What Type Of Returns Would Azkoyen's(BME:AZK) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

Azkoyen, S.A. (BME:AZK) shareholders should be happy to see the share price up 21% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 33% in the last three years, significantly under-performing the market.

See our latest analysis for Azkoyen

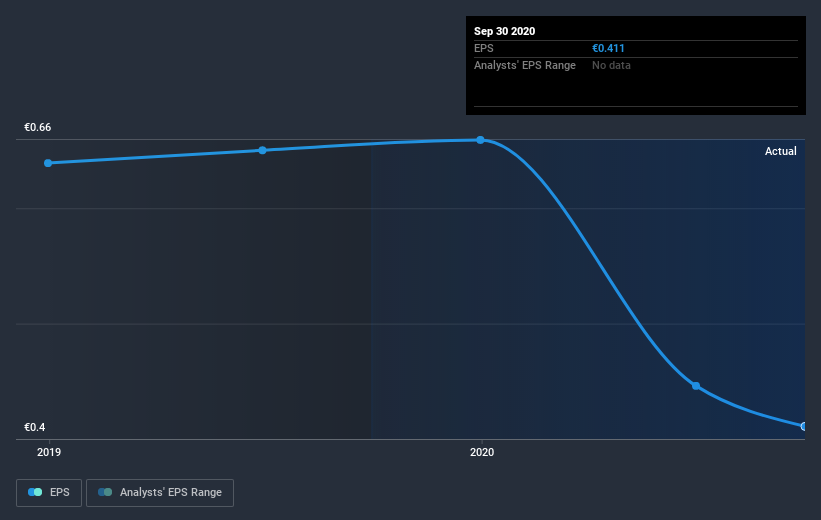

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Azkoyen's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Azkoyen's TSR, which was a 24% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 11% in the twelve months, Azkoyen shareholders did even worse, losing 15%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Azkoyen you should know about.

Of course Azkoyen may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you’re looking to trade Azkoyen, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:AZK

Azkoyen

Designs, manufactures, and markets technology solutions in Spain and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives