Undiscovered European Gems with Promising Potential In September 2025

Reviewed by Simply Wall St

As the European markets experience a modest upswing, with the pan-European STOXX Europe 600 Index rising by 1.03% amid expectations of interest rate adjustments from the U.S. Federal Reserve, investors are increasingly attentive to small-cap opportunities that may thrive in this environment. In such a climate, discovering stocks with strong fundamentals and growth potential can be particularly rewarding for those seeking to capitalize on Europe's evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Arteche Lantegi Elkartea (BME:ART)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arteche Lantegi Elkartea, S.A. specializes in the design, manufacture, integration, and supply of electrical equipment and solutions with an emphasis on renewable energies and smart grids across Spain and international markets, with a market capitalization of €889.39 million.

Operations: Arteche Lantegi Elkartea generates revenue primarily from three segments: Systems Measurement and Monitoring (€352.38 million), Automation of Transmission and Distribution Networks (€79.77 million), and Network Reliability (€46.51 million). The Systems Measurement and Monitoring segment is the largest contributor to its revenue stream.

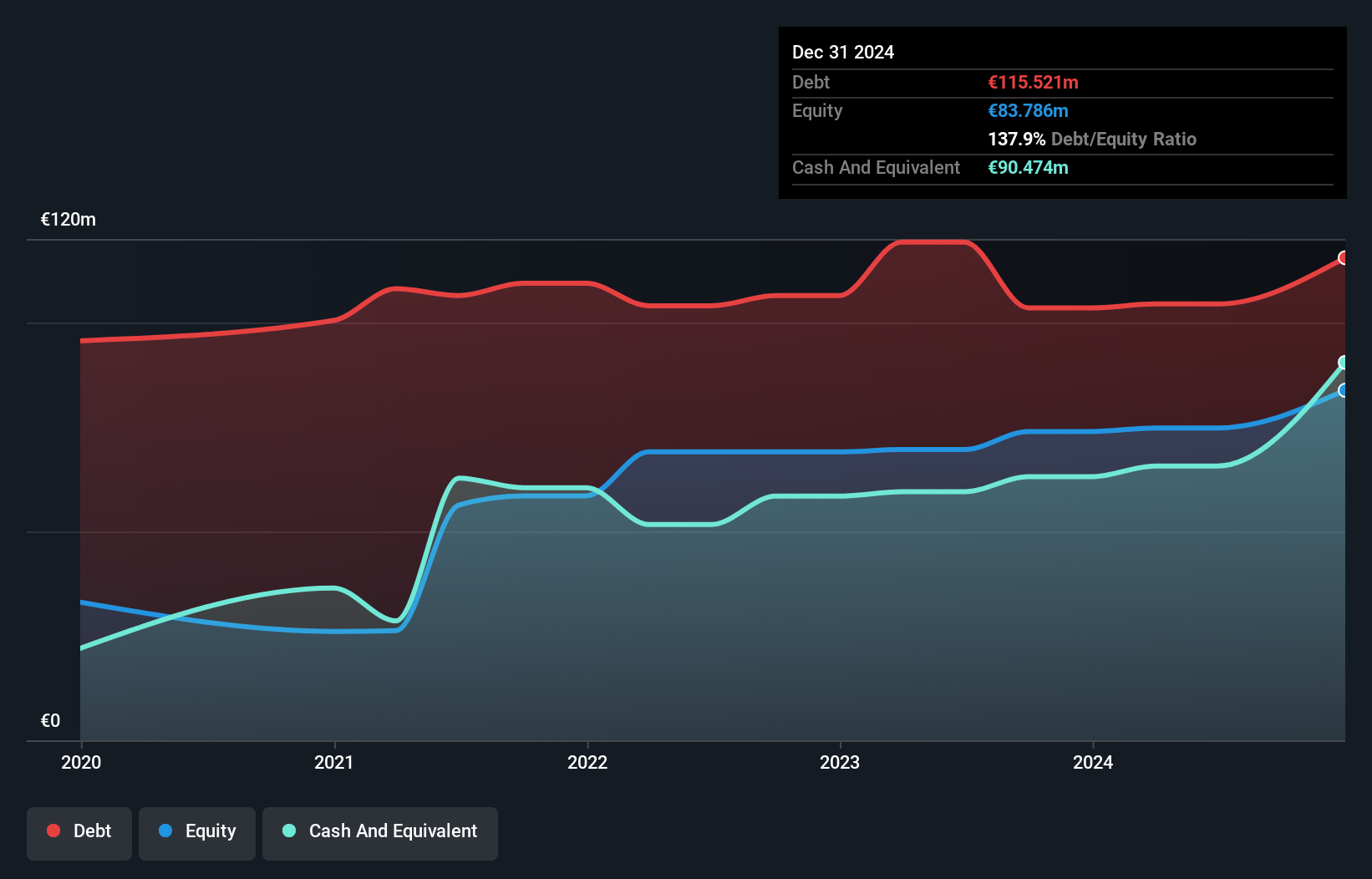

Arteche's recent performance showcases a promising yet challenging landscape. The company reported a significant jump in net income for the first half of 2025, reaching €19.91 million from €7.42 million last year, with sales climbing to €244.23 million from €212.39 million. Despite this growth, Arteche faces hurdles such as high debt levels with a net debt to equity ratio at 41.3% and volatility in its share price over the past three months. Earnings have grown impressively by 120%, outpacing industry averages; however, future projections suggest caution due to potential market risks and operational challenges.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renta 4 Banco, S.A. is a financial institution that offers wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €801.66 million.

Operations: Renta 4 Banco generates revenue through wealth management, brokerage, and corporate advisory services. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

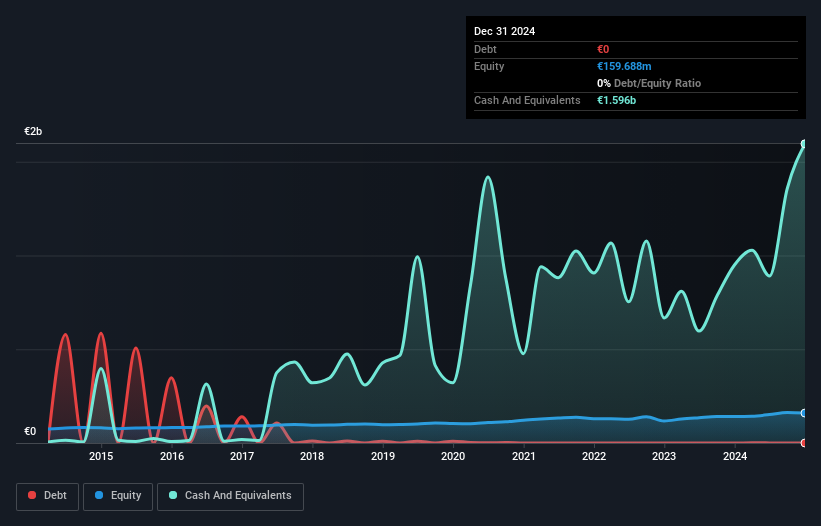

With a nimble presence in the financial sector, Renta 4 Banco has shown impressive earnings growth of 33% over the past year, outpacing its industry peers. The bank reported a net income of €19.26 million for the first half of 2025, up from €15.18 million last year, with basic earnings per share rising to €0.47 from €0.37. Notably debt-free and boasting high-quality earnings, Renta 4's performance is supported by positive free cash flow and an improved debt-to-equity ratio from five years ago when it stood at 0.8%. Despite recent share price volatility, these factors highlight its robust financial health.

- Click here and access our complete health analysis report to understand the dynamics of Renta 4 Banco.

Review our historical performance report to gain insights into Renta 4 Banco's's past performance.

STIF Société anonyme (ENXTPA:ALSTI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: STIF Société anonyme specializes in manufacturing and selling components for the handling of bulk products in France, with a market capitalization of €382.08 million.

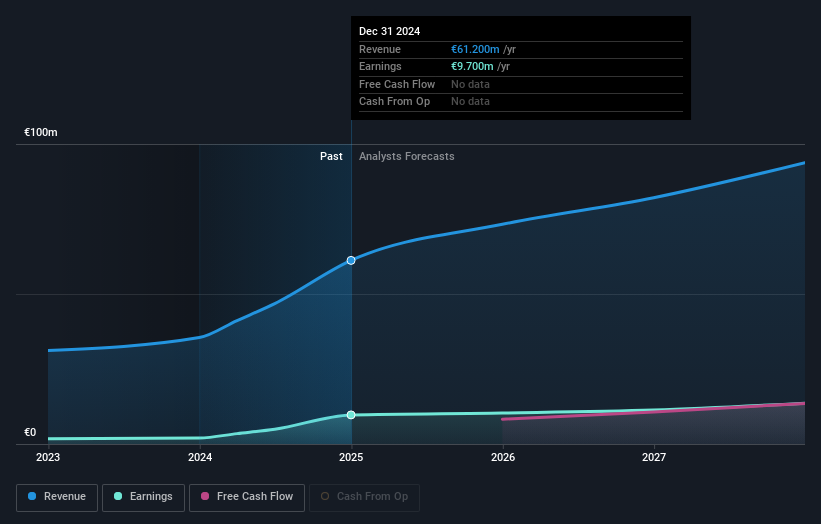

Operations: The company generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to €63.70 million.

STIF Société anonyme, a niche player in explosion protection, has been making waves with impressive earnings growth of 384.1% over the past year, outpacing its industry significantly. Trading at 24.2% below estimated fair value suggests potential upside for investors. The company's interest payments are comfortably covered by EBIT at 64.7 times, highlighting strong financial health. Recent discussions about acquiring a larger stake in BOSS PRODUCTS could expand STIF's footprint in North America and bolster its market position further. This acquisition is set to be financed through bank debt and aligns well with their strategic goals for growth and expansion.

- Click to explore a detailed breakdown of our findings in STIF Société anonyme's health report.

Assess STIF Société anonyme's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 333 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALSTI

STIF Société anonyme

Manufactures and sells components for the handling of bulk products in France.

High growth potential with proven track record.

Market Insights

Community Narratives