Banco Santander (BME:SAN) Is Up 7.7% After Surpassing Earnings and Affirming 2025 Revenue Targets – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Banco Santander recently reported its financial results for the first nine months of 2025, highlighting net income of €10.34 billion and improved earnings per share compared to a year ago, alongside reaffirmed confidence in achieving its full-year revenue targets of €62 billion with anticipated fee income growth.

- The bank also completed several fixed-income offerings totaling $2.8 billion, announcing a broad consortium of underwriters, which reflects continued demand for its debt securities and deep access to international capital markets.

- We'll look at how Banco Santander's higher net income and strong revenue guidance may influence its longer-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Banco Santander Investment Narrative Recap

To be a Banco Santander shareholder, you need to believe in the company’s ability to balance growth in both mature and emerging markets, as well as its drive to expand fee-based revenue streams. The recent earnings update supports the revenue story for 2025, while ongoing fixed-income offerings show continued market access; however, the most important catalyst remains management's execution on digital transformation, and the biggest risk continues to be loan quality in Brazil. These events do not materially change either factor in the short term.

Among the recent announcements, the appointment of a special shareholder meeting in Brazil stands out. This could be especially relevant, given Brazil is central to both revenue opportunities and credit risk, shaping how the most critical short-term and regional risks play into the broader investment case for Santander.

Yet, while these trends are promising, investors should still consider the implications of persistent loan quality challenges in Brazil, especially when...

Read the full narrative on Banco Santander (it's free!)

Banco Santander's outlook anticipates €63.8 billion in revenue and €13.2 billion in earnings by 2028. This is based on analysts projecting 8.4% annual revenue growth and a €0.6 billion increase in earnings from the current €12.6 billion.

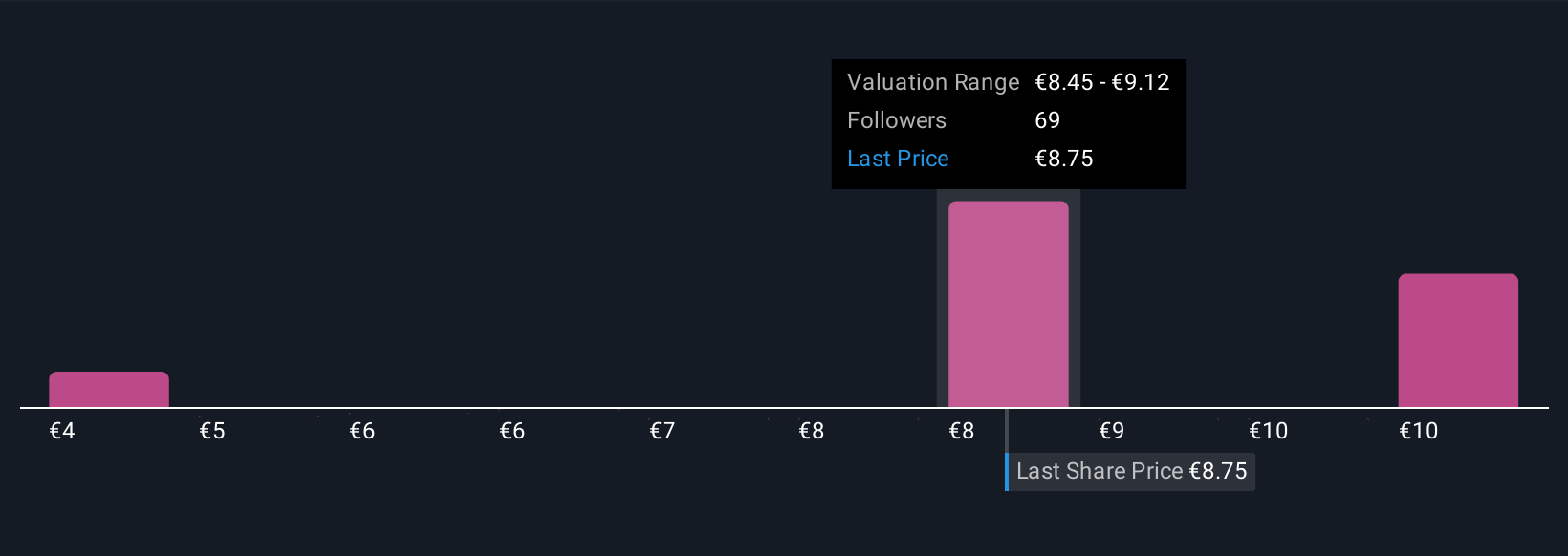

Uncover how Banco Santander's forecasts yield a €9.19 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value Santander between €4.43 and €11.79, with 12 distinctly different forecasts. But with loan quality in core regions still a key risk, you may want to review several views before deciding.

Explore 12 other fair value estimates on Banco Santander - why the stock might be worth less than half the current price!

Build Your Own Banco Santander Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Banco Santander research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Santander's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives