Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies. Gestamp Automoción, S.A. (BME:GEST) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Gestamp Automoción

What Is Gestamp Automoción's Net Debt?

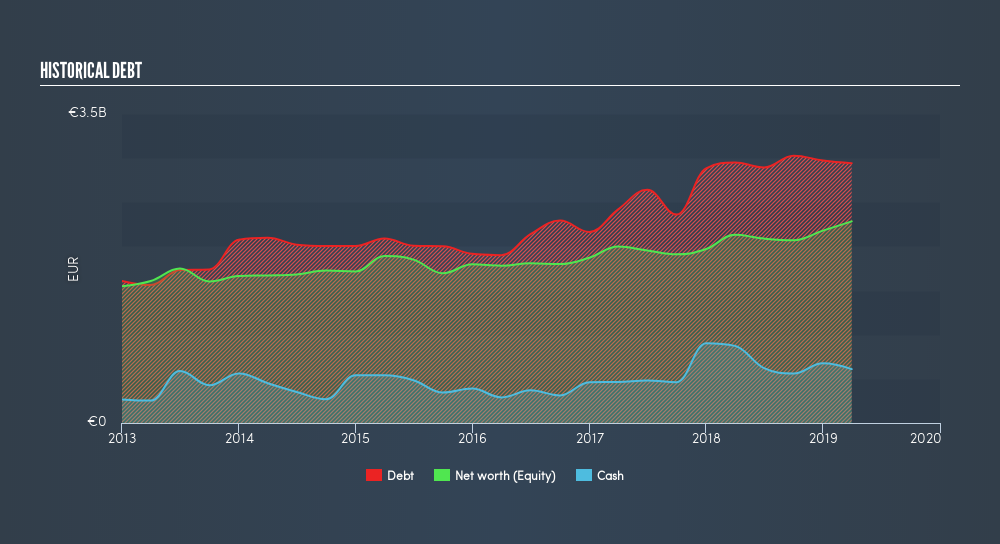

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Gestamp Automoción had €3.40b of debt, an increase on €2.98b, over one year. However, because it has a cash reserve of €610.7m, its net debt is less, at about €2.79b.

How Healthy Is Gestamp Automoción's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Gestamp Automoción had liabilities of €2.43b due within 12 months and liabilities of €3.66b due beyond that. Offsetting this, it had €610.7m in cash and €1.87b in receivables that were due within 12 months. So it has liabilities totalling €3.61b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's €2.64b market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. Either way, since Gestamp Automoción does have more debt than cash, it's worth keeping an eye on its balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Gestamp Automoción has a debt to EBITDA ratio of 3.15 and its EBIT covered its interest expense 4.18 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, Gestamp Automoción's EBIT was pretty flat over the last year, which isn't ideal given the debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Gestamp Automoción's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Gestamp Automoción burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Gestamp Automoción's level of total liabilities and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. Overall, it seems to us that Gestamp Automoción's debt load is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Given our concerns about Gestamp Automoción's debt levels, it seems only prudent to check if insiders have been ditching the stock.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BME:GEST

Gestamp Automoción

Designs, develops, and manufactures metal components for the automotive industry in Western Europe, Eastern Europe, Mercosur, North America, and Asia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives