- Spain

- /

- Professional Services

- /

- BME:COM

Those Who Purchased Cátenon (BME:COM) Shares Five Years Ago Have A 69% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While not a mind-blowing move, it is good to see that the Cátenon, S.A. (BME:COM) share price has gained 13% in the last three months. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 69% after a long stretch. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

View our latest analysis for Cátenon

While Cátenon made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over five years, Cátenon grew its revenue at 15% per year. That's a fairly respectable growth rate. The share price return isn't so respectable with an annual loss of 21% over the period. It seems probably that the business has failed to live up to initial expectations. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

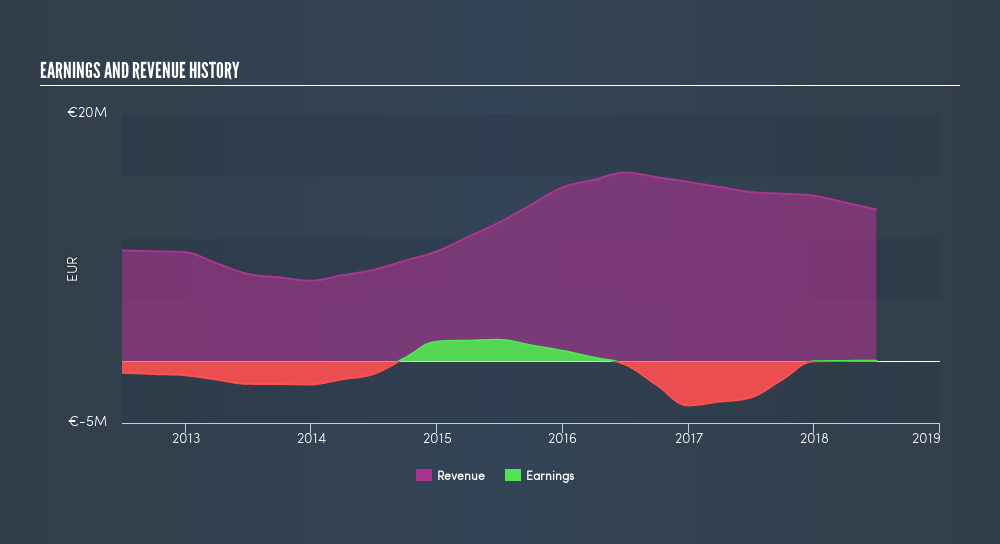

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We know that Cátenon has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Cátenon in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 2.4% in the twelve months, Cátenon shareholders did even worse, losing 13%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 21% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You could get a better understanding of Cátenon's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Cátenon may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BME:COM

Catenon

A technology-based company, provides recruitment services in Spain and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives