- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Shareholders in Ørsted (CPH:ORSTED) have lost 67%, as stock drops 9.9% this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Ørsted A/S (CPH:ORSTED) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 67% drop in the share price over that period. And the ride hasn't got any smoother in recent times over the last year, with the price 34% lower in that time. Even worse, it's down 17% in about a month, which isn't fun at all. However, we note the price may have been impacted by the broader market, which is down 12% in the same time period.

Since Ørsted has shed kr.12b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

We know that Ørsted has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

Arguably the revenue decline of 13% per year has people thinking Ørsted is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

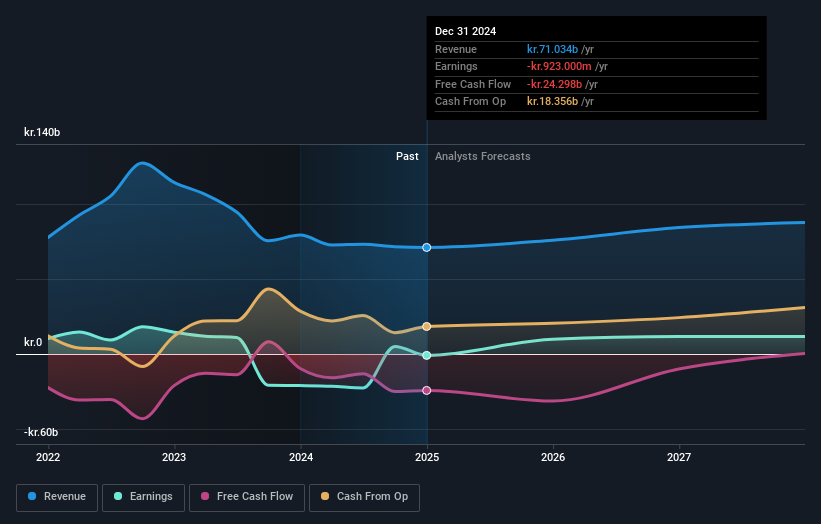

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Ørsted stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

The total return of 34% received by Ørsted shareholders over the last year isn't far from the market return of -34%. So last year was actually even worse than the last five years, which cost shareholders 10% per year. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Ørsted that you should be aware of before investing here.

But note: Ørsted may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ørsted might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion