The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Nordecon AS (TAL:NCN1T) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Nordecon

What Is Nordecon's Debt?

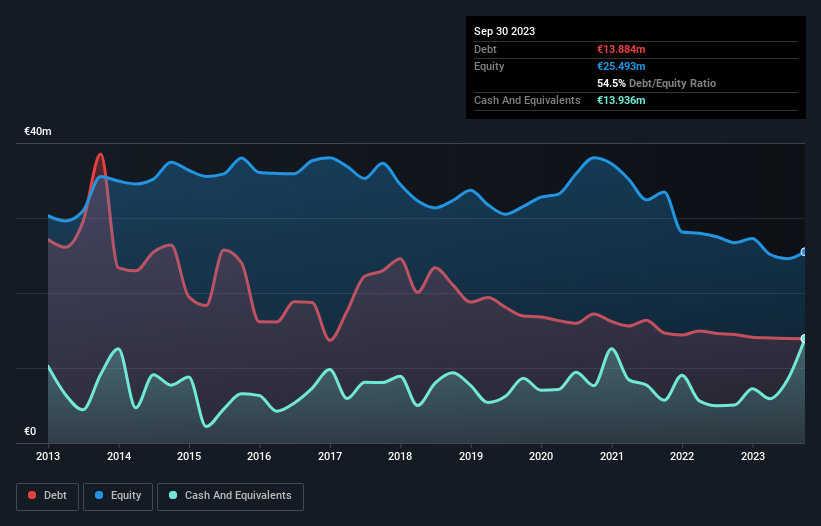

You can click the graphic below for the historical numbers, but it shows that Nordecon had €13.9m of debt in September 2023, down from €14.5m, one year before. However, it does have €13.9m in cash offsetting this, leading to net cash of €52.0k.

A Look At Nordecon's Liabilities

According to the last reported balance sheet, Nordecon had liabilities of €114.0m due within 12 months, and liabilities of €10.4m due beyond 12 months. Offsetting this, it had €13.9m in cash and €53.1m in receivables that were due within 12 months. So its liabilities total €57.4m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €20.3m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Nordecon would probably need a major re-capitalization if its creditors were to demand repayment. Nordecon boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

Notably, Nordecon made a loss at the EBIT level, last year, but improved that to positive EBIT of €2.8m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Nordecon will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Nordecon has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, Nordecon actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While Nordecon does have more liabilities than liquid assets, it also has net cash of €52.0k. And it impressed us with free cash flow of €14m, being 490% of its EBIT. So although we see some areas for improvement, we're not too worried about Nordecon's balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Nordecon (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Nordecon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TLSE:NCN1T

Nordecon

Operates as a construction company in Estonia, Sweden, Finland, Ukraine, Latvia, and Lithuania.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives