Uncovering September 2024's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets grapple with economic slowdown concerns, the S&P 500 Index experienced its steepest weekly decline in 18 months, driven by fears of a weakening U.S. labor market and a potential Federal Reserve rate cut. Despite these challenges, small-cap stocks often present unique opportunities for growth, particularly when carefully selected based on strong fundamentals and resilience to broader market volatility. In this environment, identifying undiscovered gems—stocks with robust financial health and promising future prospects—can be particularly rewarding for investors looking to navigate uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 4.12% | 8.95% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Proeduca Altus (BME:PRO)

Simply Wall St Value Rating: ★★★★☆☆

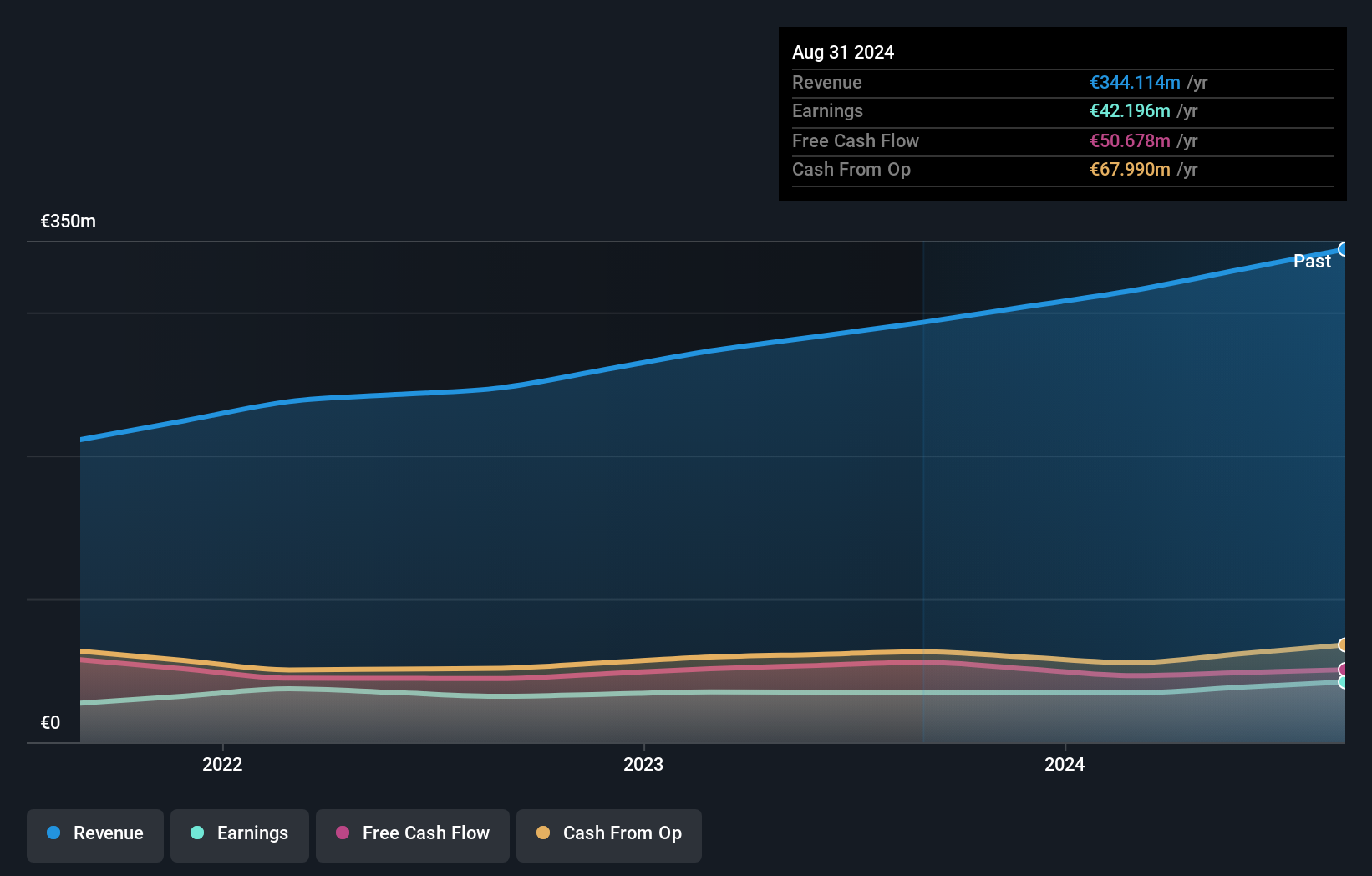

Overview: Proeduca Altus, S.A. offers online education services and has a market cap of approximately €1.10 billion.

Operations: Proeduca Altus generates revenue primarily through the provision of services (€315.28 million) and sales (€0.04 million). The company has a market cap of approximately €1.10 billion.

Proeduca Altus, a smaller player in the education sector, reported revenue of €174.64 million for the half year ending February 2024, up from €152.38 million a year ago. Net income slightly dipped to €28.28 million from €28.74 million in the same period last year. Despite negative earnings growth of -1.8%, Proeduca's interest coverage remains strong and it has more cash than total debt, indicating financial stability and high-quality earnings amidst industry challenges.

Perusahaan Perkebunan London Sumatra Indonesia (IDX:LSIP)

Simply Wall St Value Rating: ★★★★★★

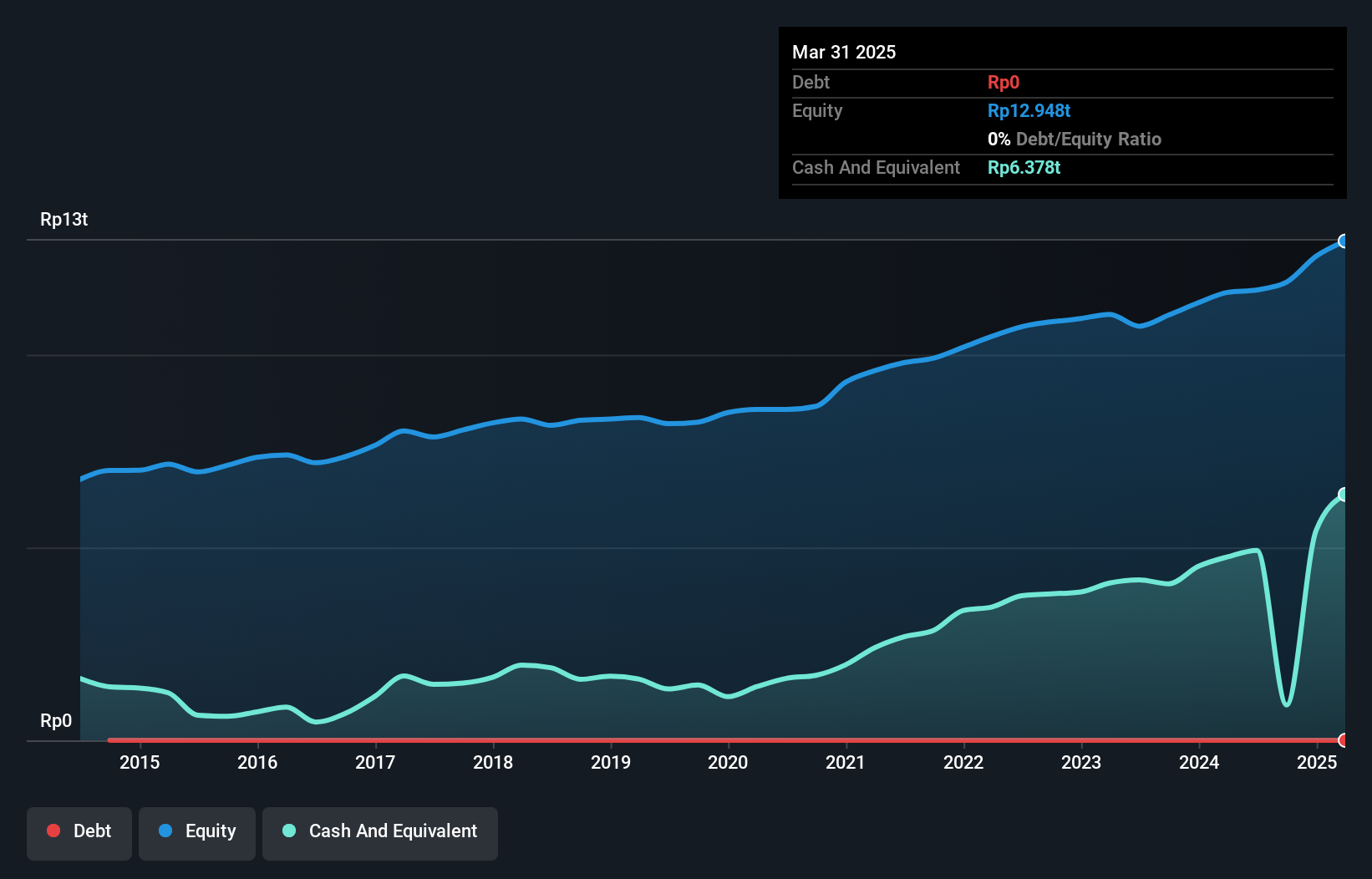

Overview: PT Perusahaan Perkebunan London Sumatra Indonesia Tbk, together with its subsidiaries, engages in the plantation business in Indonesia and internationally with a market cap of IDR6.82 trillion.

Operations: LSIP generates revenue primarily from Oil Palm Products (IDR3.88 billion), followed by Rubber (IDR109.08 million) and Seeds (IDR63.86 million). The company's net profit margin is 10%.

PT Perusahaan Perkebunan London Sumatra Indonesia (LSIP) offers an intriguing proposition with its strong financial health and notable earnings growth. LSIP has been debt-free for the past five years, and its earnings surged by 82.5% last year, outperforming the Food industry’s -6.7%. Trading at 57% below fair value estimates, it presents a compelling valuation case. Recent half-year results show net income of IDR 598 billion, a significant rise from IDR 167 billion previously.

International Financial Advisors Holding - KPSC (KWSE:IFA)

Simply Wall St Value Rating: ★★★★★☆

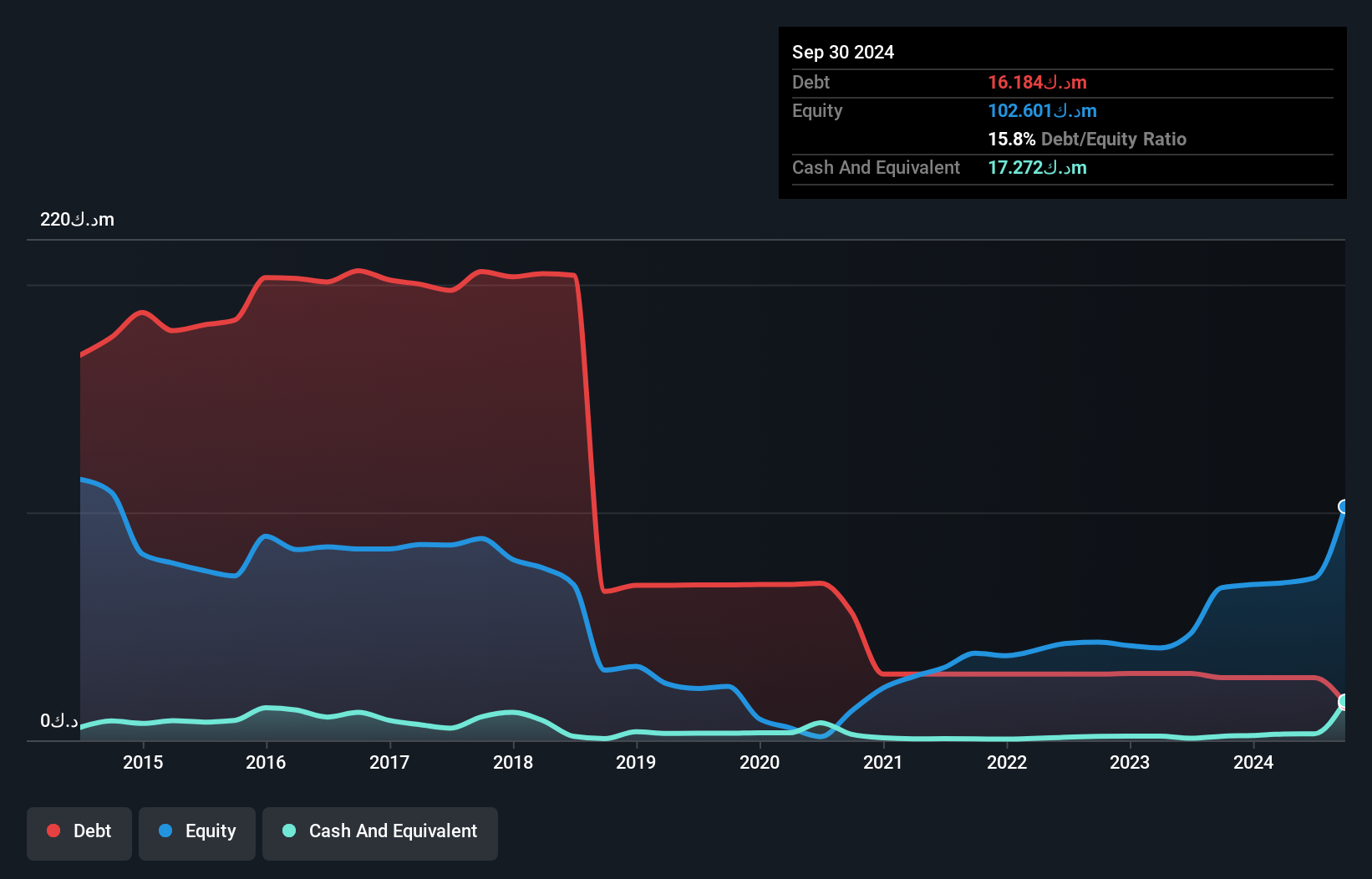

Overview: International Financial Advisors Holding - KPSC, along with its subsidiaries, operates in the treasury and investments, real estate, and other sectors within the GCC and other Middle Eastern countries with a market cap of KWD180.05 million.

Operations: IFA generates revenue primarily from its treasury and investments segment, which recorded KWD12.47 million. The company also reported a segment adjustment of KWD5.19 million.

IFA's debt to equity ratio has impressively reduced from 300.1% to 38.6% over five years, reflecting strong financial management. Earnings growth of 159.7% in the past year outpaced the industry average of 78.5%. Despite a significant one-off gain of KWD4.8M, net income for Q2 was KWD1.66M compared to KWD4.85M the previous year, highlighting some volatility in performance metrics but still showcasing potential value with a P/E ratio of 11.9x below market average.

Summing It All Up

- Unlock our comprehensive list of 4832 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:LSIP

Perusahaan Perkebunan London Sumatra Indonesia

Engages in the plantation business in Indonesia and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives