- Spain

- /

- Hospitality

- /

- BME:MEL

How Much Did Meliá Hotels International's(BME:MEL) Shareholders Earn From Share Price Movements Over The Last Five Years?

Over the last month the Meliá Hotels International, S.A. (BME:MEL) has been much stronger than before, rebounding by 82%. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 50% in that time, significantly under-performing the market.

See our latest analysis for Meliá Hotels International

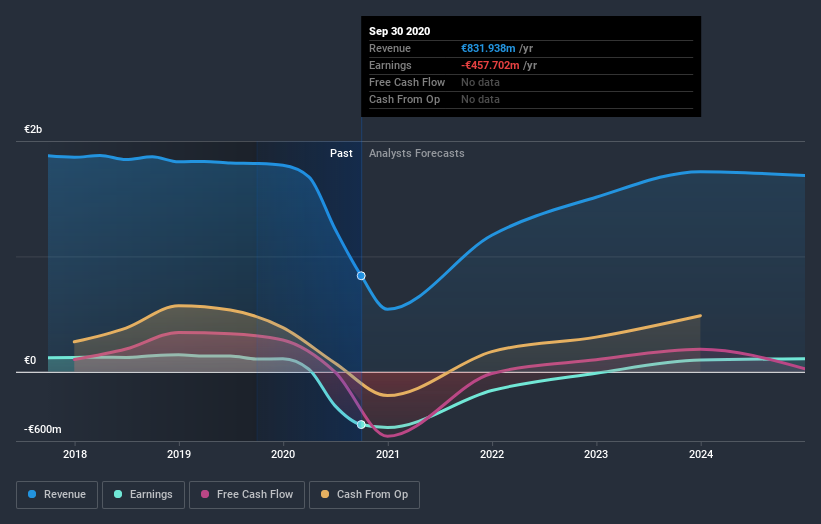

Given that Meliá Hotels International didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Meliá Hotels International saw its revenue shrink by 3.8% per year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 8% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Meliá Hotels International is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Meliá Hotels International's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Meliá Hotels International's TSR, which was a 48% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We regret to report that Meliá Hotels International shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 6.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Meliá Hotels International (1 is concerning!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

When trading Meliá Hotels International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:MEL

Meliá Hotels International

Owns, manages, operates, leases, and franchises hotels worldwide.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives