- Estonia

- /

- Real Estate

- /

- TLSE:PKG1T

AS Pro Kapital Grupp (TAL:PKG1T investor three-year losses grow to 26% as the stock sheds €8.5m this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term AS Pro Kapital Grupp (TAL:PKG1T) shareholders, since the share price is down 26% in the last three years, falling well short of the market decline of around 4.2%. On top of that, the share price is down 14% in the last week.

If the past week is anything to go by, investor sentiment for AS Pro Kapital Grupp isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Our free stock report includes 3 warning signs investors should be aware of before investing in AS Pro Kapital Grupp. Read for free now.Given that AS Pro Kapital Grupp didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years AS Pro Kapital Grupp saw its revenue shrink by 47% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 8% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

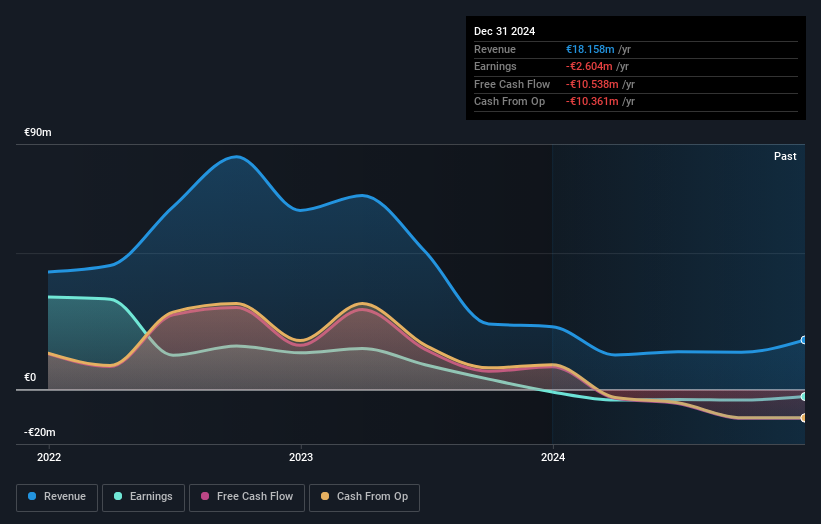

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at AS Pro Kapital Grupp's financial health with this free report on its balance sheet.

A Different Perspective

Investors in AS Pro Kapital Grupp had a tough year, with a total loss of 2.0%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 2% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for AS Pro Kapital Grupp (1 is a bit unpleasant) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Estonian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TLSE:PKG1T

AS Pro Kapital Grupp

A real estate development company, purchases, develops, operates, manages, rents, and sells commercial and residential real estate properties in Estonia, Latvia, Germany, Lithuania, and Italy.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026