Last Update 01 Nov 25

Analysts have held their price target for Arteche Lantegi Elkartea steady at €18.03. They have made only minor adjustments to the discount rate and future price-to-earnings assumptions to reflect modest changes in the market outlook.

Valuation Changes

- Consensus Analyst Price Target remains unchanged at €18.03 per share.

- Discount Rate has risen slightly from 11.10% to 11.13%.

- Revenue Growth projection is steady at 11.59%.

- Net Profit Margin is unchanged at 9.22%.

- Future P/E ratio has increased marginally from 22.65x to 22.68x.

Key Takeaways

- Lagging R&D investment and slow innovation could cause market share loss, reduced pricing power, and margin compression amid rapid industry digitalization.

- Rising supply chain, labor, and compliance costs from global risks and regulations threaten profitability and strain resources needed for growth.

- Strong secular demand, robust financial health, and ongoing innovation drive Arteche's resilient international growth, supporting sustained margin expansion and revenue gains, regardless of cyclical volatility.

Catalysts

About Arteche Lantegi Elkartea- Engages in the design, manufacture, integration, and supply of electrical equipment and solutions focusing on renewable energies and smart grids in Spain and internationally.

- There are increasing expectations that rapid global electrification and the integration of renewables will disproportionately benefit larger, more innovative competitors with advanced digital grid solutions-raising concerns that Arteche's R&D (at just 3.5% of revenue) may be insufficient to keep pace, potentially leading to future erosion of market share and stagnant revenue growth.

- The accelerated decentralization and digitalization of energy infrastructure is expected to require more cutting-edge digital products and software integration; if Arteche cannot innovate at the speed of these industry shifts, it risks losing pricing power and being relegated to commoditized segments, putting downward pressure on future net margins.

- Heightening trade tensions and potential tariff barriers-especially between the US, Mexico, and China-may increase Arteche's supply chain costs and disrupt sales in key regions, resulting in higher input costs and volatility that could compress margins and earnings.

- Global labor shortages in STEM and digital fields are expected to drive talent migration toward leading technology firms, creating structural hiring challenges for Arteche and possibly leading to elevated wage costs or operational inefficiencies that negatively impact net margins.

- The proliferation of stricter ESG regulations and reporting standards worldwide may drive up compliance and capex requirements for smaller and mid-sized industrial players like Arteche, leading to higher operating costs and diverting resources from growth, ultimately weighing on future profitability and capital allocation.

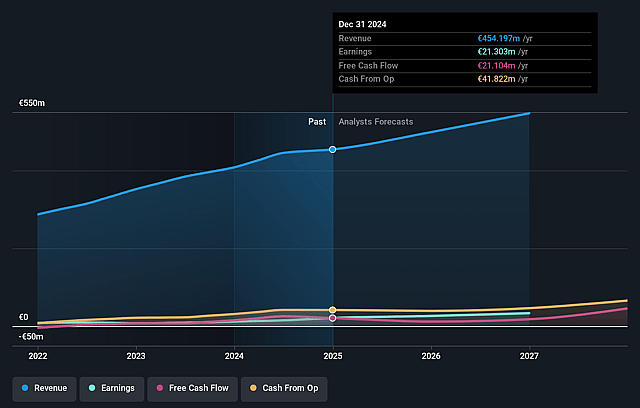

Arteche Lantegi Elkartea Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arteche Lantegi Elkartea's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.7% today to 6.9% in 3 years time.

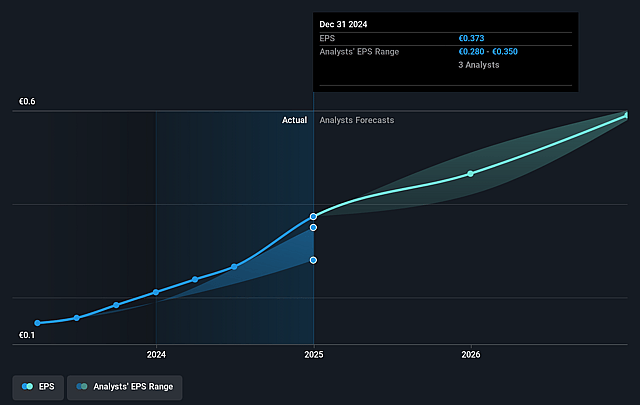

- Analysts expect earnings to reach €41.0 million (and earnings per share of €0.72) by about September 2028, up from €21.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, down from 35.3x today. This future PE is lower than the current PE for the ES Electrical industry at 35.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.7%, as per the Simply Wall St company report.

Arteche Lantegi Elkartea Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Arteche continues to outpace its own strategic plan targets, with double-digit revenue, order intake, and profitability growth; combined with a robust order backlog and a 1.2 book-to-bill ratio, this indicates a healthy outlook for future revenues and suggests an underlying secular demand strength that could sustain or grow earnings.

- Sustained investment in R&D (over 3.5% of revenue) and consistent product innovation (notably in digital platforms, sustainable transformers, and grid reliability solutions) point to a long-term trend of expanding the company's capabilities and addressable markets, likely supporting future margin expansion and revenue growth.

- Arteche's aggressive international expansion and geographic diversification-especially growth in EMEA and Asia-Pacific, and capacity increases in China and Mexico-mitigate regional risks and currency volatility, enhancing revenue and earnings resilience to localized downturns.

- Strong cash generation, low leverage (0.5x EBITDA), and a free operating cash flow conversion rate of 78% afford Arteche the flexibility to pursue opportunistic inorganic growth (acquisitions) and capacity expansion, supporting topline growth, while improving capital efficiency and potential for earnings growth.

- Secular global trends in electrification, renewable energy integration, and grid modernization continue to drive high demand for Arteche's core solutions across utility, industrial, and infrastructure clients, suggesting robust tailwinds that could underpin continued revenue and margin improvement despite cyclical or political challenges.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €9.55 for Arteche Lantegi Elkartea based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €597.8 million, earnings will come to €41.0 million, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 10.7%.

- Given the current share price of €13.2, the analyst price target of €9.55 is 38.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.