- Denmark

- /

- Marine and Shipping

- /

- CPSE:MAERSK B

Assessing Maersk After Shipping Route Disruptions and a 19% One Year Share Price Gain

Reviewed by Bailey Pemberton

- If you have ever wondered whether A.P. Møller Mærsk is really a bargain or just cruising on its reputation, you are not alone. Let us break down what might make this shipping giant undervalued or overpriced right now.

- The stock has moved 3.6% higher in the last week, but is still down 7.1% over the past month, with a year-to-date return of 1.6% and a solid 19.0% gain over the past year. These movements give investors a lot to consider in terms of growth or changing risk signals.

- Recently, the company has been in the news as global shipping routes remain disrupted and supply chain uncertainty makes headlines. This has fueled both bullish sentiment and some nerves in the market. Ongoing coverage around freight rates and container traffic has brought extra attention to Maersk as shipping remains a barometer for global trade health.

- With a valuation score of 2 out of 6 on our checks, A.P. Møller Mærsk is showing potential for value, but our analysis goes deeper than any single score. Keep reading to see the methods, and stick around for a perspective on valuation you may not have seen before.

A.P. Møller - Mærsk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: A.P. Møller Mærsk Discounted Cash Flow (DCF) Analysis

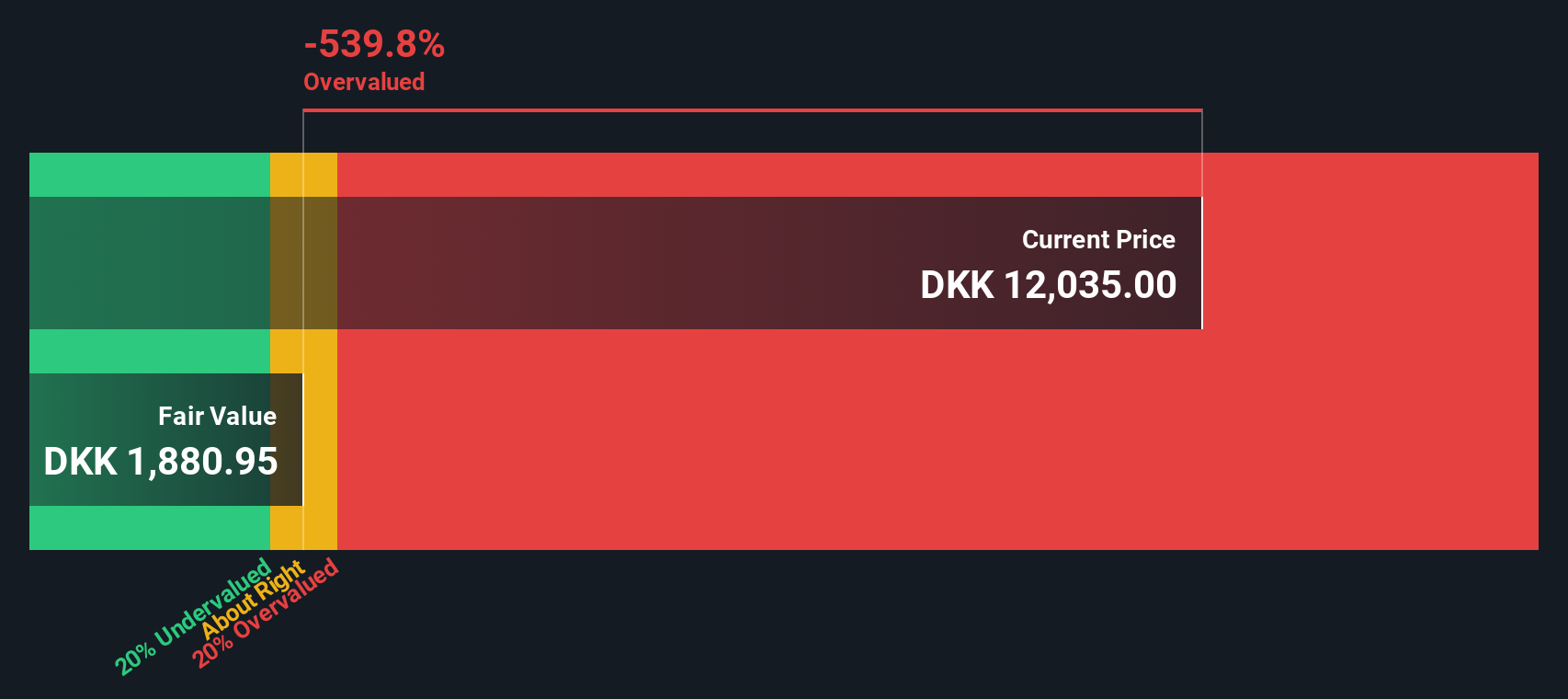

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. For A.P. Møller Mærsk, this involves looking ahead at how much cash the company is expected to generate over the next decade and adjusting those figures for the time value of money.

Mærsk's last twelve months’ Free Cash Flow sits at $7.4 billion, with a significant decrease forecasted in the coming years. By 2027, analyst projections show annual free cash flow dropping to $303.5 million. Beyond 2027, further estimates become less certain, but the trend suggests notably lower cash generation as modeled and extrapolated by Simply Wall St.

Using a two-stage Free Cash Flow to Equity method, the model calculates Mærsk’s intrinsic value at $752 per share. However, when compared to the current share price, this estimate reveals a striking 1,587.9% premium, indicating the stock trades at levels far above its DCF-derived fair value.

This sizeable disconnect suggests that A.P. Møller Mærsk is significantly overvalued right now, at least under the DCF methodology’s assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests A.P. Møller - Mærsk may be overvalued by 1587.9%. Discover 933 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: A.P. Møller Mærsk Price vs Earnings

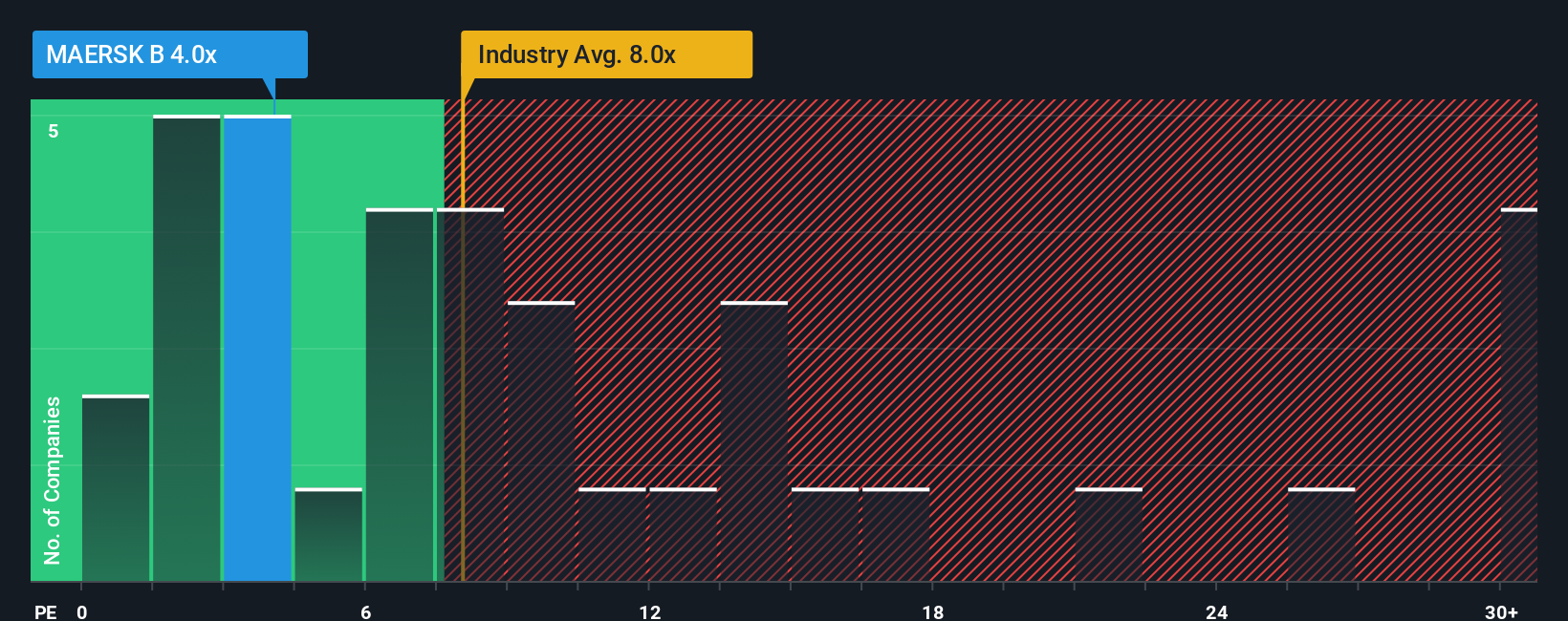

The price-to-earnings (PE) ratio is a popular way to value profitable companies, making it particularly relevant for A.P. Møller Mærsk. This metric compares a company’s current share price with its earnings per share, offering a quick snapshot of how much the market is willing to pay for a unit of today’s profit. Profitable, consistent businesses are best evaluated in this way, as it directly links price to intrinsic earning power.

What constitutes a fair PE ratio depends on several factors. Companies with stronger earnings growth and lower risk typically deserve higher PE ratios, while those with uncertain prospects warrant lower values. For Mærsk, the current PE ratio stands at 6.0x. This is well below the shipping industry average of 9.7x and the peer average of 17.0x, suggesting the stock is priced more conservatively than its rivals.

Simply Wall St’s proprietary "Fair Ratio" aims to quantify the PE a company deserves, adjusting for profitability, earnings growth, industry profile, risk factors, profit margins, and market cap. In Mærsk’s case, the Fair Ratio arrives at 2.8x, much lower than even the company’s own PE and well under peer and industry benchmarks. This approach is more refined than standard comparisons, as it accounts for company-specific strengths and challenges rather than relying solely on broad industry averages.

Since Mærsk’s actual PE ratio of 6.0x is well above its Fair Ratio of 2.8x, the stock appears somewhat overvalued according to this methodology.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your A.P. Møller Mærsk Narrative

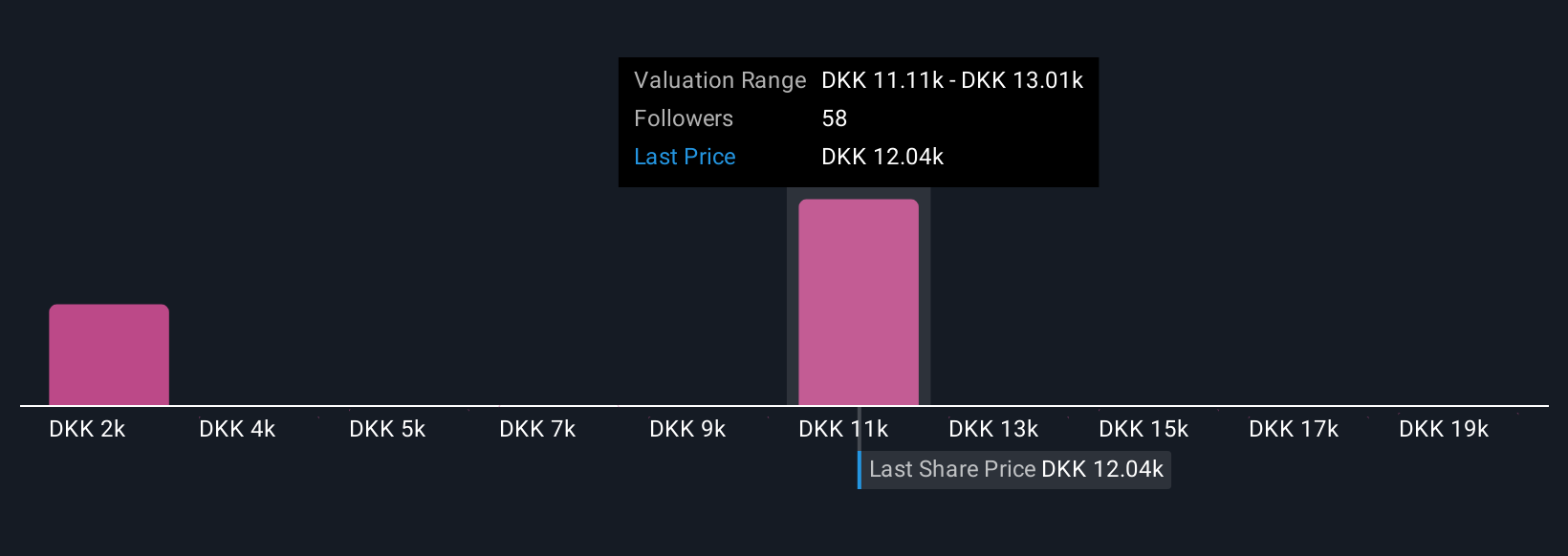

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a powerful tool that lets you put your story behind the numbers. In simple terms, a Narrative links your perspective on a company’s future with a financial forecast and calculates a fair value so you can see exactly how the story stacks up against real data.

On Simply Wall St’s Community page, millions of investors use Narratives to reflect their own views about forecasts for revenue, earnings, and profit margins, helping them track whether the current share price is above or below their fair value assumption. Narratives make investing approachable: you create or select a narrative that matches your beliefs, see the projected outcomes, and decide if the time is right to buy, sell, or hold. This information is dynamically updated as news or earnings are released.

For example, some investors currently see strong profit margins and diversified services leading to high fair values for A.P. Møller Mærsk. Others focus on overcapacity and industry headwinds, leading to much lower fair values. Narratives bring all these market viewpoints together in one place and update in real time, letting you make informed, timely investment decisions that are always backed by the latest data and trends.

Do you think there's more to the story for A.P. Møller - Mærsk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MAERSK B

A.P. Møller - Mærsk

Operates as an integrated logistics company in Denmark and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.