- Sweden

- /

- Consumer Durables

- /

- OM:DUNI

3 European Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the STOXX Europe 600 Index and major stock indexes like Germany's DAX and the UK's FTSE 100 showing notable gains, investors are increasingly looking toward dividend stocks as a stable source of income amid fluctuating economic conditions. In this environment, selecting dividend stocks that offer robust yields can be an effective strategy for those seeking to balance growth with income generation.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.32% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.54% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.44% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.92% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.12% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.63% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.44% | ★★★★★★ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

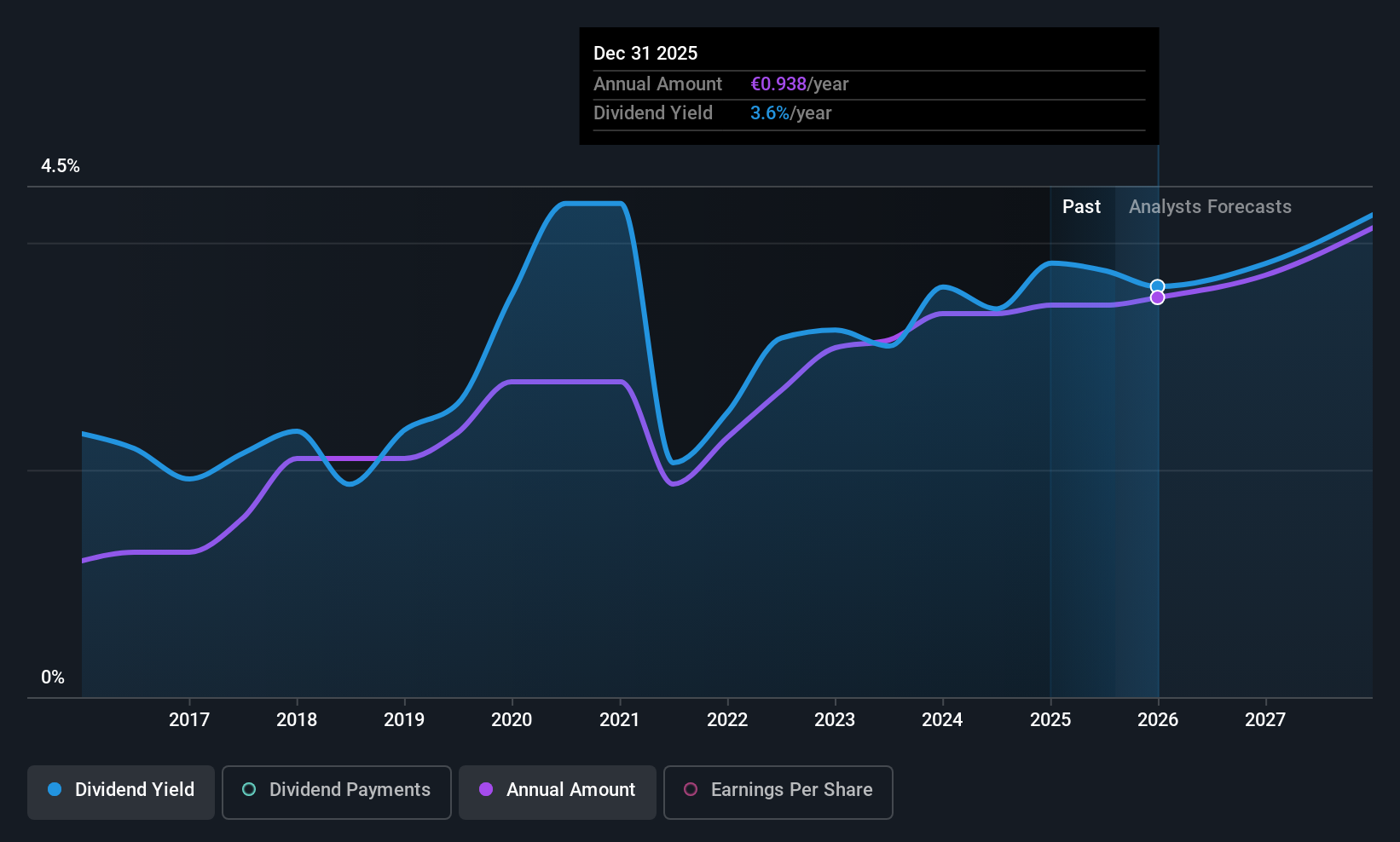

CIE Automotive (BME:CIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIE Automotive, S.A., along with its subsidiaries, designs, manufactures, and sells automotive components and sub-assemblies, with a market cap of €3.54 billion.

Operations: CIE Automotive generates its revenue through the design, manufacture, and sale of automotive components and sub-assemblies.

Dividend Yield: 3.1%

CIE Automotive's dividend profile shows both strengths and weaknesses. Despite a history of volatility in dividend payments, recent results indicate solid earnings coverage with a payout ratio at 16.6% and cash flow coverage at 32.1%, suggesting sustainability. However, the dividend yield of 3.11% lags behind the top Spanish market payers. Recent earnings reports reveal modest growth, with third-quarter net income rising to €80.4 million from €74.9 million year-over-year, highlighting potential for future stability in payouts despite past inconsistencies.

- Delve into the full analysis dividend report here for a deeper understanding of CIE Automotive.

- Our comprehensive valuation report raises the possibility that CIE Automotive is priced lower than what may be justified by its financials.

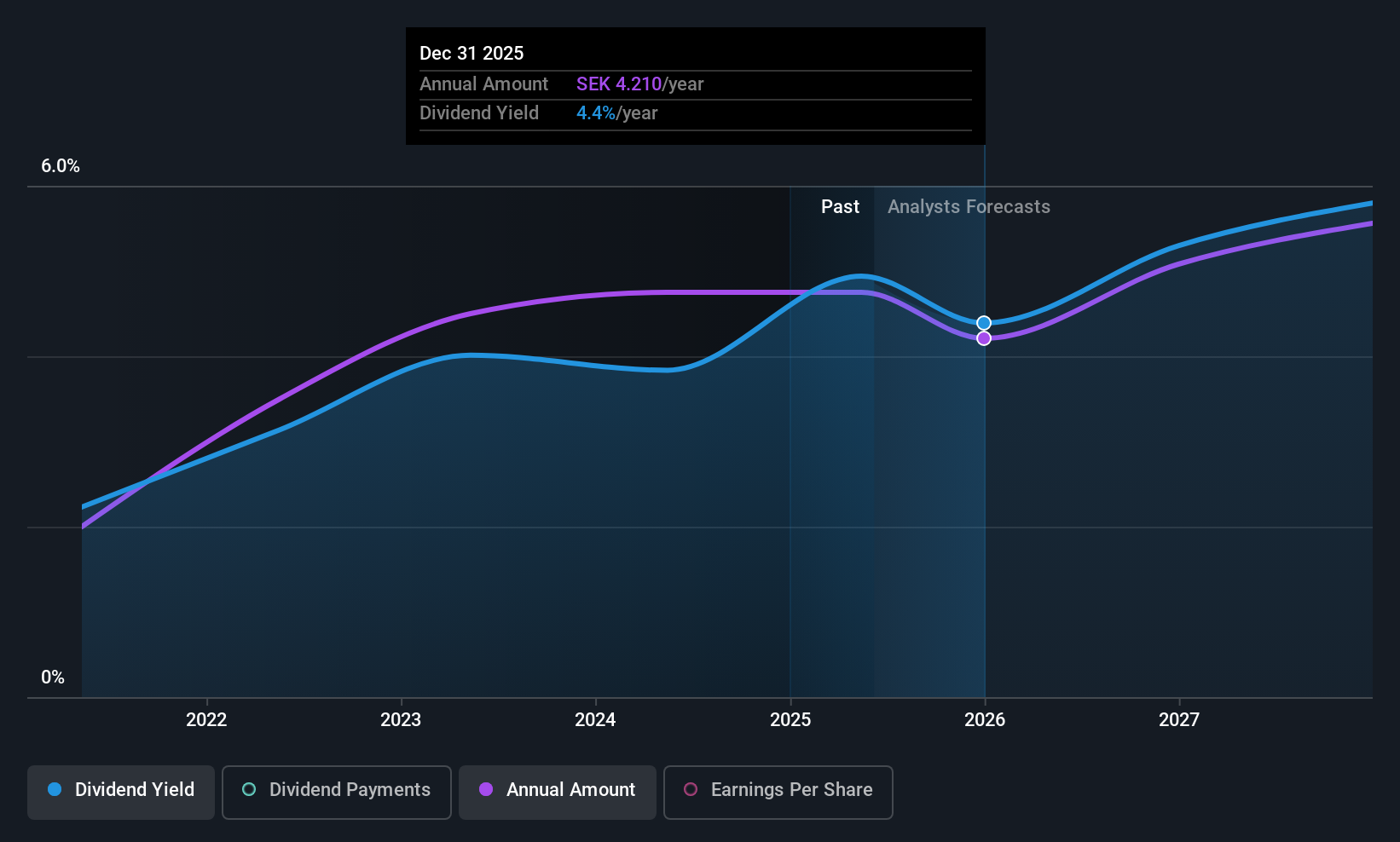

Duni (OM:DUNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Duni AB (publ) is involved in the development, manufacturing, and sale of meal serving, take-away, and packaging products across Sweden, Poland, and international markets with a market cap of SEK4.95 billion.

Operations: Duni AB (publ) generates revenue through its development, manufacturing, and sale of meal serving, take-away, and packaging products across various markets.

Dividend Yield: 4.7%

Duni's dividend profile presents a mixed outlook. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 71.9% and 69.7%, respectively, suggesting sustainability. However, despite a top-tier yield of 4.74% in the Swedish market, Duni's dividend history has been volatile over the past decade, indicating unreliability. Recent earnings improvements show potential for stability, as net income rose to SEK 105 million from a loss last year.

- Click here to discover the nuances of Duni with our detailed analytical dividend report.

- The analysis detailed in our Duni valuation report hints at an deflated share price compared to its estimated value.

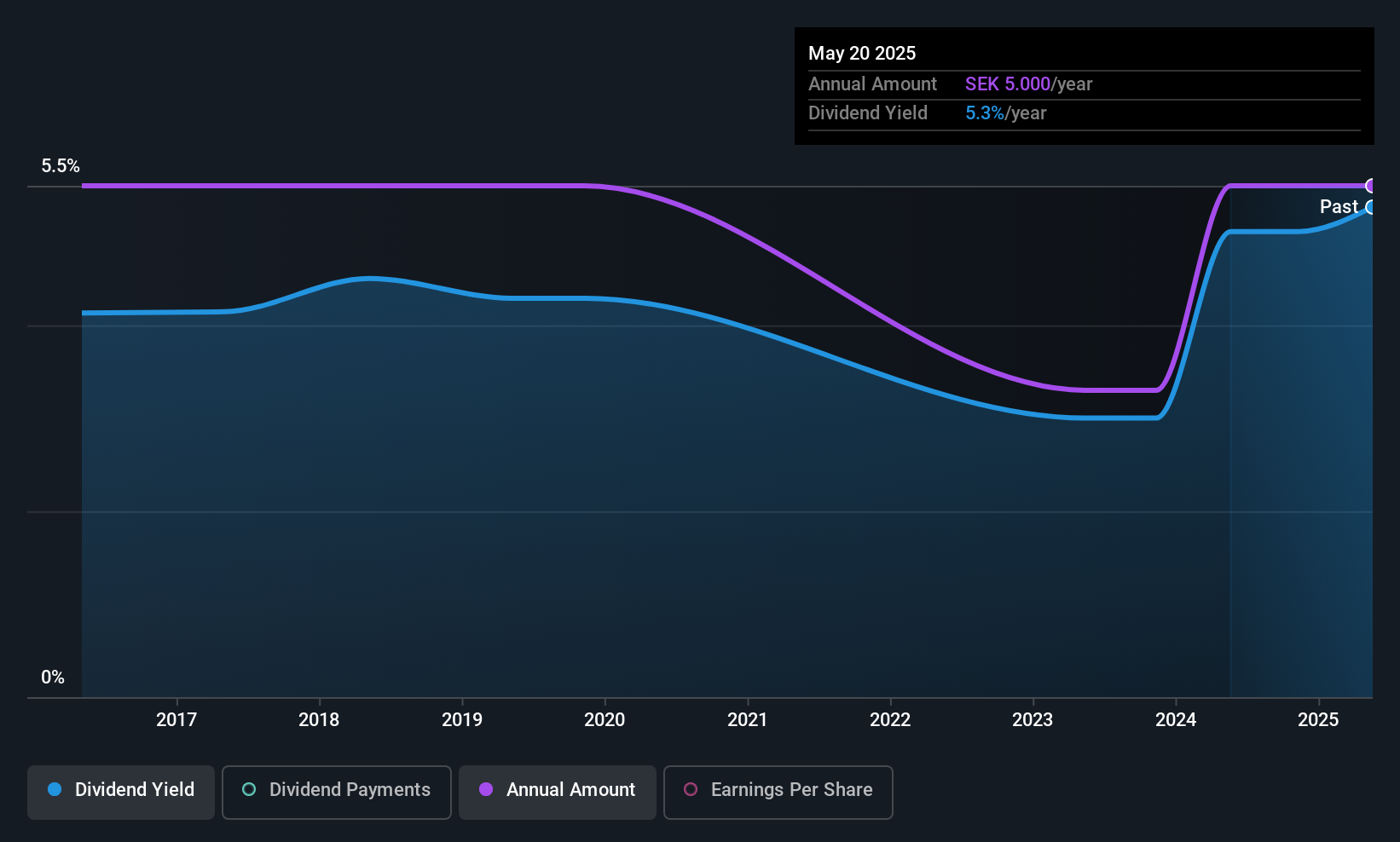

Prevas (OM:PREV B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prevas AB offers technical consultancy services in Sweden and internationally, with a market capitalization of SEK1.01 billion.

Operations: Prevas AB's revenue segments include technical consultancy services provided both within Sweden and internationally.

Dividend Yield: 6.1%

Prevas offers a compelling dividend profile with its 6.09% yield ranking in the top 25% of Swedish dividend payers, backed by strong cash flow coverage at a 41.5% payout ratio. Despite only five years of payments, dividends have been stable and growing, albeit with an earnings payout ratio of 84.3%. Recent earnings show improved net income for Q3 at SEK 17.24 million, indicating potential for ongoing financial health despite high debt levels and one-off items impacting results.

- Unlock comprehensive insights into our analysis of Prevas stock in this dividend report.

- The valuation report we've compiled suggests that Prevas' current price could be quite moderate.

Key Takeaways

- Access the full spectrum of 226 Top European Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DUNI

Duni

Develops, manufactures, and sells concepts and products for the serving, take-away, and packaging of meals in Sweden, Poland, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives