- Denmark

- /

- Marine and Shipping

- /

- CPSE:MAERSK B

Should Maersk's Strategic Pivot and Balance Sheet Strength Influence A.P. Møller - Mærsk (CPSE:MAERSK B) Investors?

Reviewed by Sasha Jovanovic

- Earlier this month, A.P. Møller - Mærsk announced a renewed strategic focus on operational reliability and higher shipping volumes through the Gemini Cooperation, while highlighting its strong net cash position that supports ongoing share repurchase plans.

- This combination of financial strength and a shift in industry focus sets Maersk apart in a sector currently facing freight rate declines and oversupply challenges.

- We'll now explore how Maersk’s balance sheet resilience could influence its investment outlook during ongoing shipping industry headwinds.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

A.P. Møller - Mærsk Investment Narrative Recap

To be a Maersk shareholder today, you need confidence in the company's long-term ability to generate strong cash flows even as the shipping industry deals with falling freight rates and oversupply. The latest news, reinforcing Maersk's focus on operational reliability and higher volumes through Gemini, may support core business strengths, but does not fundamentally shift the most immediate catalyst, which is whether Maersk can maintain margin resilience; nor does it materially remove the biggest risk, which remains continued freight rate pressure.

Among the recent developments, Maersk's ongoing share repurchase plans stand out as particularly relevant, enabled by its robust net cash position. This reflects management's commitment to capital discipline and returning value to shareholders, which could help shore up sentiment during a period when some analysts are questioning medium-term pricing power and volume trends in shipping.

By contrast, investors should be aware that persistent declines in freight rates and rising competition continue to threaten...

Read the full narrative on A.P. Møller - Mærsk (it's free!)

A.P. Møller - Mærsk's outlook suggests revenues of $50.9 billion and earnings of $1.2 billion by 2028. This reflects a 3.6% annual decline in revenue and a decrease in earnings of $5.7 billion from the current $6.9 billion.

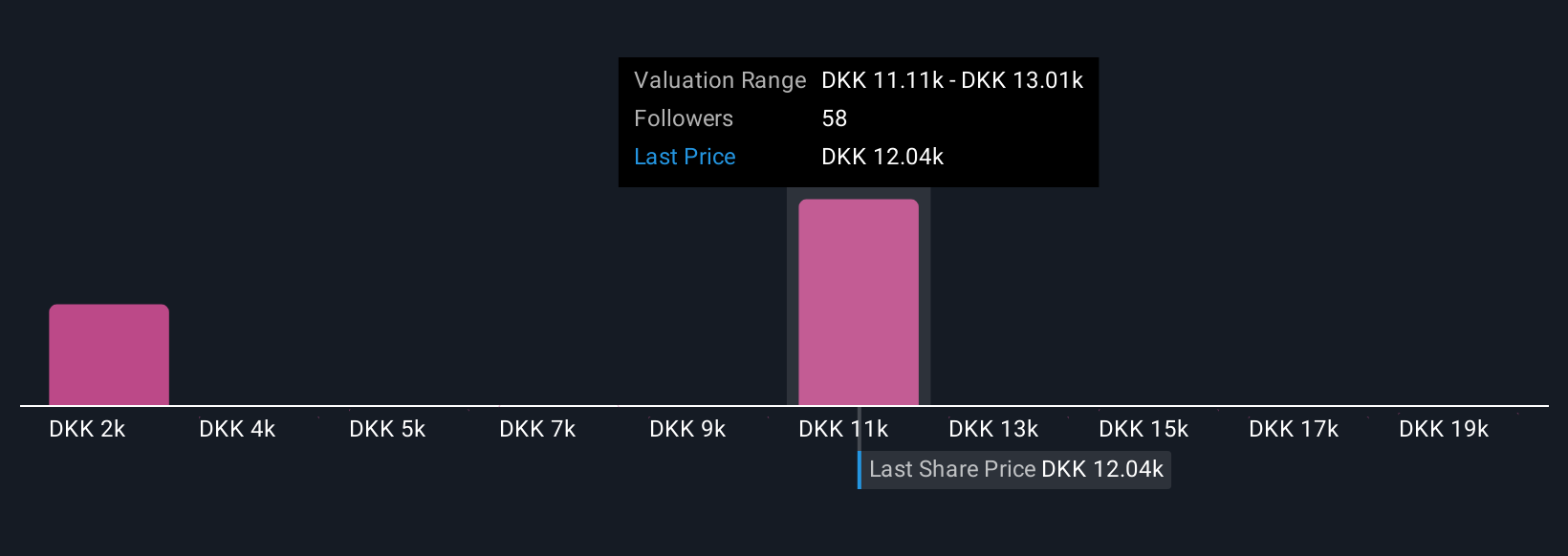

Uncover how A.P. Møller - Mærsk's forecasts yield a DKK11802 fair value, a 7% downside to its current price.

Exploring Other Perspectives

While nine individual fair value estimates from the Simply Wall St Community range widely from DKK1,628 to DKK20,587 per share, freight rate declines and structural industry headwinds remain a central concern. Your take on Maersk’s outlook may differ, explore how others are recalibrating their expectations in response to shifting shipping dynamics.

Explore 9 other fair value estimates on A.P. Møller - Mærsk - why the stock might be worth as much as 62% more than the current price!

Build Your Own A.P. Møller - Mærsk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your A.P. Møller - Mærsk research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free A.P. Møller - Mærsk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate A.P. Møller - Mærsk's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MAERSK B

A.P. Møller - Mærsk

Operates as an integrated logistics company in Denmark and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives