- Denmark

- /

- Marine and Shipping

- /

- CPSE:MAERSK B

Maersk (CPSE:MAERSK B) Valuation in Focus as New Share Buyback Program Launches

Reviewed by Kshitija Bhandaru

A.P. Møller - Mærsk (CPSE:MAERSK B) has kicked off the second phase of its large-scale share buy-back program, targeting up to DKK 7.2 billion in repurchases through early February 2026. Such buy-backs often attract investors' attention because of their implications for capital allocation and earnings.

See our latest analysis for A.P. Møller - Mærsk.

Mærsk's decision to ramp up its buy-back program arrives after a year of strong total shareholder returns, with the stock delivering 37.4% over twelve months, even as the 30-day share price return slipped into negative territory. Despite short-term volatility, momentum has stayed resilient, reflecting shifting market views on the company’s future potential and ongoing capital-return initiatives.

If corporate buybacks spark your interest, now might be the perfect moment to seek out other opportunities and discover fast growing stocks with high insider ownership

But with the stock trading near all-time highs and recent buy-backs boosting returns, investors may wonder if Mærsk still offers hidden value or if the current share price already factors in expectations for future growth.

Most Popular Narrative: 7.9% Overvalued

At DKK12,740, A.P. Møller - Mærsk trades above the fair value projected by the most widely followed narrative, which puts the stock’s worth at DKK11,802. This sets up a debate about whether recent optimism can withstand tougher long-term profit assumptions.

The ongoing decline in average freight rates due to industry overcapacity, combined with intensifying digitalization and the rise of asset-light competing platforms, poses a structural challenge to Maersk's pricing power and long-term revenue growth. If investors are discounting these headwinds, forecasts for sustained high profitability or outsized long-term earnings may be too optimistic.

Want to understand why this valuation is so elevated? The underlying forecast depends on crucial shipping trends and fierce competition. Which forward-looking assumptions tip the balance? Dive in to see what’s fueling the narrative’s bold calculation.

Result: Fair Value of DKK11,802 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating efficiency gains from the Gemini network or stronger resilience in Maersk’s terminal operations could quickly challenge this cautious narrative.

Find out about the key risks to this A.P. Møller - Mærsk narrative.

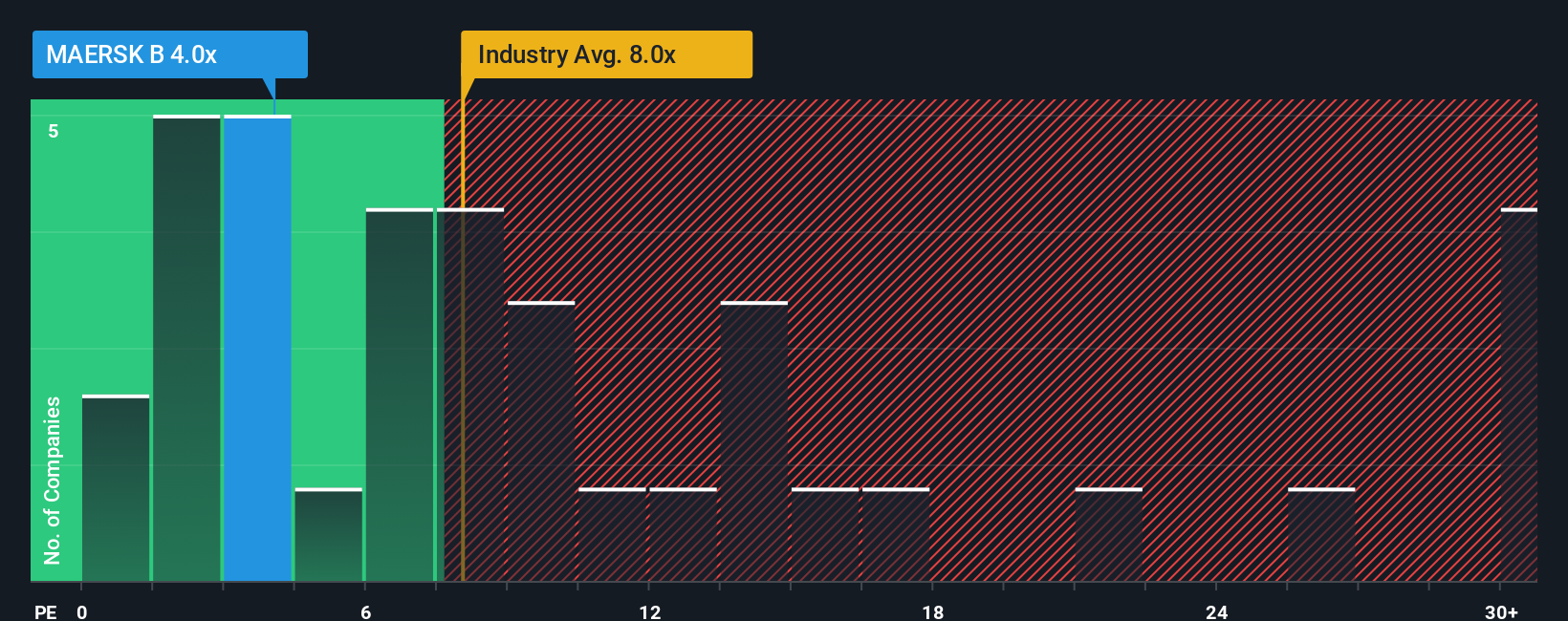

Another View: Market-Based Comparison

Stepping away from forecast-driven models, a look at Maersk's current valuation multiples offers a different angle. The company is trading at a price-to-earnings ratio of 4.3x, which is much lower than both its European shipping peers (8.3x) and the sector average (14.7x). However, it is notably above its fair ratio of 2.3x, a benchmark some see as a realistic long-term anchor. This raises a key question for investors: is the market underestimating near-term risks, or is Maersk’s quality keeping its valuation propped up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own A.P. Møller - Mærsk Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own narrative and insights in just minutes. Do it your way.

A great starting point for your A.P. Møller - Mærsk research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investing edge by taking action now. Uncover stocks that others might overlook and position your portfolio ahead of the curve with these powerful tools:

- Target reliable income streams and maximize payouts by evaluating these 20 dividend stocks with yields > 3% offering yields above 3% for a stronger cash flow foundation.

- Ride the cutting edge of artificial intelligence by screening these 24 AI penny stocks to spot tomorrow’s market movers disrupting entire industries right now.

- Capitalize on deep value opportunities and seek the market’s best bargains by analyzing these 874 undervalued stocks based on cash flows where strong cash flows point to hidden potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MAERSK B

A.P. Møller - Mærsk

Operates as an integrated logistics company in Denmark and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives