- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Ørsted (CPSE:ORSTED) Valuation After US Offshore Wind Lease Freeze and Sharp One‑Day Share Price Drop

Reviewed by Simply Wall St

The Trump administration’s decision to freeze leases for five US offshore wind farms, including Ørsted (CPSE:ORSTED) projects Revolution Wind and Sunrise Wind, has abruptly stalled construction and rattled the company’s stock.

See our latest analysis for Ørsted.

The sharp 1 day share price return of minus 12.67 percent, taking Ørsted shares to about 117.2 Danish kroner, caps a tough year in which the year to date share price return is minus 65.15 percent and the 1 year total shareholder return is minus 37 percent. This signals that sentiment around offshore wind risks is still fragile despite a slightly positive 90 day share price return.

If this regulatory shock has you reassessing the clean energy space, it could be worth exploring fast growing stocks with high insider ownership as potential alternative growth ideas.

With the shares down heavily over one year but still trading below analyst targets, are investors looking at a mispriced clean energy leader in temporary turmoil, or is the market already discounting years of challenged growth?

Price-to-Sales of 2.2x: Is it justified?

On a price-to-sales ratio of 2.2 times, Ørsted trades slightly cheaper than the wider European renewable energy space and far below its closest peer group, despite its recent share price slide to 117.2 Danish kroner.

The price-to-sales multiple compares a company’s market value with the revenue it generates. It is especially useful for loss making or volatile earnings businesses in capital intensive sectors like renewables.

For Ørsted, this lens suggests investors are not paying a premium for its current revenue base relative to similar green power developers. This is the case even though the stock screens as overvalued against the SWS DCF model, which estimates fair value closer to 58.94 Danish kroner.

Compared with the European renewable energy industry average of 2.3 times sales, Ørsted trades at a small discount. It looks even cheaper against a peer average of 5.2 times, which implies the market is assigning a far lower revenue multiple to the company than to many rivals despite its global scale and forecast return to profitability.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 2.2x (ABOUT RIGHT)

However, regulatory unpredictability and continued losses despite recent net income growth could still pressure the stock and undermine confidence in Ørsted’s long term growth story.

Find out about the key risks to this Ørsted narrative.

Another View, DCF Signals Caution

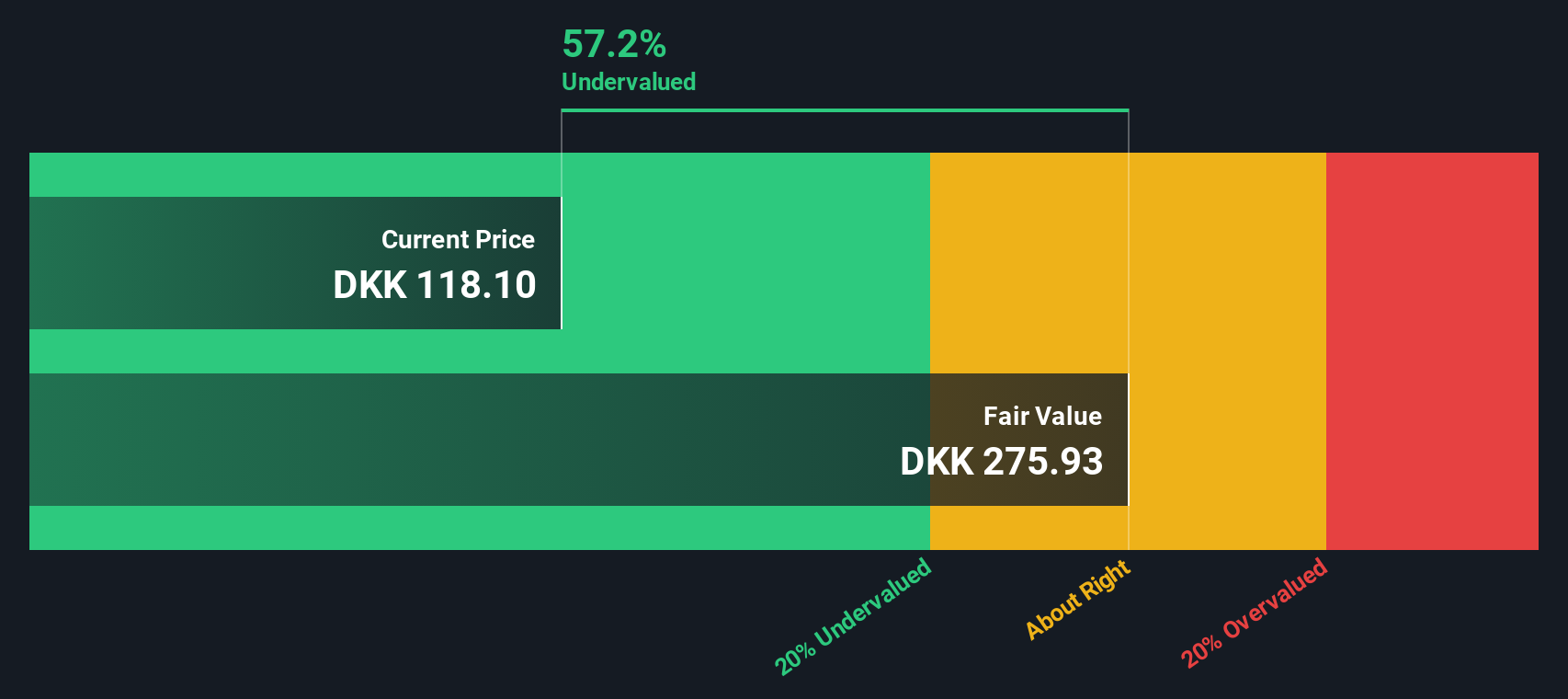

While the 2.2 times sales multiple looks reasonable, our DCF model paints a tougher picture. It suggests fair value around 58.94 Danish kroner, well below today’s 117.2 Danish kroner. If cash flows really matter most, is Ørsted still pricing in more growth than it can deliver?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ørsted for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ørsted Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in minutes with Do it your way.

A great starting point for your Ørsted research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before this opportunity passes you by, use the Simply Wall St Screener to explore more opportunities and consider how to position your portfolio for potential market moves.

- Explore possible value opportunities by focusing on companies trading below estimated cash flow value through these 898 undervalued stocks based on cash flows that may have been overlooked by the market.

- Follow innovation themes and growth narratives by targeting cutting edge names featured in these 24 AI penny stocks that are building real world applications.

- Support an income-focused approach by searching for regular payouts with these 10 dividend stocks with yields > 3% that can complement long term total return objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ørsted might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion