- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Can a Single Quarterly Loss Reshape Investor Sentiment Toward Ørsted (CPSE:ORSTED)?

Reviewed by Sasha Jovanovic

- Ørsted A/S recently reported third quarter 2025 earnings, revealing sales of DKK 12,270 million and a net loss of DKK 1,789 million, compared to net income of DKK 5,114 million a year earlier.

- This unexpected swing from profit to loss in the quarter stands out, especially as nine-month results remained stable year-over-year.

- We’ll explore how Ørsted’s shift to a quarterly loss, despite steady nine-month performance, shapes discussion around the company’s outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Ørsted's Investment Narrative?

To hold Ørsted shares, you really have to believe in the long-term strength of renewable energy and the company’s ability to navigate evolving sector headwinds. Despite the recent quarterly loss, Ørsted’s nine-month results stayed steady, which might ease some immediate concerns, but the swing into the red this quarter pushes risks like project execution and cost overruns into sharper focus. Major short-term catalysts, such as large project sales, follow-on share offerings, and planned divestitures, could still move the story forward but may now be eyed more cautiously by markets. Given that ORSTED shares were already under pressure and the board is still relatively fresh, this latest setback could make the company’s path to stability more complicated, particularly if it signals a deeper challenge than just a one-off quarter.

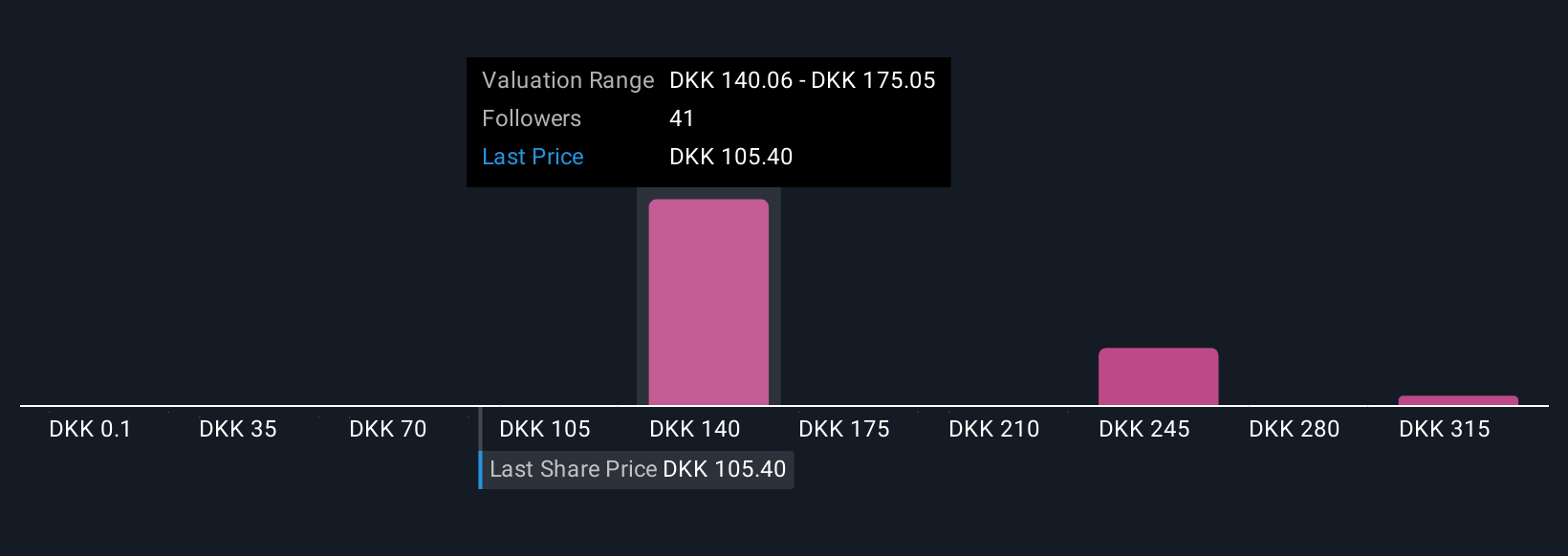

But how much could execution risks shift the investment case from here is a key question. Ørsted's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 14 other fair value estimates on Ørsted - why the stock might be worth less than half the current price!

Build Your Own Ørsted Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ørsted research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Ørsted research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ørsted's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ørsted might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives