How Does BBVA's (BME:BBVA) Net Income Growth Reflect Its Profitability Ambitions?

Reviewed by Sasha Jovanovic

- Banco Bilbao Vizcaya Argentaria reported its third quarter and nine-month 2025 results, highlighting net interest income of €6.64 billion for the quarter and €19.25 billion for the year to date, along with net income of €2.53 billion and €7.98 billion respectively.

- While quarterly net income saw a slight year-over-year decline, the year-to-date figures reflect growth in both net interest income and profitability compared to the prior period.

- We'll explore how BBVA's year-to-date net income growth shapes its investment outlook and supports evolving profitability expectations.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Banco Bilbao Vizcaya Argentaria Investment Narrative Recap

To own shares in Banco Bilbao Vizcaya Argentaria, investors need to believe in the lasting strength of its emerging market franchises and digital banking ambition, while also accepting the volatility these regions bring. The most recent earnings show year-to-date growth but a dip in quarterly profit, which does not materially alter current views on BBVA’s near-term growth prospects or its key risk: exposure to shifting economic and currency conditions in Mexico and Turkey.

Among BBVA’s recent announcements, the interim dividend of €0.32 per share, declared in September and payable in November, speaks directly to its commitment to capital returns, an important factor supporting short-term confidence in the bank’s profitability despite near-term earnings fluctuations. This capital return policy helps reinforce investor trust but highlights the importance of monitoring core earnings growth in volatile markets.

Yet, alongside the recent profitability trends, investors should keep in mind that if macroeconomic or currency volatility escalates in BBVA’s largest emerging markets…

Read the full narrative on Banco Bilbao Vizcaya Argentaria (it's free!)

Banco Bilbao Vizcaya Argentaria is expected to reach €39.4 billion in revenue and €11.4 billion in earnings by 2028. This outlook is based on an anticipated 7.9% annual revenue growth rate and represents an increase of €1.3 billion in earnings from the current €10.1 billion.

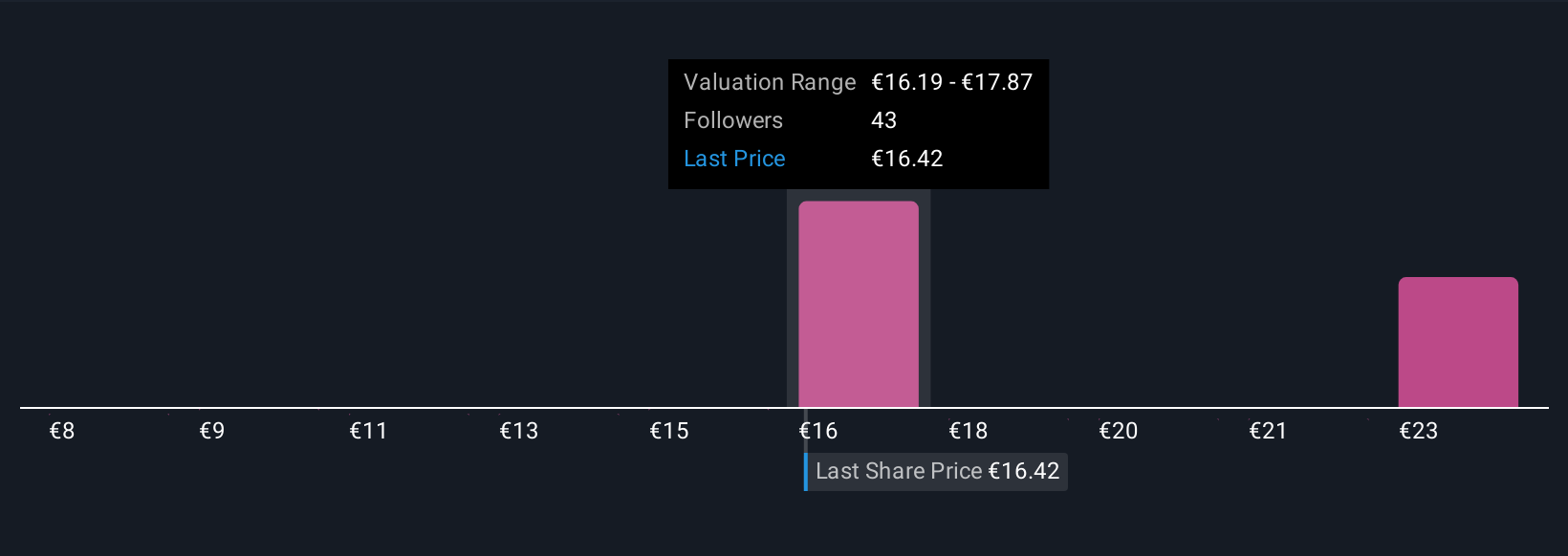

Uncover how Banco Bilbao Vizcaya Argentaria's forecasts yield a €17.45 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 11 fair value estimates for BBVA, ranging from €10.53 to €26.16 per share. While opinions span a wide spectrum, many participants remain attentive to BBVA’s exposure to emerging market risks and the broader impact this could have on future earnings growth potential.

Explore 11 other fair value estimates on Banco Bilbao Vizcaya Argentaria - why the stock might be worth as much as 41% more than the current price!

Build Your Own Banco Bilbao Vizcaya Argentaria Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Bilbao Vizcaya Argentaria research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Banco Bilbao Vizcaya Argentaria research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Bilbao Vizcaya Argentaria's overall financial health at a glance.

No Opportunity In Banco Bilbao Vizcaya Argentaria?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives