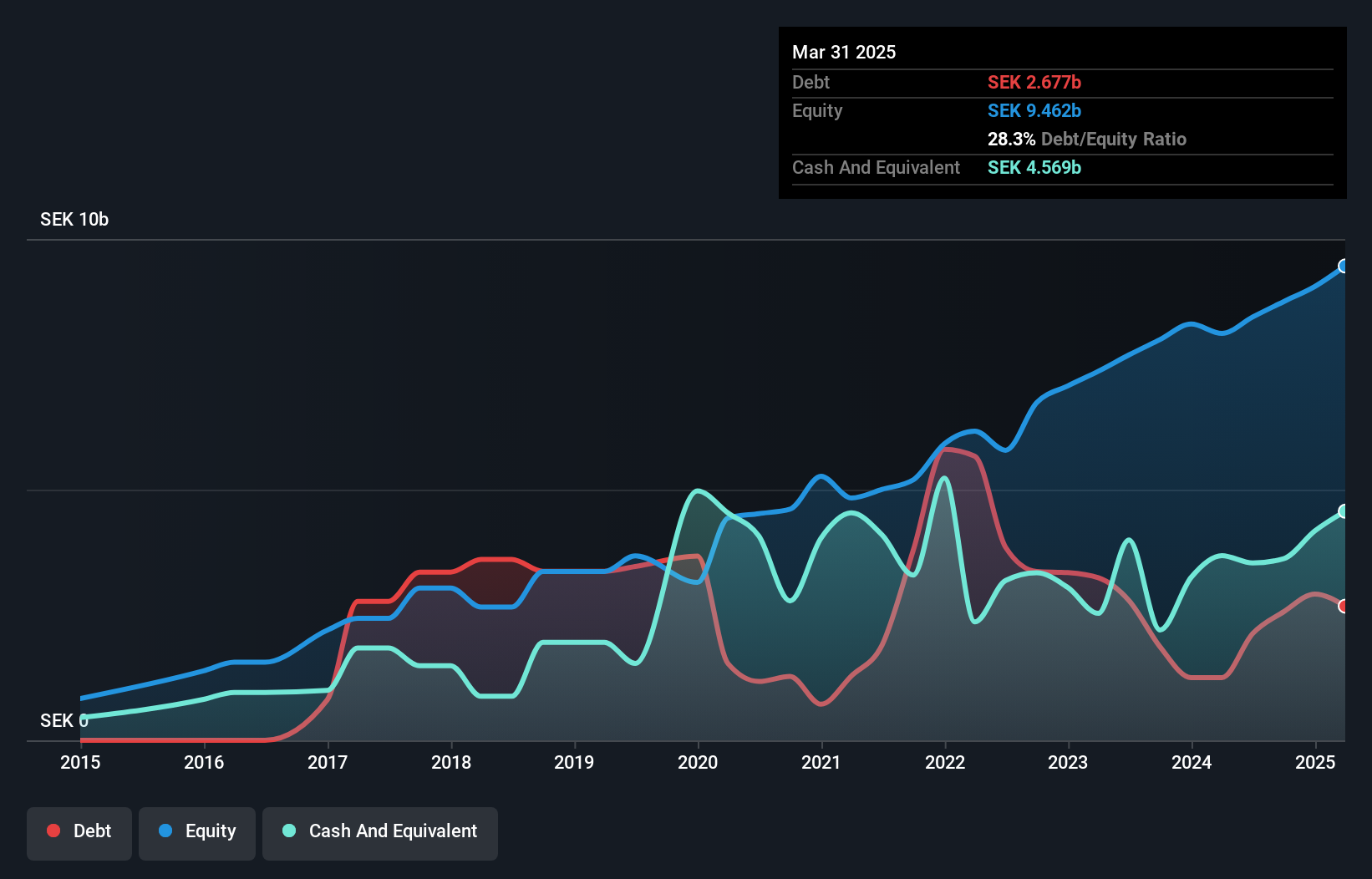

Norion Bank, a compact player in the financial sector, is gaining attention with its robust fundamentals. It has total assets of SEK67.2 billion and equity of SEK9.1 billion, while customer deposits form a low-risk funding base at SEK53 billion. Total loans stand at SEK50.3 billion, indicating prudent lending practices despite a high bad loan ratio of 21.1%. With earnings growth outpacing the industry at 1.1%, Norion showcases high-quality past earnings and trades significantly below its estimated fair value by 78%. The bank's forecasted earnings growth rate is pegged at 9.5% annually, underscoring potential for future expansion amidst considerations for share repurchases in late 2024.

- Click to explore a detailed breakdown of our findings in Norion Bank's health report.

Evaluate Norion Bank's historical performance by accessing our past performance report.

Boji Medical TechnologyLtd (SZSE:300404)

Simply Wall St Value Rating: ★★★★★☆

Overview: Boji Medical Technology Co., Ltd. offers professional contract research services focusing on the R&D and production of drugs and medical devices for pharmaceutical companies both in China and globally, with a market cap of CN¥3.48 billion.

Operations: Boji Medical Technology generates revenue primarily through its contract research services in drug and medical device R&D and production for pharmaceutical companies.

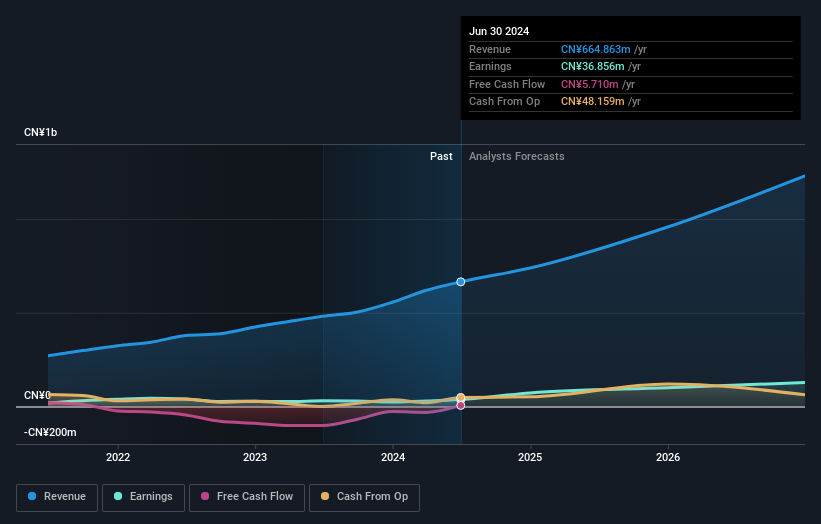

Boji Medical Technology, a small player in the Life Sciences sector, outpaced its industry with a 52% earnings growth over the past year, despite facing a -13.5% industry trend. A notable CN¥14M one-off gain significantly impacted its recent financial results. While Boji's debt to equity ratio rose from 3.5 to 6.9 over five years, it maintains more cash than total debt and comfortably covers interest payments with profits. Although free cash flow isn't positive yet, earnings are expected to grow at an impressive rate of about 40% annually, hinting at promising future potential for this emerging company.

Next Steps

- Get an in-depth perspective on all 4724 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORION

Norion Bank

Provides financial solutions for medium-sized corporates and real estate companies, merchants, and private individuals in Sweden, Germany, Norway, Denmark, Finland, and internationally.

Undervalued with proven track record.

Market Insights

Community Narratives