Fluidra, S.A. (BME:FDR) Will Pay A €0.243 Dividend In Three Days

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Fluidra, S.A. (BME:FDR) is about to go ex-dividend in just three days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Thus, you can purchase Fluidra's shares before the 1st of December in order to receive the dividend, which the company will pay on the 3rd of December.

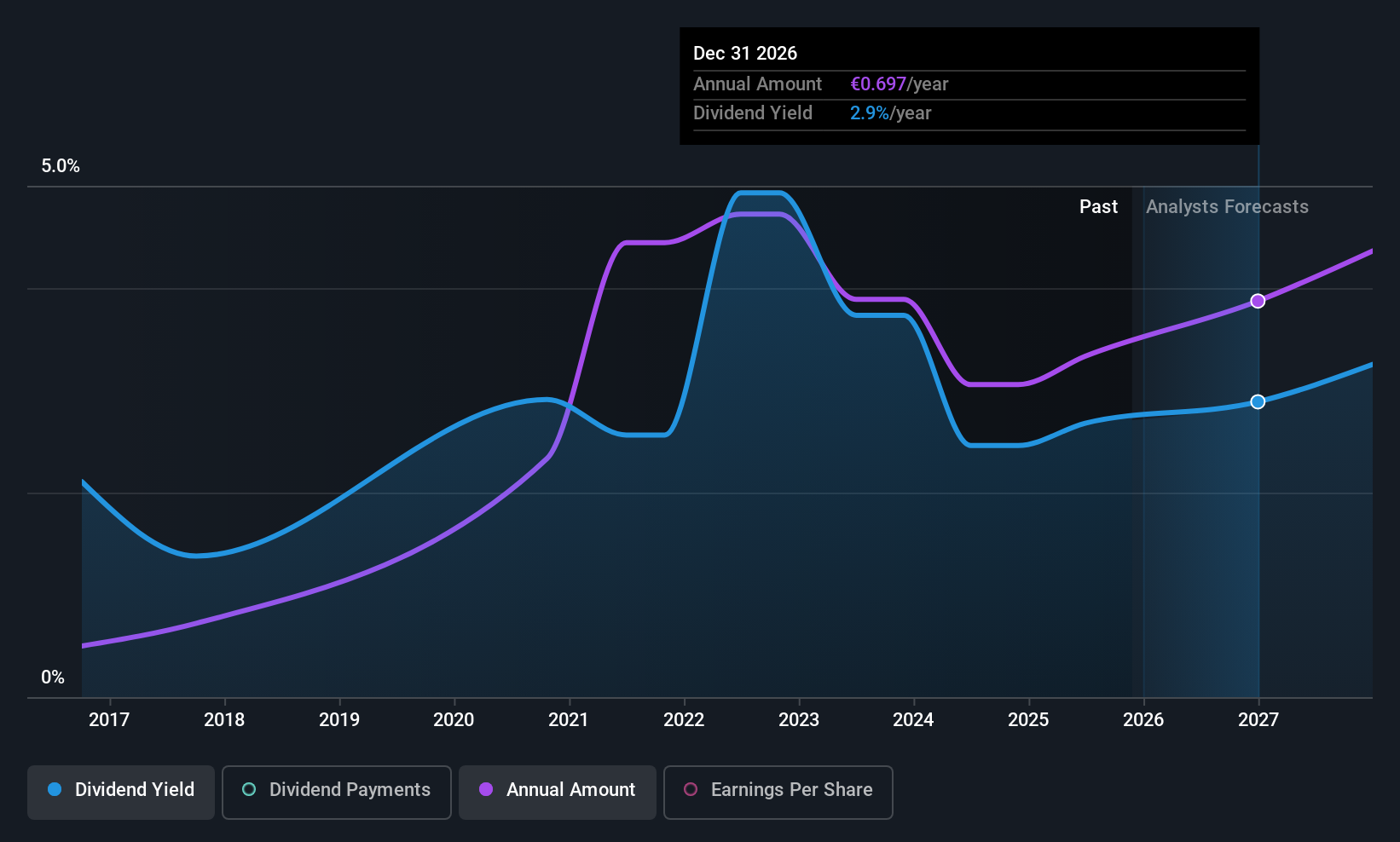

The company's next dividend payment will be €0.243 per share, and in the last 12 months, the company paid a total of €0.60 per share. Based on the last year's worth of payments, Fluidra stock has a trailing yield of around 2.5% on the current share price of €24.14. If you buy this business for its dividend, you should have an idea of whether Fluidra's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fluidra paid out 70% of its earnings to investors last year, a normal payout level for most businesses. A useful secondary check can be to evaluate whether Fluidra generated enough free cash flow to afford its dividend. Over the last year it paid out 59% of its free cash flow as dividends, within the usual range for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Check out our latest analysis for Fluidra

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's comforting to see Fluidra's earnings have been skyrocketing, up 85% per annum for the past five years. Management appears to be striking a nice balance between reinvesting for growth and paying dividends to shareholders. Earnings per share have been growing quickly and in combination with some reinvestment and a middling payout ratio, the stock may have decent dividend prospects going forwards.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, Fluidra has lifted its dividend by approximately 26% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

Should investors buy Fluidra for the upcoming dividend? It's good to see earnings are growing, since all of the best dividend stocks grow their earnings meaningfully over the long run. However, we'd also note that Fluidra is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. In summary, while it has some positive characteristics, we're not inclined to race out and buy Fluidra today.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Case in point: We've spotted 2 warning signs for Fluidra you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:FDR

Fluidra

Designs, manufactures, distributes, and markets accessories and machinery for swimming-pools, irrigation and water treatment, and residential and commercial pool purification market worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success